In the post-pandemic world, digital disruption is affecting all sectors and areas with emerging technologies, and Artificial Intelligence (AI) has become a buzzword. It is through AI and other emerging technologies that we are today seeing huge advancement in digitalization, not to mention several innovative applications for every aspect of business management and to ease individual’s lives. While banking and financial services have traditionally been an industry that relied on face to face interactions, the pandemic forced many of them to innovate by using AI in banking and finance to provide digital services. Artificial intelligence in finance is seeing mass application in all aspects, whether it is digitalization of back end processes such as KYC or verifications or client-facing aspects like applying for a loan or opening a bank account.

But what exactly is Artificial Intelligence? As per the simplest definition, “AI refers to systems or machines that mimic human intelligence to perform tasks and can iteratively improve themselves based on the information they collect”. Some of the common forms of AI that we already use unknowingly are chatbots and virtual assistants like Alexa and Siri.

And, much like its impact on several sectors, Artificial Intelligence is also disrupting the financial services or fintech industry. Fintech is a portmanteau of financial technology that refers to use of technology for delivery of financial services. There has been much advancement in the fintech industry with the adoption of not just artificial intelligence in finance, but also other emerging technologies such as cloud computing, Big Data and Blockchain. As such, the market for AI in finance and banking is likely to see a big jump in the future. As per reports, in 2020, the AI in fintech was estimated at around USD 8 billion; it is expected to increase to USD 26.6 billion by 2025.

While there has been tremendous progress in the adoption of Artificial Intelligence in the financial services industry, the biggest transformation has been in the banking and insurance sector. AI is really good at analyzing, extracting insightful data from tons of unstructured data. So, fraud prevention and credit monitoring has been taken over by Artificial Intelligence in the banking and finance sector.

On the front end, there have been many use cases for AI in finance. Companies are offering digital wallets, touchless payment options, while financial apps have really improved and offer several benefits to the users. These consumer facing solutions are solely dependent on finance AI. That apart, today, the chatbots and virtual assistants can do much more than just answer basic questions. They have begun to handle some really complex issues that usually are resolved only after interaction with customer service personnel.

Fintech and insurance companies are also using AI to process insurance claims, for things like car accidents. Finance AI is being used to detect frauds, such as photoshopping photos submitted with applications seeking claims. There are examples of companies leveraging AI and Big Data and behavior economics to offer customers insurance policies, while using AI and chatbots to process a lot of claims; some claiming that they are able to process claims in a matter of seconds even!

Source

Though there has been a marked rise in the use of AI in finance, with a combination of machine learning and advanced analytics, there is also a lot of innovation that is happening with various applications of AI in finance. So, AI in fintech helps with improved usability of apps, real-time data collection and analysis, all of which helps improve the digital experience.

There is a strong future of AI in finance, with many benefits for companies to become more efficient and engage with consumers better. Let us look at the other applications of AI in finance and banking:

- Security and fraud prevention

AI in the financial industry has greatly helped improve data security. Several banks and fintechs have begun to depend on AI solutions to improve data security, whilst assisting their customers to navigate easily. Some of the AI solutions that have already been put in place include additional access controls, cyber threat mitigation etc.

- Artificial intelligence in accounting and finance

Several applications of AI have been proven in back-end financial processes such as accounting and finance. Finance professionals need not have to be techies in order to understand ways in which to apply artificial intelligence in accounting and finance to make processes automated and more effective.

- Contract management solutions

Management of contracts, which is central to the fintech sector, was hitherto a major bugbear. It was tedious and took a lot of time and effort to keep track of. However, with the adoption of AI, with a combination of Machine Learning, Natural Language Processing and Optical Character Recognition, financial institutions have been able to streamline and automate the management of contracts.

AI is already being adopted across many sectors for its ability to offer hyper-personalized solutions. Customer service is integral to the fintech sector. With the younger generations fully exposed to digital solutions, fintechs are adopting AI to not just attract younger customers by offering them digital financial management solutions, but also retain existing customers by offering hyper-personalized solutions. Manual processes have been automated, with even customer support being replaced with chatbots.

From transacting through cash to now just scanning the QR code to pay… there has been a lot of advancement that has been achieved in the way we pay. In the future, AI is likely to cause further disruption. A glimpse of what can be expected can already be seen at the Amazon Go stores that are in 42 different locations in the U.S. and U.K. Several technologies are used to automate the stores, including computer vision, deep learning algorithms, sensor fusion, that allows customers to walk in after scanning the QR code, pick up whatever they want and leave. The payment for the items picked up is automatically deducted from the customer’s linked account.

Risks of AI in fintech

Despite the several benefits of adopting AI in the financial services sector, such as hyper-personalisation offering, automation of hitherto manual processes, real-time analysis of data, data security and other benefits, there still are risks involved.

Source

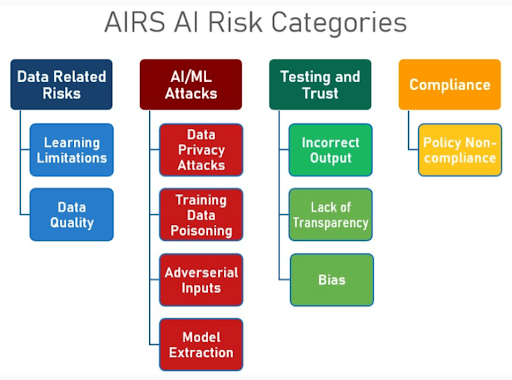

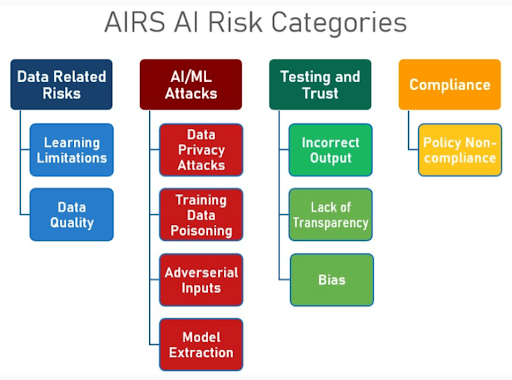

According to a white paper published by the Wharton AI for Business, the risks of AI adoption in the financial services industry may be addressed with the right governance approaches. The paper by the Artificial Intelligence/ Machine Learning Risk and Security (or AIRS) is largely on self-governance of AI risks, such as AI and ML attacks. Some of the other risks that the paper highlighted by the paper include:

- Lack of judgment: Unlike humans, AI cannot be expected to make judgements based on various factors, such as context and environment. AI, however superior in other aspects, cannot replace a human to take decisions or make judgements in critical cases.

- Poor data quality: Poor data quality will limit the learning capability of the AI and ML systems, apart from negatively impacting how it makes inferences and decisions in future. Inadequate data, erroneous data etc. could pose a big risk as it will lead to poor predictions and bias in judgment.

- Job loss: With AI automating manual processes, there is a threat of job loss. However, automation of processes is hailed as a benefit, with many experts claiming that automation and adoption of AI would help free valuable human resources from menial jobs.

Despite these risks, it is certain that we have only just scratched the surface of the disruption that AI could cause to the financial services sector. With stringent regulation and laws governing the adoption and use of AI and other emerging technologies, much of these risks can be mitigated, which will mean a win-win situation for both fintechs and their customers.

The advent of digitalization and adoption of AI and other forms of latest technology has resulted in a huge demand for data scientists, engineers, AI practitioners etc. in the fintech job market. However, there is a huge supply-demand mismatch. Organizations are looking for persons with the right aptitude and willingness to try new things, as the fintech job market has immense employment opportunities. Over the next decade, fintech will be one of the most interesting domains, and a career in fintech will be extremely engaging, stimulating and impactful.

Those interested in a fruitful career in fintech can enroll in the Integrated program in Data Science, Machine Learning and Artificial Intelligence or the Integrated program in Finance and Financial Technologies offered by Hero Vired. The integrated programs will equip individuals with skills to analyze data, build complex data models to solve business problems.

In the Integrated program in Data Science, Machine Learning and Artificial Intelligence, one will learn Python, ML and statistics foundations, working with Deep Learning frameworks, application of Deep Learning in Computer vision and application of Deep Learning in NLP. In the Integrated program in Finance and Financial Technologies, one will learn the foundations of modern finance, financial accounting, behavioral finance and technical analysis, apart from overview of ML, AI and Python programming for financial applications.