Navigating such a competitive market calls for strategic decisions on where to place bets, what to invest, what to improve, and when to pivot. The number of products, services, or business units can become too vast without a clear strategy in hand.

How do you know every effort counts towards long-term growth? This is where portfolio analysis in strategic management becomes indispensable.

A methodical approach to the evaluation of business units, products, or investments and portfolio analysis can help in tracking high-performing areas, managing risk, and allocating resources effectively. It is not just about numbers; it is about aligning decisions with broader organisational goals for staying ahead in this dynamic marketplace.

Portfolio analysis in strategic management is a source of actionably obtained insight that empowers the business to optimise growth from balancing risks to seizing new opportunities, thus being a cornerstone for organisations aiming at thriving in today’s fast-changing environment. It discusses proven tools such as BCG Matrix and SWOT Analysis.

This blog explores tools, processes, and applications that clarify how portfolio analysis can be used to drive strategic success.

What is Portfolio Analysis in Strategic Management

Portfolio analysis, at its very core, means analysing the performance of products, services, or even business units within a firm. Optimisation in resource usage for strategic achievements forms the heart of its mission.

We consider everything: profitability, market share, and growth prospects. That way, we know what to retain and play better, what to improve, and what scope still exists. It’s all about strategy, not just numbers.

For example, consider a company with three product lines: one generating steady revenue, another in a high-growth market, and a third struggling to break even. Portfolio analysis helps decide whether to double down on the high-growth product, maintain the steady performer, or exit the struggling market.

Thus, the strategic purpose goes beyond resource allocation. It ensures that every decision fits the context of the company’s mission and vision. In this manner, it’s a step ahead in market changes rather than reacting to those.

POSTGRADUATE PROGRAM IN

Strategic Management & Business Essentials

Develop strategic thinking, leadership skills, and business acumen to excel in management roles.

Why Portfolio Analysis in Strategic Management is Necessary

Portfolio analysis in strategic management is crucial to achieving financial goals and enhancing investment strategies. Investors can improve their overall financial performance and make better judgments if they understand the reason behind portfolio analysis.

Evaluating Current Investments

- Assesses the performance of existing investments.

- Identifies underperforming assets for necessary adjustments.

- Maximises returns and mitigates risks for efficient management.

Developing Growth Strategies

- Analyses asset and sector performance to spot growth opportunities.

- Supports diversification and resource reallocation.

- Focuses on investing in high-performing assets and emerging trends.

Making Product Retention or Divestment Decisions

- Evaluate product or asset performance and potential.

- Determines whether to retain or divest from underperforming products.

- Optimises resource allocation to align with financial goals.

A Generalised Overview of Techniques and Tools for Portfolio Analysis in Strategic Management

How do we decide which products or services deserve more attention? Which business units are worth scaling up, and which ones need to be reassessed? This is where portfolio analysis in strategic management tools shines.

Every tool in portfolio analysis serves a purpose. They simplify complex decisions, allowing us to see where opportunities lie and where resources are better spent. Let’s explore some of the most effective techniques and tools businesses use.

BCG Matrix: Identifying the Star Performers

The BCG Matrix categorises business units into four groups based on their market growth rate and market share:

- Stars: High growth, high market share. These are the products driving growth.

- Cash Cows: Low growth, high market share. Steady revenue generators.

- Question Marks: High growth, low market share. These are risky but potentially rewarding.

- Dogs: Low growth, low market share. Often candidates for divestment.

For example, Procter & Gamble uses the BCG Matrix to evaluate its product lines. Tide and Pampers, with their strong market positions, fall under the Cash Cow category, while newer brands aim to become Stars.

GE-McKinsey Matrix: A More Detailed Perspective

This tool goes beyond the BCG Matrix by analysing two dimensions: industry attractiveness and business strength. It uses a nine-cell grid to categorise units:

- Top-right cells: Invest and grow.

- Middle cells: Selectively maintain or build.

- Bottom-left cells: Harvest or divest.

General Electric applies this matrix to assess sectors like aviation, renewable energy, and healthcare. High-growth sectors are prioritised, while weaker divisions face restructuring.

SWOT Analysis: Streamlining Strategic Decisions

SWOT Analysis considers the strengths, weaknesses, opportunities, and threats of an entity. It is a versatile tool that is easily applicable to portfolio analysis. The SWOT analysis gives businesses the idea of where they are good and what’s happening on the outside to affect them.

Ansoff Matrix: Strategising Growth

The Ansoff Matrix emphasizes growth by examining four strategies:

- Market Penetration: Selling more of the same products in the existing markets.

- Market Development: Venturing into new markets with current products.

- Product Development: New products for existing markets.

- Diversification: New products in new markets.

Hofer’s Matrix: Linking Products to Their Lifecycle

Hofer’s Matrix connects products to their lifecycle stages: introduction, growth, maturity, and decline. This helps decide whether to invest, maintain, or exit a product line.

Key Components of Business Portfolio Analysis

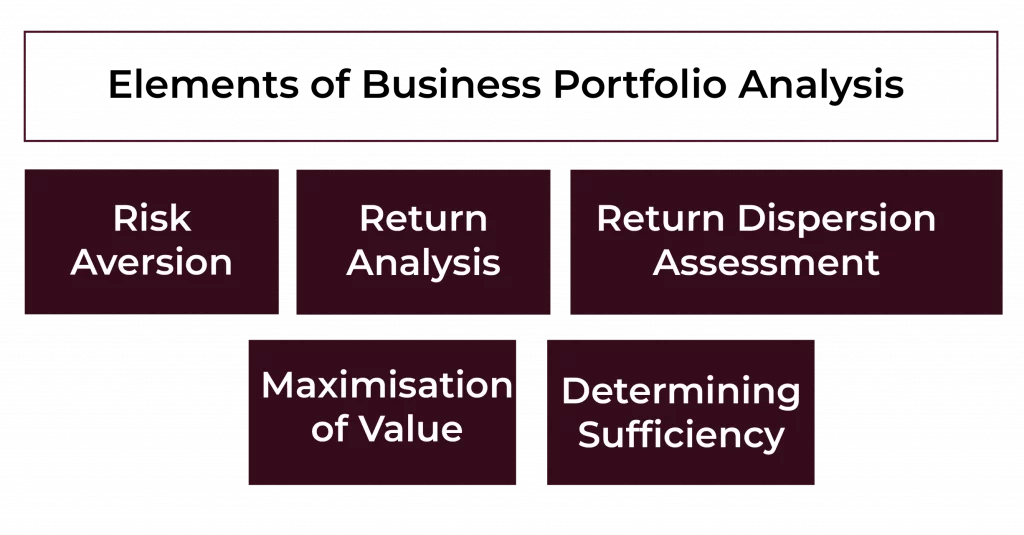

A careful analysis of several elements is necessary for effective business portfolio analysis to support strategic decision-making. The following are essential components of the portfolio analysis in strategic management process:

Risk Aversion

- Evaluate downside risks for each product or service.

- Addresses challenges like market fluctuations, competition, and legal changes to mitigate potential impacts.

Return Analysis

- Measures the financial performance of products and services.

- Assesses metrics like turnover, profit, and investment efficiency to identify strengths and areas needing improvement.

Return Dispersion Assessment

- Examines variations in sales returns across the portfolio.

- Analyses revenue volatility, production adaptability, cost structures, and profitability to focus on the most lucrative areas.

Maximisation of Value

- It emphasizes resource deployment, which maximises portfolio value.

- Invests in high-growth opportunities and divests ailing assets

Determining Sufficiency

- Guarantees that the portfolio supports strategy and long-term goals.

- Assessing factors such as market share, revenue growth, and profitability would be considered for measuring adequacy.

Also Read: Strategic Management Process

82.9%

of professionals don't believe their degree can help them get ahead at work.

A Step-by-Step Process to Effectively Conduct Portfolio Analysis

Portfolio analysis in strategic management can be overwhelming. But breaking it into clear steps makes it manageable. Let’s go through the process step by step.

Step 1: List All Business Lines or Units

Start by identifying every product, service, or strategic business unit (SBU). This provides a clear picture of everything you’re working with.

Step 2: Group Business Units by Performance

Categorise these units based on key metrics like profitability, market share, and growth potential. This grouping makes it easier to spot patterns and outliers.

Step 3: Compare Business Units Against Strategic Goals

Match up each business unit with the firm’s mission and objectives. This way, resources are devoted to areas that will aid in the long-term vision.

Step 4: Apply Analytical Tools

Select the appropriate tools for your needs. For example:

- Use the BCG Matrix to classify by market position.

- Use the GE-McKinsey Matrix to further analyse competitive strength and market potential.

- Utilise SWOT Analysis to examine internal strengths and external threats.

Step 5: Develop Strategic Plans

Based on the analysis, decide:

- Where to invest more.

- What to maintain.

- Which units to divest.

Key Advantages of Portfolio Analysis for Business Success

Portfolio analysis in strategic management isn’t just a tool; it’s a game-changer. Here’s how it drives success:

Improved Decision-Making

- Enables informed, data-driven decisions on investments, divestments, and resource allocation.

- Focuses efforts on areas with the highest potential for growth and value.

Enhanced Resource Allocation

- Every business has limited resources. Portfolio analysis helps prioritise where to invest for the best returns.

- Identifies the most promising opportunities to direct resources efficiently.

- Ensures investments are channelled into profitable projects and units for better returns.

Managing Risks Across Business Units and Investments

- Diversification is key to mitigating risks. Portfolio analysis shows us which investments balance risk and reward.

- Helps detect and mitigate risks by analysing performance patterns and trends.

- Develop strategies to minimise potential losses and safeguard assets.

- By identifying underperforming units early, we can take corrective action before they drag the business down.

Goal Alignment and Performance Tracking

- Aligns investments with organisational objectives for unified success.

- Tracks performance over time to identify areas for improvement and refine strategies.

Competitive Advantage

- Drives better market performance by focusing on profitable opportunities.

- Enhances market share and profitability and ensures long-term success.

| Business Unit | Market Share | Growth Potential | Current Status | Action Recommended |

| Snacks | High | Moderate | Strong revenue generator | Maintain investment levels. |

| Beverages | Moderate | High | Growing but needs support | Increase marketing efforts. |

| Dairy Products | Low | Low | Struggling in competition | Consider divesting resources. |

What Makes Portfolio Analysis Essential?

It’s not just about cutting losses or chasing profits. It’s about seeing the connections, understanding the trade-offs, and making every decision count. When we invest time in portfolio analysis, we gain a clear, actionable plan that aligns with both immediate needs and future aspirations.

Also Read: Strategic Management Model

Examples of How Global Companies Use Portfolio Analysis to Gain Competitive Advantage

Procter & Gamble: Focusing Resources Where It Matters

Procter & Gamble uses the BCG Matrix to evaluate its extensive product portfolio. Tide and Pampers, for example, are in the Cash Cow category, providing steady revenue. This allows the company to reinvest in newer brands with high growth potential.

General Electric: Diversifying with Precision

General Electric applies the GE-McKinsey Matrix to manage its diverse sectors. The aviation division, placed in the top-right cell, receives heavy investment, while weaker sectors are restructured or divested.

Venus Investments: Balancing Risk and Reward

Venus Investments uses advanced metrics like the Sharpe Ratio to analyse its portfolio’s risk-adjusted returns. By focusing on funds with higher ratios, they optimise performance while managing risks effectively.

Exploring Types of Portfolio Management and Their Strategic Objectives

Every business has unique challenges when managing investments and resources. Some prefer an aggressive approach, while others play it safe. The way we handle these decisions is what defines our portfolio management strategy.

Portfolio analysis in strategic management isn’t just about investing money; it’s about making smart, calculated moves that align with business goals. Let’s explore the different types of portfolio management and their specific objectives.

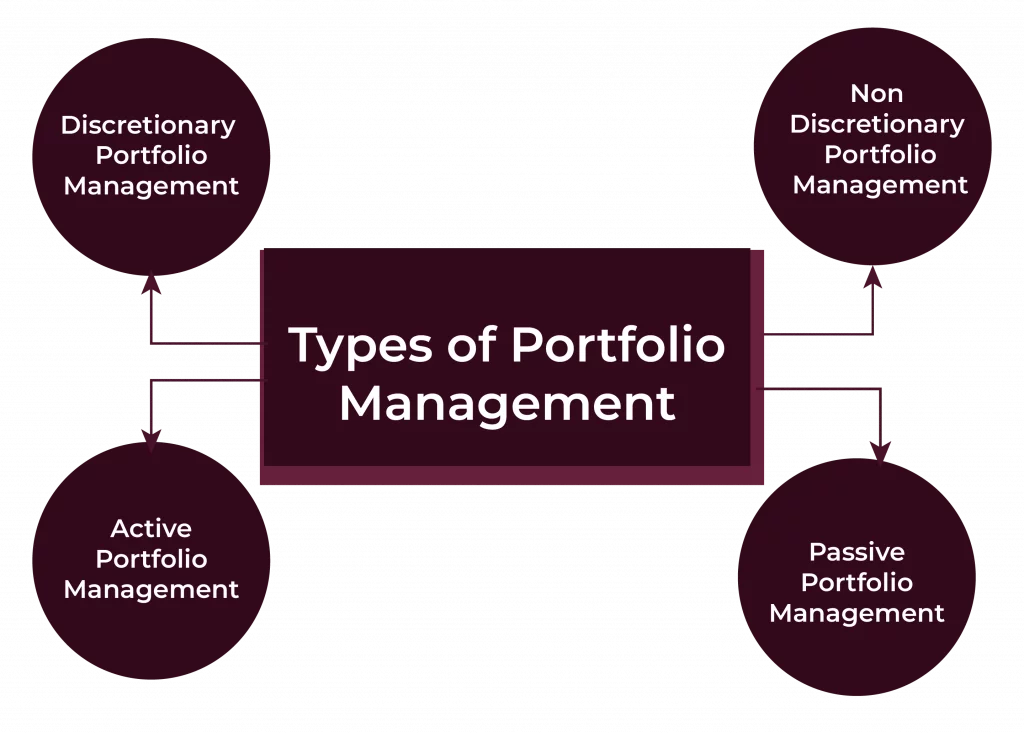

Active Portfolio Management: Maximising Returns Through Strategic Moves

Active portfolio management is like driving on a winding road, where every turn and decision needs attention. Managers here focus on frequent buying and selling to outperform the market.

For instance, think of a company investing in emerging sectors like renewable energy. The manager buys undervalued stocks and sells them as they grow, creating a dynamic portfolio. The aim is simple—higher returns by actively tracking market trends.

Passive Portfolio Management: Steady Growth Without Constant Monitoring

This approach is the polar opposite of active management. Instead of chasing trends, passive managers build a portfolio that mirrors market indices. The goal is long-term growth with minimal intervention.

Consider a company investing in Nifty 50 funds. Holding these investments for years achieves consistent growth without frequent adjustments. This method suits organisations focused on stability over risk.

Discretionary Portfolio Management: Giving Away All Trust to Professionals

Portfolio managers are handed the reins under discretionary management. They decide on behalf of an investor, taking into consideration the organisation’s goals and risk appetite.

For example, a retail company may need to utilise a professional in the allocation of real estate or technology equities. The agreement, therefore, permits companies to concentrate on business operations while the professionals handle the investment portfolio.

Non-Discretionary Portfolio Management: Guidance Without Authority

Non-discretionary management refers to advisory rather than having the power to choose. Here, the portfolio manager suggests options, but the decision rests with the investor.

Imagine a small business exploring mutual funds. The manager suggests options, but the owner decides where to invest. This approach works well for those who want expert insights without losing control.

Strategic Objectives of Portfolio Management

Regardless of the type of portfolio management, they are intended to meet predefined specific objectives:

- Risk Optimisation: Reducing vulnerability to unpredictable investment opportunities.

- Capital Appreciation: Increasing the value of investments over time.

- Resource Deployment: Developing a way to get better returns through better resource allocation.

- Flexibility: Commitment to Response in Shifting Market Conditions.

- Stability: Maintaining consistent growth despite market fluctuations.

Conclusion

Portfolio analysis in strategic management is a very important process for analysing business units, products and investments to increase growth and profitability. It ensures that resources are well utilised so opportunities are balanced with risks.

With tools like BCG Matrix and SWOT Analysis, businesses are able to make appropriate decisions on what to steer towards. Either through active or passive management, the aim is the same: more specifically, to align investments with strategic objectives.

This blog describes how portfolio analysis is the pathway to competitive advantage and sustainable profit in that order, using the most high-profile examples such as Procter & Gamble and General Electric. In the rapidly changing and very competitive environment of the present, any organisation desiring to flourish needs to adopt the same.

The Certificate Program in Strategic Management and Business Essentials by Hero Vired will be an opportunity for you to learn and gain deeper expertise in this area. The book is designed as a primer, giving you practical tools and strategies that will allow you to master the concepts of portfolio management and strategic decision-making.

How can portfolio analysis benefit a business?

Which tools are most commonly used in portfolio analysis?

Which tools are commonly used in portfolio analysis?

Is active portfolio management better than passive management?

How often should portfolio analysis be conducted?

Updated on December 10, 2024