An essential component of financial management in businesses is Management accounting. Financial information is used in many ways to support Management decision making, including:

- Identification

- Measurement

- Analysis

- Interpretation

- Communication

Management accounting seeks to assist internal management in organising and regulating operations, whereas financial accounting is primarily concerned with informing external stakeholders. Management accounting practices are unquestionably important in improving organisational performance, but their significance still needs to be understood or addressed. In order to improve your understanding of the concept, this article examines the definition and goals of Management accounting. Let’s examine its useful applications in regular company operations and stress how crucial it is to attain sustainable growth.

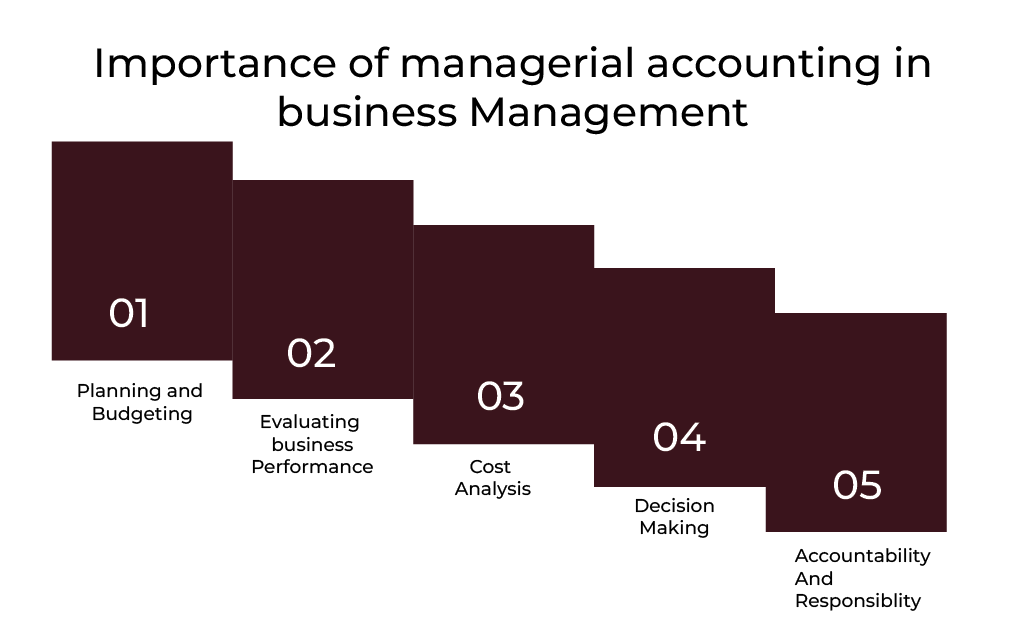

Importance of Management Accounting

Management accounting is specifically designed to provide executives with accurate, current financial and quantitative data to aid in decision-making regarding the near and distant future. Locating, sorting, tallying, communicating, and analysing information helps an organisation achieve its goals. There are significant differences between accounting for financial transactions and accounting for management. Financial accounting provides insightful information to all parties involved, including those inside and outside the company. Accounting for management is typically used to support internal managers in their basic Management duties. The following is a list of the significance of management accounting for your research and knowledge needs.

Management accounting is a vital tool that provides you with the financial data you need to successfully negotiate the challenges of managing a successful business. Let’s take a closer look at its meaning.

Planning and budgeting

The process of examining past financial data and projecting future patterns gives you the ability to create reasonable spending plans that support the goals of the business. These spending plans act as a guide. They direct resource distribution and guarantee that all departments work together to achieve the shared objective.

Evaluating business performance

Performance reports, such as variance analysis, can be used to pinpoint your strengths and weaknesses. Gaining knowledge of these KPIs helps you to maximise operational effectiveness and take preventative action.

Cost analysis

Making sense of costs by dividing them into fixed and variable components will help you decide on production volume and price. Having a thorough understanding of costs enables your business to continue being profitable and competitive.

Decision-making

Data-driven insights from management accounting lower uncertainty and risks, and along with assessing a new product line’s profitability, it aids in determining investment prospects and component procurement decisions. For the success of the business, you can depend on accurate financial information to help you make wise decisions.

Accountability and responsibility

Metrics from performance reviews help you and your staff recognise the contributions that each person makes. They still have the drive to reach or surpass goals. The accountability culture encourages collaboration and self-reliance. It propels the business quickly in the direction of its strategic goals.

Get curriculum highlights, career paths, industry insights and accelerate your technology journey.

Download brochure

Techniques in Management Accounting

In order to achieve business goals, Management accounting uses a number of different techniques.

- Marginal analysis: This assesses profits from various types of costs and deals with the benefits of increased production. It involves calculating the break-even point, which requires knowing the contribution margin on the company’s sales mix. Here, the sales mix is the proportion of a product that a business has sold when compared to the total sales of that business. This is used to determine the unit volume for which the business’s gross sales are equal to total expenditures. This value is used by Management accountants to determine the price points for various products.

- Constraint analysis: Management accounting monitors the constraints on profits and cash flow with respect to a product. It analyses the principal bottlenecks and the problems they cause and calculates their impact on revenue, profit, and cash flow.

- Capital budgeting: It is an analysis of information to make decisions related to capital expenditures. In this analysis management accountants calculate the net present value and internal rate of return to help managers with capital budgeting decisions, such as calculating the payback period or the accounting rate of return.

- Inventory valuation and product costing: This deals with determining the actual cost of goods and services. The process generally involves computing the overhead charges and assessment of direct costs associated with the cost of goods sold.

- Trend analysis and forecasting: This mainly addresses differences in product prices. The resulting data can be used to spot odd trends and devise effective strategies for locating and fixing the underlying problems.

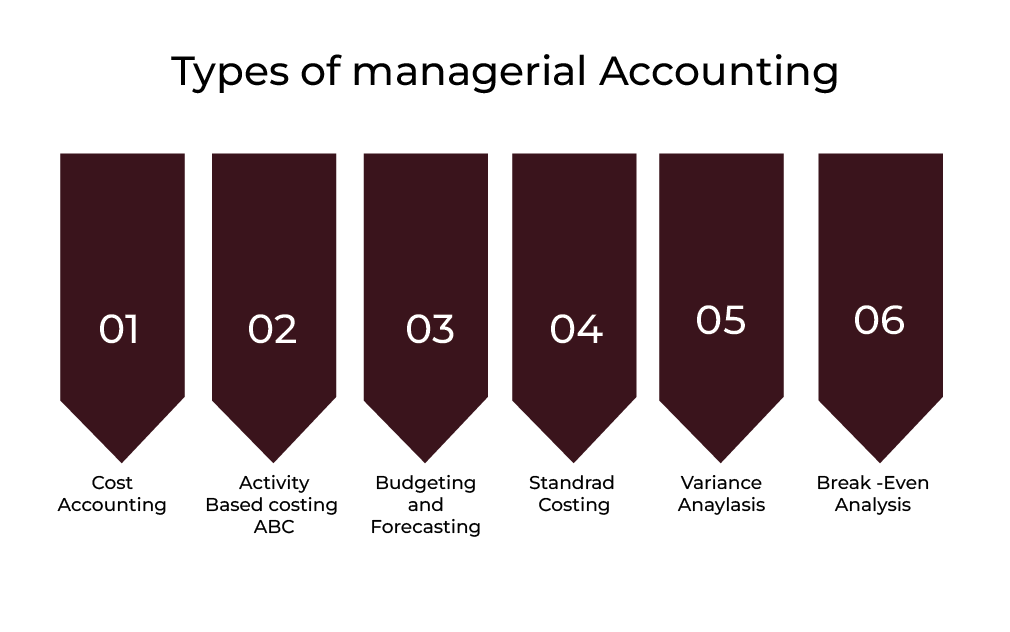

Types of Management Accounting

Let’s explore some of the critical types commonly employed by businesses.

Cost accounting

Cost accounting analyses and records the costs associated with producing goods or services. It involves tracking direct costs (raw materials and direct labour) and indirect costs (overhead) to determine the total cost of production. You can better comprehend the cost structure of goods and services by using cost accounting. It also aids in pricing decisions and points out areas where cost-efficiency can be increased.

Activity-based costing (ABC)

ABC is a specialised form of cost accounting that allocates indirect costs to specific activities rather than departments or products. Identifying cost drivers and linking them to activities helps ABC accurately track resource consumption. It also helps make more informed decisions regarding resource allocation and process improvements.

Budgeting and forecasting

Budgeting involves setting financial targets for the organisation for a period. On the other hand, forecasting predicts future financial performance based on historical data and expected market conditions. Budgeting and forecasting are crucial for planning purposes. They help you allocate resources and set performance benchmarks.

Standard costing

The process of standard costing entails setting fixed cost benchmarks for overhead and materials. These guidelines act as reference points for actual cost comparisons. Variations from average expenses may point up problems that need to be fixed. It enables you to act quickly to make corrections.

Variance analysis

Actual performance is contrasted with the planned or standard version using variance analysis. Analysing the distinctions between the two aids in determining the underlying reasons for deviations. You can ascertain whether they result from outside influences or from within-control factors. Variance analysis is a potent instrument for ongoing improvement and performance assessment.

Breakeven analysis

The analysis helps you determine the level of sales or production required to cover fixed and variable costs, resulting in zero profit or loss. Understanding the breakeven point is crucial for making pricing decisions and assessing the impact of cost changes or sales volumes. It also guides the financial feasibility of new projects.

Also Read: Advantages of Management Accounting

Conclusion

Management accounting is a dynamic tool that empowers you to navigate the complexities of modern business management effectively. By analysing and recording financial information, it helps increase efficiency and productivity. Its valuable insights, presented at regular intervals through techniques like standard costing, marginal costing, project appraisal, and control accounting, form the backbone of successful organisations across industries. Although its effectiveness relies on accurate financial statements, making it crucial to maintain error-free records, Management accounting remains a powerful tool for better business management despite certain disadvantages.

FAQs

Giving financial data to support internal decision-making and business management is known as management accounting. It is not the same as financial accounting, which is concerned with providing standardised financial statements to regulators and investors, among other external stakeholders.

Among other things, management accounting helps businesses track and create spending plans, cut expenses, forecast sales, and manage cash flows.

By defining financial goals and projecting future financial performance, budgeting and forecasting support the planning and control process. While forecasting enables managers to foresee obstacles and opportunities, budgets act as road maps.

Updated on October 1, 2024