A strong financial system is like the backbone which holds together everything in today’s money world where money makes the wheels turn.

A financial system is not some isolated set of banks or other institutions; it’s an engine driving everything from job growth to the acquisition of new technology. It facilitates the flow of funds from people with cash surpluses to those who have urgent needs for cash, thereby providing a means for economies to grow and individual financial goals to be met.

When the financial system works well, economies grow; when it falters, the shock waves can hit everyone.

This article highlights some of the most important functions of financial system that ensure the smooth running of an economy.

We explore, in this article, what makes these functions crucial, how they function in the real world, and why they matter to anyone interested in finance or economics.

What is a Financial System?

A financial system is a network of institutions, markets, instruments, and regulations that facilitate funds flow within an economy.

It links people who save with investors who need capital, thereby allowing money to flow from those who have surplus funds in households or businesses towards those who need funding to invest, grow, or spend. This, therefore, includes banks, stock exchanges, government policies, and payment networks in a way that allows for the management of transactions, investment support, and, above all, stabilisation of the economy.

A well-functioning financial system can help a lot in the light of economic development since it provides an orderly, efficient way of allocating support for innovation and, most importantly, financial stability.

Also Read: Financial Management – Meaning, Scope and Importance

POSTGRADUATE PROGRAM IN

Financial Analysis, Valuation, & Risk Management

Learn financial modeling, valuation techniques, and risk management to drive strategic business decisions.

Components, Roles, Advantages, and Disadvantages of Financial Systems

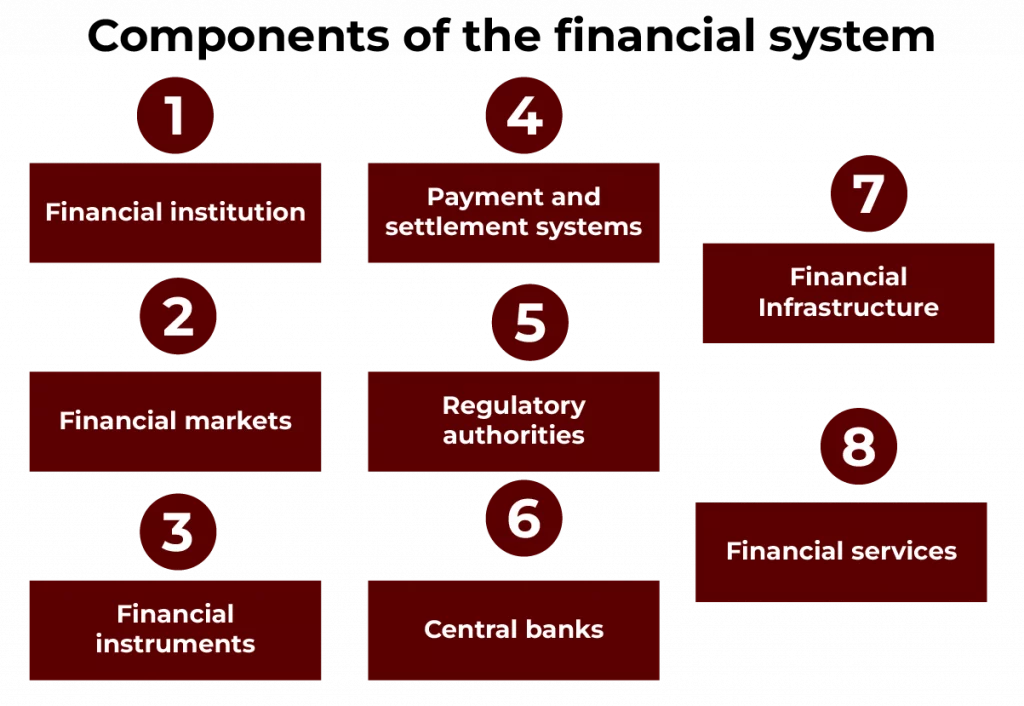

Components of the Financial System

- Financial institution

- Financial markets

- Financial instruments

- Payment and settlement systems

- Regulatory authorities

- Central banks

- Financial Infrastructure

- Financial services

Role of Financial Institutions

- Economic Growth of the Nation

- Capital Formation

- Regulate Monetary Supply

- Banking Services

- Pension Fund Services

Advantages of Financial Institutions

- Procurement of Funds

- Offer Safety

- Financial Consultation

- Employment Creation

- Ensure Regional Balance

Disadvantages of Financial Institutions

- Complex and Lengthy Process

- Security Deposit

- Hidden Risk Involved

- Limitation on the Borrower

Now, let’s see some key functions of financial system.

Mobilising Savings and Converting Them into Productive Investment

Each economy requires capital to grow. But where does this capital come from?

It all begins with savings, people setting aside a part of their earnings. The financial system’s first role is to convert these savings into investments.

This is required since, in the absence of investment, businesses cannot expand, and the economy cannot grow.

How does it work?

- When money is put in the banks, it is not sitting around idle. What happens is that banks gather all the money and lend it out to businesses and entrepreneurs who are seeking the capital to grow.

- The flow of savings into investments means businesses have money to expand, create jobs, and make new products.

Savings not only secure your future, but they also play our part in an investment cycle that benefits society.

Also Read: Financial Instruments: Types and Functions

Efficient Capital Investment to Foster Economic Growth

Saving alone is not enough. The financial system also has to employ capital efficiently, that the capital is channelled into projects or businesses with a promise to yield the best returns to benefit society at large.

It simply means putting money where it can make a difference.

If funds are not properly allocated, they might end up in uncertain or low-return projects that could even slow growth.

Why does this matter?

- When a commercial bank, investment fund, or venture capital firm has to make a choice of where to place their money for lending or investment, they look for projects that would likely be potential winners.

- This is what is called capital allocation, and it greatly determines how money is routed into industries or businesses that could actually work.

When we fund projects that have growth potential, it fuels the economy in a manner that will provide long-term benefits.

82.9%

of professionals don't believe their degree can help them get ahead at work.

Channeling Liquidity for Easy Asset Flows and Investments

Liquidity might seem to be a tough term, but it is simply the ability to convert assets into cash in a short time.

Liquidity in an efficient financial system enables businesses and investors to sell or buy assets without having to wait. This is very important because when there is uncertainty, they must find a way to raise cash at some point.

If liquidity does not exist, investments get stuck, and businesses end up in a tight corner when seeking access to funds.

How the Financial System Enables Liquidity:

- Financial markets, like stock exchanges, allow us to sell assets like shares or bonds quickly.

- This instant access to funds lets us adjust our investments or address financial needs without hassle.

By ensuring liquidity, the financial system helps individuals and businesses meet unexpected needs and make timely decisions.

Enabling Secure and Efficient Payment Mechanisms Across Economies

What happens each time we buy a coffee, pay a bill, or transfer funds?

These simple transactions only seem easy because the financial system is working behind the scenes. A reliable payment mechanism is one of the most critical functions of financial system.

It allows businesses and individuals to make and receive payments quickly, safely, and without any hassle. Without this mechanism, even everyday purchases would be challenging.

How Payment Mechanisms Work:

- Payment systems include everything from bank transfers and credit cards to mobile wallets.

- These systems allow for fast, secure transactions, whether we’re buying groceries or paying salaries.

Secure payment systems keep transactions smooth, encouraging people to engage in commerce and keep the economy running.

Expanding Access to Credit and Loans to Drive Business and Innovation

What does it take for a new business to start or expand?

More often than not, it’s access to credit. Whether it’s a small family shop or a large corporation, businesses often need loans to grow.

The financial system makes this possible, providing the structure for banks and lenders to offer loans and credit lines. These financial services empower individuals, entrepreneurs, and even governments to fund their goals.

Why Access to Credit Matters:

- Credit isn’t just about money; it’s about opportunity.

- With credit, people can start businesses, buy homes, or invest in education.

Risk Management through Diversified Financial Instruments

Business or personal finance carries inherent risks. Price or interest rate fluctuations and sometimes even unexpected events compromise financial stability.

The financial system offers a way to manage these risks using tools that spread, reduce, or transfer risk. Whether through insurance, investment diversification, or hedging, financial tools provide options to manage uncertainty.

How Risk Management Works:

- Financial institutions offer various instruments like insurance policies, derivatives, and diversified investment options.

- These options allow individuals and businesses to protect themselves from financial shocks.

By managing risks effectively, the financial system allows people to plan with greater confidence and stability.

Also Read: 5-Step Risk Management Process

Facilitate Transparent Price Discovery to Obtain a Fair Valuation of the Market

Price discovery is one function of the financial system that provides fair prices to the given asset based on supply and demand. Simply put, it’s about the right setting for prices in the stock market or even commodities like gold.

This method brings transparency, thus aiding buyers in making informed decisions and helping sellers buy or sell.

Why price discovery is important?

- Transparent pricing helps us not to overpay or undervalue the asset.

- It makes the markets fair and thus helps investors make sound decisions.

By this kind of transparency, the financial system promotes its own trust in the market.

Financial Inclusion to Facilitate Inclusive Access to the Economy

Access to banking should be as smooth for people living in some far-flung villages as it is for people living in big cities. Financial systems attain this good cause through the promotion of financial inclusion.

This implies offering all, regardless of location whether rural or poorly serviced areas, access to the fundamental financial services: savings accounts, loans, and insurance. Financial inclusion is not just about numbers; it is about equal opportunities for economic participation and security.

When people have access to financial tools, they can save, borrow, invest, and improve their livelihoods.

How does financial inclusion work?

- Microfinance institutions lend money to low-income earners.

- Mobile banking applications allow people who live far from the bank to visit the bank without needing to do so.

Financial inclusion brings out a better economy because everybody participates and, therefore, benefits from it.

Capital Formation for Sustainable Long-Term Growth

Just imagine that nobody is saving, and nobody invests. Therefore, almost nothing develops long-term growth, such as schools, hospitals, or infrastructure, that directly propels growth.

During this process, the financial system plays a very significant role in facilitating savings and investment that sustain the formation of capital among people and institutions.

Capital formation is the acquisition of funds that can be used to raise the creation of assets that can support long-term economic growth. As a result, the economy becomes strong and ready to face higher challenges.

How does capital formation work?

- Banks and other financial institutions encourage people to save, collecting those savings to pool them into bigger investment schemes.

- Pension funds and insurance companies invest in infrastructure improvement and job-creating projects.

Capital formation thus helps the financial system support laying down the foundation for a stable and prosperous future.

Also Read: Functions of Capital Market

Assisting Government Policy Implementation and Maintaining Economic Stability

How does a government control inflation or respond to a recession?

It’s not just policies; the financial system plays a big part in these processes. Through central banks and other regulatory bodies, the financial system assists in implementing government policies that promote economic stability.

This might involve adjusting interest rates, managing money supply, or setting regulations that guide lending practices. These tools keep inflation in check, prevent economic downturns, and ensure the economy grows steadily.

How the Financial System Supports Stability:

- Central banks like the Reserve Bank of India set policies to control interest rates and manage inflation.

- Regulatory bodies monitor and guide financial institutions, ensuring fair practices and financial security.

Through these measures, the financial system becomes a partner in keeping the economy steady and resilient.

Conclusion

The functions of financial system, therefore, form the spine structure of a thriving economy by aligning a saver with a borrower, facilitating smooth payments, and opening up access to credit as sources of growth.

Each function, from investment and financial inclusion to risk management and fair pricing, compounds to create a structure that will favour economic activity growth. Policy and regulations by central banks and the regulatory body are helpful for capital formations on long-term projects.

Together, these functions create a balanced and inclusive economy to enable individuals, firms, and communities to create a future anchored by growth and security.

For further information about the principles of financial systems and to see how to analyse, value, and manage risk, check out the Certificate Program in Financial Analysis, Valuation, and Risk Management at Hero Vired.

What are the major functions of financial system?

How does financial inclusion impact the economy?

What is the connection between capital formation and economic growth?

How does the financial system help in controlling risk?

Why does price discovery matter in financial markets?

Updated on November 11, 2024