Capital markets can be broadly categorised into two types:

- Primary Market

- Secondary Market

They are crucial to the financial structure, raising capital, and aiding trade.

Primary Market: A Key Source of Capital for New Ventures

All of it begins at the primary market.

When the company wants to raise funds, it goes public for the first time by releasing new shares, bonds, or securities. Think of it like a business that is looking to grow- they need cash, and the primary market is that avenue.

Here, business firms can make an Initial Public Offering (IPO). This way, investors can purchase shares that would eventually be used to finance the expansion of the business.

For example, consider a local renewable energy firm in India that is building solar power farms. They would need funds to expand all over the states.

By raising capital from the primary market through issuing shares, they attract investors willing to make a bet on their growth in the future. They use the funds to purchase more land and equipment and hire employees.

The primary market connects investors willing to grow their wealth with those businesses that need capital to grow.

This is where the magic happens:

- Companies issue new securities.

- The investors buy them directly.

- The funds are channelled to the corporation, which could either establish new ventures or expand existing ones.

Secondary Market: Facilitating Trading of Existing Securities

Once a company has issued its stocks or bonds in the primary market, the show goes to the secondary market. It is a marketplace where investors buy and sell stocks and bonds.

You’re undoubtedly familiar with India’s National Stock Exchange (NSE) or Bombay Stock Exchange (BSE).

These are secondary markets.

Here, investors can sell shares to others, thus allowing them to make some profit or cut some losses based on the ups and downs of the market.

Assume you bought shares in that renewable energy company through their IPO. After months, the same shares are more valuable. You’ve come to be interested in liquidating your gains; thus, sell your shares in the secondary market.

This is the liquidity aspect of the secondary market- you can liquidate your investment very quickly.

Some of the key participants in the secondary market are:

- Individual investors buying or selling shares.

- Institutional investors like banks and mutual funds.

- Brokers and traders who facilitate sales.

Without a secondary market, investors will have no one to sell to. This would make it less appealing for them to buy in the first place.

Key Differences between Primary and Secondary Markets

| Aspect |

Primary Market |

Secondary Market |

| Purpose |

Raising new capital for companies |

Trading of existing securities |

| Participants |

Companies and investors |

Investors and brokers |

| Key Feature |

Direct issuance of new securities |

Liquidity through the trading of securities |

| Example |

A company’s Initial Public Offering (IPO) |

Shares traded on NSE or BSE |

| Funds go to |

The issuing company |

Other investors (not the issuing company) |

How Do These Markets Work Together?

The primary market helps businesses raise capital by issuing new shares or bonds.

The secondary market provides a place where issued securities are bought and sold by other investors. In other words, this is a trading place for previously issued securities.

In simpler terms:

- The primary market is like the “launchpad” for a business’s financial journey.

- The secondary market is the “stock exchange”, wherein investors trade their shares once these are issued.

Both markets are very crucial to the economy.

Without the primary market, companies would have some difficulty raising finance for new ventures. Without the secondary market, investors would not invest, knowing that they could not easily sell assets.

Together, they enable the efficient flow of capital from those who have it to those who need it. This is how companies grow, governments fund projects, and investors build wealth.

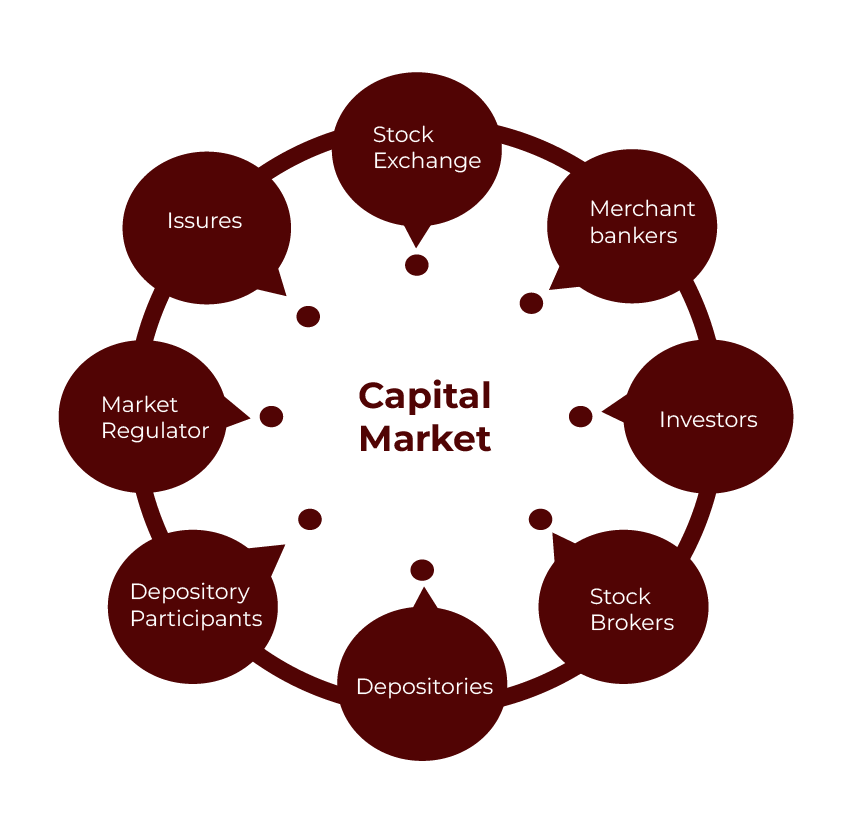

Who Are the Main Participants in the Capital Markets?

Now that we know how these markets work, let’s see who plays here.

Regulatory Bodies

- SEBI checks whether the market is running properly or not; it prevents fraud and protects the investors.

Individual Investors

- Just like us, individuals can buy and sell shares, bonds, or other securities to add to their personal wealth.

Institutional Investors

- These consist of big parties like banks and insurance companies, mutual funds, and pension funds. They purchase in large volumes and thus have a heavy impact on the market.

Companies and Governments

- Emitters of securities for fund mobilisation toward their ventures.

Brokers and Traders

- The middlemen are brokers and traders who allow both buying and selling on the market.

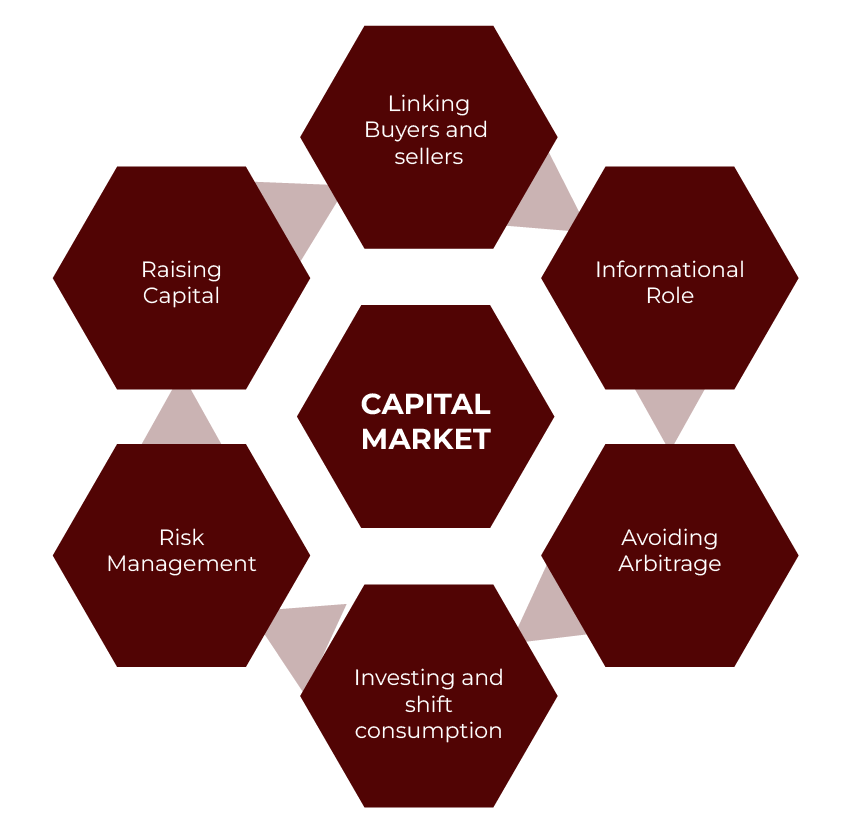

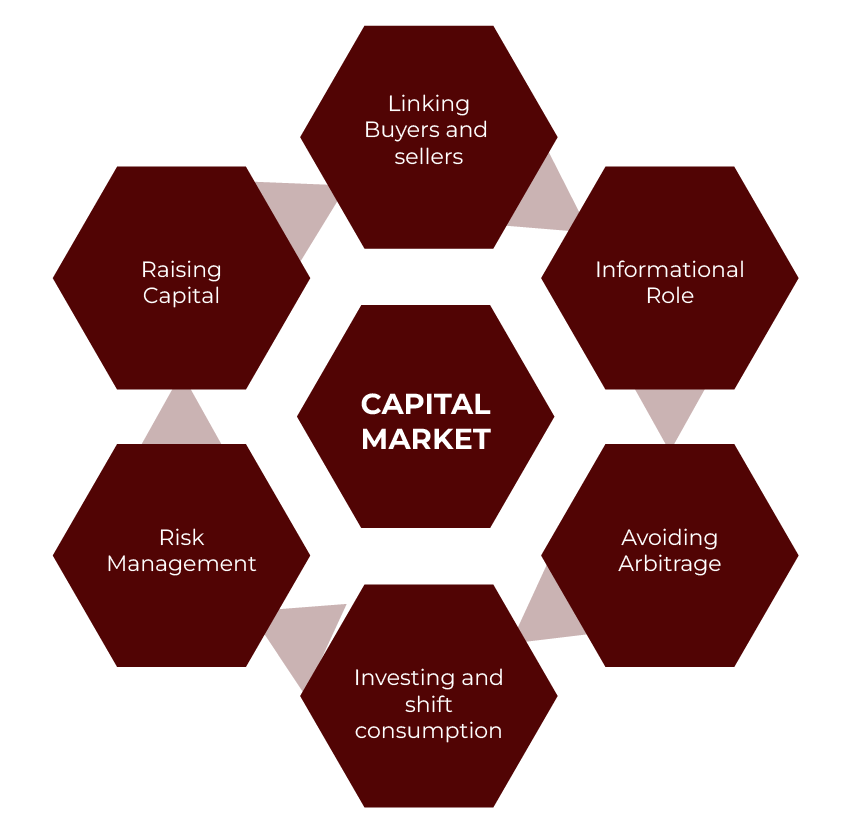

Mobilisation of Savings for Productive Investment

Ever wonder where all the unused money in our savings account goes? It is the fuel that runs our businesses, governments, and big infrastructure projects.

This capital market plays a very critical role in it. It mobilises savings from all types of individuals, households, and institutions and employs that fund. Instead of letting the money gather dust, it is being put to work in productive endeavours like building new highways, launching a tech startup, or expanding hospitals.

It is a mutual gain.

We get an opportunity to invest and earn through savings while the companies and governments receive the money to expand and develop.

For example, when you or I buy shares in a company, we are not only investing for ourselves; the company uses money to create more factories, employ people, and finance new projects.

In simple terms, capital markets collect all the scattered savings and direct them towards avenues from which the entire economy benefits.

Facilitating Capital Formation and Promoting Economic Development

Now that savings are being invested, what happens next? This is where capital formation comes into play.

When savings find their way into the capital market, they enable businesses to raise the funds necessary for projects with long-term timelines. Some examples of such projects may involve constructing a new metro system in a big city or financing a renewable energy company to construct its solar farms.

Most of these projects would not have been undertaken had there been no capital market.

Capital formation is among the most important functions of capital markets. It is the journey from saving to creating real economic growth.

Think of businesses in your city. If they can access capital, they will expand, grow jobs, and introduce new products. If they cannot access capital, things grind to a halt. Access to capital allows companies to buy new equipment, increase capacities, or introduce new products.

This creates ripple effects- for example, more jobs, better infrastructures, and a more robust economy.

Risk Diversification through Various Financial Instruments

Who does not know that investing is highly risky? No one wants to put all their eggs in one basket, correct?

It is here that the capital market helps manage risk.

It provides us with a range of financial instruments-like stocks, bonds, and derivatives-that allow risk diversification. You can diversify your investments across different industries and kinds of assets instead of placing everything in one company’s stocks.

Supposing you believe that the technology company is going to give big returns, but you have concerns about the market as well.

In that way, you will balance out the risk by buying bonds for a certain government project that you think will be reliable. You would tend to earn more in returns with the shares of the technology company but possibly a lot more stable on the bond.

This way, it is ensured that even when one of the investments fails, your overall portfolio can still make a profit.

The capital market does all this.

It helps us mitigate the risk by allowing different investment options while we are making wise financial decisions.

Also Read: Instruments of the Capital Market

Providing Liquidity for Long-Term Investments

Liquidity might sound technical, but it is just simple. It’s the ease at which an asset can be transferred into cash without losing any value.

Imagine buying shares in a firm today and later realising you need that money back after a month. You would be stuck with such shares until the firm goes public again or finds another person to buy them off.

The case is different today because of the secondary market. You can sell your shares anytime and get cash back.

That is why long-term investments in the capital market become attractive. We can liquidate our investments any time we want.

Let’s assume you bought a government infrastructure bond three years ago. Now you want to sell. The secondary market allows you to sell that bond to another investor.

Here again, it saves you the liquidity required to sell, and the bond continues to raise finance for essential projects.

The Capital Market makes sure long-term investment cannot trap your money. You can always find a buyer, and that’s what makes the system work for both investors and businesses.

Ensuring Fair Pricing and Transparency in Financial Markets

One of the biggest nightmares many investors have is whether they’re getting a fair deal. Nobody wants to be scammed or overpay for an asset that’s worth less.

Fortunately, capital markets operate on transparency.

Stock markets such as the BSE and NSE of India will make sure that prices are established based on supply and demand rather than on unscrupulous backroom deals. The same information is received by every investor, whether big or small. The market is balanced due to this.

Let’s say you are investing some amounts in a company that leads in the field of technology. You will know the precise amount in the market, and there will be no chance of backroom deals that can affect your investment.

Everything is open and accessible to view.

This level of openness or transparency establishes trust and ensures that prices represent the true value of the assets traded.

It is one of the essential functions of capital markets: making sure people play by the same rules.

Serving as a Platform for Long-Term Funding to Businesses

Every business requires financing for growth.

Whether it is a small start-up at a local level or an extensive multinational corporation, the capital market provides a base to raise long-term funds. Companies can issue stocks, bonds, or other forms of securities to raise the amount they need.

Consider, for instance, a renewable energy company that wants to expand its wind farm operations across India. It can issue corporate bonds to pool together the same amount of funds that it requires for such a big investment.

Through the issue of securities, the company acquires the required capital, and the investors get the chance to generate returns from their investment. A win-win situation for both.

Without the capital market, businesses would have a tough time gathering the funds required for them to grow.

However, with it, they can gather the long-term investment they require in order to achieve the targeted goals.

Supporting Government and Corporate Borrowing through Bonds

Not only organisations but the government also depend much on the capital market. They issue bonds to obtain funds for public projects involving roads, bridges, schools, and hospitals.

When we buy government bonds, then we are providing credits to the government.

They, in turn, pay us interest and pay back our principal amount after a given period.

Let us assume that it is a government which wants to raise money for a large infrastructure project, such as building a new railway crossing the country. This government issues bonds in the capital market to raise the funds required for the project. People buy those bonds expecting that they will get the amount at regular intervals of years.

Under this system, governments can raise funds to finance projects which are beneficial to the whole nation without having to access large sums of money at one time.

Strengthening Investor Confidence through Regulatory Mechanisms

Any market is governed by trust. Without it, investors would not put their money into anything.

Regulation of capital markets, therefore, is very crucial.

In India, SEBI plays a critical role for all the market players. It ensures that a stiff rule is followed by all the market participants to prevent fraud from surfacing in the hands of investors and making wrong statements about companies. It is like having a referee in the game of football.

Without regulations, the game would turn to chaos. It is the same for the capital market.

SEBI regulates the market and keeps on making it fair, transparent, and trustworthy.

These scenarios boost investor confidence and encourage more people to be associated with the market.

Promoting Innovation and Advancing Technological Development

Innovations are supported by capital. Ideas, technologies and start-ups require venture capital to bring them into reality.

The capital market offers that capital.

For instance, an emerging company in the tech industry may produce a new pay application. Such an application may easily be raised some capital through an IPO. The capital is used to get more engineers to work on it, develop the product, and bring it into the market.

In return, the investors get a share of the company and later enjoy its fruits.

Without capital markets, many of today’s giants would not have come into existence. It is important in providing funding for innovation as well as technology improvement.

Offering Investment Opportunities Across Risk Preferences

Investors are not the same.

Some would need to take more risk with the hope of high return, and some want safer, steady investments.

The capital market caters to both.

High-growth tech stocks and stable government bonds could go on the list. A younger investor might even be able to handle taking a risk on a start-up, hoping for high returns. Meanwhile, an investor near retirement may desire a government bond for security.

This is the most diversified capital market that accommodates every kind of risk appetite.

This is part of the reason this form of market attracts such a high level of participants.

You may be a conservative or want to make aggressive investments. Whatever your type of investor, there is something for everyone in the capital market.

There is so much money going through the capital market. How do we know that things will just work out?

This is where regulatory bodies come in.

India has the Securities and Exchange Board of India or SEBI. The regulatory body ensures the market is fair and that the functions of the capital market are transparent and trustworthy.

Without this regulation, the capital market would be a completely chaotic place. The confidence of investors could drop, and companies may indulge in malpractices.

SEBI’s Role in Ensuring Investor Protection and Market Integrity

SEBI works to protect investors from fraud and misleading practices.

SEBI focuses on fraud and misleading practices against investors.

Let’s assume that a company wishes to issue some shares. SEBI makes sure that the company keeps its house in order and accurately lets the investors know where it stands in terms of financial health, plans, and even the risks involved.

This simply means that the investor knows where he or she is putting his or her money after knowing what they are getting themselves into before making an investment.

Another role that SEBI plays is in the regulation of trading on the stock exchange to prevent insider trading and some market manipulation.

In essence, SEBI plays a role in maintaining a clean and transparent market, ensuring that investors’ confidence is built and that business becomes quiet according to the rules.

International Regulatory Impact on Global Capital Markets

It is not just domestic regulations. The capital market is international. International regulations also play a very important role.

For example, many large companies in India trade on both local and international exchanges. Thus, to be able to operate internationally, these companies need to follow the rules of multiple bodies acting in different countries.

Such international standards ensure standardisation to make it less risky for firms and investors to trade across borders.

Without this international cooperation, foreign investment would be significantly riskier.