Fintech, or financial technology, is a fast-expanding business that is altering the way people interact with money. VC investment in Fintech businesses reached a record high of $52.3 billion in 2021, and this figure is projected to rise in the coming years.

It’s no wonder that the massive growth of Fintech is having an influence on the Metaverse. This is also giving rise to many finance certification courses that help students open themselves up to new opportunities.

What is Fintech?

Fintech is a broad phrase that encompasses many different techniques and services. It is fundamentally about leveraging technology to improve the efficiency and accessibility of financial services.

This can range from mobile banking applications and online investing platforms to blockchain-based payments and artificial intelligence-powered financial advising.

Fintech includes many companies, from startups to established firms, offering innovative products and services in mobile payments, peer-to-peer lending, and crowdfunding.

Many Fintech startups have brought new competition to the financial services industry, which has been historically slow to embrace change. These companies have also raised billions of dollars in venture capital in recent years, and the industry is expected to continue to grow.

With that growth, a lot of new finance certifications have been created to help new entrants to this industry gain insight and knowledge required to start.

There are also several factors driving the growth of the Fintech industry, including:

- increasing use of mobile devices

- rise of digital banking

- growth of the sharing economy

In addition, as traditional financial services companies have become more risk-averse, Fintech companies have been able to fill the void with their innovative products and services.

Get curriculum highlights, career paths, industry insights and accelerate your technology journey.

Download brochure

Source

The term “Metaverse” refers to the virtual world that exists online, apart from the actual world. It is a location where individuals may connect with one another and with digital material in a natural and engaging way.

While the concept of the Metaverse has been around for decades, it has only lately gained widespread notice. This is partly due to technological advancements that have enabled the creation of increasingly realistic and lifelike virtual environments.

Although the Metaverse is in its infancy, where there is a lot of development with little adoption, it can potentially become a significant influence in our lives. It could even replace the physical world as the central location where we connect with one another and with companies.

The Metaverse can revolutionize many industries. One of the most obvious examples is e-commerce. In a Metaverse, businesses would be able to create virtual storefronts where customers can browse and purchase products without ever leaving their homes.

Fintech companies are particularly well suited to take advantage of this opportunity. After all, one of the main advantages of Fintech is that it allows users to conduct financial transactions without having to go through a traditional bank or financial institution.

In a Metaverse, Fintech companies would be able to provide their services directly to users without any intermediaries.

Fintech is changing the Metaverse by providing new and innovative ways for people to interact with the world around them. Here are a few ways how this change is taking place:

- Making it easier to pay for things: In the past, paying for things in the Metaverse was often a complicated and time-consuming process. However, with the advent of Fintech, there are now a number of ways to make payments in the Metaverse that are both easy and convenient. This includes in-game microtransactions, in-app purchases, and even peer-to-peer payments.

- Enabling new forms of interactions: Fintech is also expanding our options for interacting with the Metaverse. For example, blockchain-based systems such as Decentraland allow users to purchase, sell, and exchange virtual land and property. This is only one example of how finance is enabling us to connect with the Metaverse in novel and creative ways.

- Easier access to financial services: One of the most significant benefits of Fintech is making it easier for individuals to access financial services. Mobile banking, internet investment, and even crypto-based financial services are examples of this. Fintech is democratizing finance and making it available to everyone by making these services more accessible.

All in all, it’s evident that Fintech is a powerful addition to the Metaverse, and we can only see it hooking more people onto the platform.

There are already several Fintech companies that are active in the Metaverse space. For example, Decentraland is a blockchain-based virtual world where users can buy, sell, or rent virtual land.

The company has also partnered with several major brands, such as McDonald’s and Microsoft, to bring their products and services into Decentraland.

Similarly, The Sandbox is another blockchain-based virtual world where users can create, own, and monetize their gaming experiences. The company has raised over $2 million from investors such as Square and Samsung.

Other Fintech companies are also exploring the potential of the Metaverse. For example, PayPal has filed a patent for a system that would allow users to make payments in virtual worlds using their PayPal account.

In China, Alibaba’s Ant Group is working on a virtual currency that could be used in the company’s upcoming blockchain-based virtual world.

Here are some of the largest brands that have purchased virtual land and created VR stores in the Metaverse:

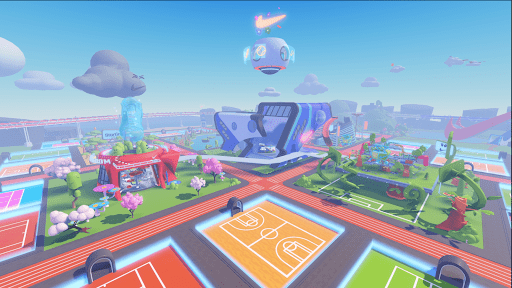

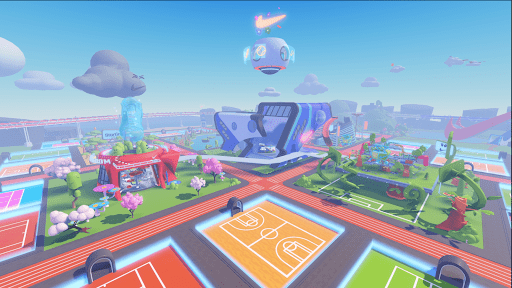

Nike

Source

Nikeland, created in collaboration with Roblox, has joined the Metaverse.

Nike developed a virtual pop-up store where customers can only access limited edition products after earning credits from past Air Max 720 purchases. The store is supported by an exhibit in Nike’s flagship store in London, Oxford Circus.

This year’s Air Max Day event concluded on March 26 with the introduction of a sneaker created by a Nike fan as part of the company’s On-Air campaign.

Threedium

Source

As part of Decentraland’s Metaverse Fashion Week, creative agency Craft and 3D engine Threedium built a virtual shopping mall that featured a variety of established and rising companies.

Threedium’s location featured Paco Rabanne, Dolce & Gabbana, and Casablanca boutiques, as well as web3 companies FangGang and DeadFellaz.

Visitors could participate in fashion events and experiences, including both real and digital drops.

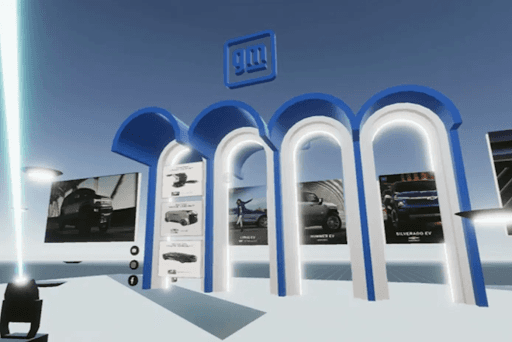

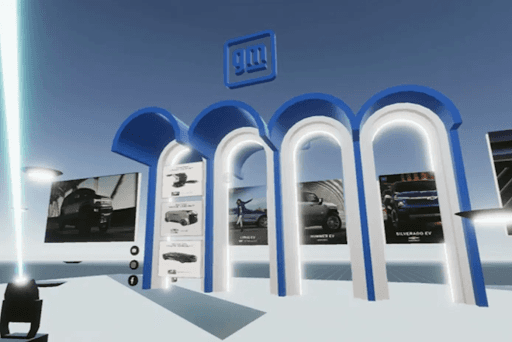

Decentraland’s VR shopping district

Source

The Decentraland team started its District Proposal process, allowing anybody on the planet to submit District Proposals to the team for consideration of their innovative idea.

The 30-day MANA commitment period for the Terraform Event began shortly after accepting District Proposals on the Decentraland Github.

The VRS District was born, and the Decentraland community contributed 418 LAND parcels. This helped the team create a Virtual Reality Shopping District that will not only bridge the gap between the real and virtual world but also connect virtual world economies as deeply as each unique world can be connected.

Currently, several worldwide high fashion businesses are fighting for admittance into the Metaverse.

DressX

DressX, a digital fashion company, has opened a store in the Decentraland Metaverse. The store is located in Metajuku, a district that takes its roots in Harajuku in Tokyo. This makes DressX one of the first companies to open a virtual store in Decentraland.

The move comes as traditional shopping malls see decreased foot traffic as retailers shift more of their operations online. Meanwhile, sophisticated virtual malls are being constructed in the Metaverse (a burgeoning business known as ‘de-commerce’).

Through DressX’s use of digital clothing items that can be purchased virtually, users can create whole new outfits without producing any waste or carbon footprint. This makes it an environmentally friendly option within the fashion industry, known to be one of the largest polluters globally.

Fintech companies use innovative technology to provide a wide range of financial services, including mobile payments, peer-to-peer lending, and digital currencies. They are typically small, nimble startups that are able to develop and deploy new technologies quickly.

The Metaverse is a virtual environment in which humans may interact with one another as well as with computer-generated characters and items. It is also a platform for developing decentralized applications.

Finance technologies can bring many benefits to the Metaverse, including:

- Convenience: One of the biggest advantages of Fintech is that it is convenient. With Fintech, you can make in-game microtransactions or in-app purchases without having to leave the Metaverse. This is a significant benefit for both users and businesses alike.

- Increased accessibility: Another major advantage of Fintech is that it’s making financial services more accessible. This includes mobile banking and online investing, which are now available to anyone with an internet connection. By making these services more accessible, Fintech is helping to democratize finance.

- Innovation: Fintech is fueling innovation in the Metaverse domain as well. With new technologies such as blockchain and AI, we are witnessing a new wave of innovation in the Metaverse. As a result, the Metaverse is becoming a more engaging and vibrant place to be.

Despite the many benefits that Fintech brings to the Metaverse space, some challenges need to be addressed:

- Regulation: Regulation is one of the most difficult obstacles that Fintech faces. The financial business is highly regulated, and Fintech firms must frequently traverse a complicated web of rules. This may be difficult, especially for small businesses.

- Security: Another issue that financial firms confront is security. With the cases of cybercrime growing, it is more critical than ever to ensure the safety and security of financial data. Fintech firms must be able to provide their users with a high level of protection.

- Customer adoption: One of the biggest challenges for Fintech is getting customers to adopt its products and services. Fintech companies must find ways to convince customers that their products are better than traditional financial products.

- Scalability: A final challenge that Fintech companies face is scalability. With the rapid growth of the industry, Fintech companies need to be able to scale quickly to meet the demands of their users. This can be formidable, especially for small startups.

Despite the many challenges that Fintech companies face, the industry is continuing to grow rapidly. This is due to the many benefits that Fintech brings to the Metaverse space, such as increased efficiency, transparency, and security.

The Metaverse is still under heavy development. Hundreds of big-budget brands, Fintech or otherwise, are working on creating a presence in the Metaverse before it goes mainstream.

Since e-commerce in the Metaverse is quite limited due to a lack of payment methods, Fintech companies need to recreate payments, tracking, trading, investing, and currencies to simulate real-world transactions.

This will give rise to new Fintech companies and, with that, a host of new job opportunities.

For example:

- Existing Fintech developers could create new applications or services that help people manage their finances or make better financial decisions.

- Fintech analysts could help businesses understand and use data from financial technology to make better strategic decisions.

- Fintech marketers could help promote financial technology products and services to consumers and businesses.

The future of Fintech is full of promise but also riddled with uncertainty. Nonetheless, the opportunities presented by Fintech are too big to pass up, and the industry is primed for exponential expansion in the coming years.

The Metaverse is one area that is ripe for disruption, and Fintech will play a major role in shaping its evolution. From enabling new forms of commerce and investment to bringing financial services to underserved populations, Fintech will have a profound impact on the Metaverse space.

The challenges that Fintech faces are significant, but with the right partnerships and regulations in place, the industry can realize its immense potential and help build a better future for us all.

Final thoughts

Fintech is a rapidly growing industry with tons of unexplored potential. Further, from making it easier to pay for things to enabling new types of interactions, Fintech is changing the way we interact with the Metaverse.

In addition, by making financial services more accessible, Fintech is helping democratize finance. While some challenges need to be addressed, such as regulation and security, the future of Fintech is teeming with potential.

If you are looking for a way to jump on board the Fintech industry, taking up certificate courses on finance like HeroVired’s Integrated Program in Finance and Financial Technologies is a great idea. It is aimed at helping students to get practical knowledge and prepare for the new markets.

Our financial technology course is created in collaboration with MIT and integrates with the MITx MicroMasters program. It is a great way to learn about Fintech and Metaverse concepts through live online certifications for finance.

Further, this online certification for finance covers emerging technologies like blockchain, big data, data modeling, applications of machine learning in finance, and more.

If you want to grab the best oncoming Fintech opportunities, Hero Vired’s Finance and Finacial Technologies program is THE finance certification course you need.

FAQs

Updated on February 13, 2023