Bonds are securities that offer fixed income, as the payment of interest for bonds having coupon rates is fixed, and the principal repayment for a typical bond is specified at the time the bond is issued and fixed for the life of the bond.

The process of bond valuation is a way of determining the theoretical fair price of the bond concerning the present worth of interest payments over the bond discounted at a reasonable rate of interest. Holders use it to determine the worth of the expected future receipt, which consists of an interest coupon and the face value that is paid at maturity of the bond. What is important is that, whereas with stocks, the investment returns are unpredictable, with bond investments, the returns are expected. Therefore, the value of bonds is quite profound yet simple for rational investment.

What is Bond Valuation?

The concept that provides the technique for finding a fair price of a bond concerning the present worth of interest payments over the bond discounted at a reasonable rate of interest is called bond valuation. In order to arrive at the fair value of a bond, the coupons that the bond will pay in the future are discounted to their face value.

Also Read: 7 Key Scope of Financial Management to know in 2025

POSTGRADUATE PROGRAM IN

Financial Analysis, Valuation, & Risk Management

Learn financial modeling, valuation techniques, and risk management to drive strategic business decisions.

Uses of Bond Valuation

- Bond valuation is utilised by investors in decision-making in the formulation of investment plans by ascertaining risks and the expected profitability of the bond.

- It enables the investors to know whether the bond is fairly priced or they are over/under price.

- It helps users understand the technicalities of the fixed-income market.

Key Components of Bond Valuation

Face Value

This value is mentioned on the face of the bond. Face value or par value refers to the amount of money those bondholders can expect from the bond issuer in case there is no failure on the part of the bondholder to make payment upon the bond’s maturity.

Coupon Rate

In general, a Bond has a fixed rate of interest payment linked to it, which is referred to as a coupon rate. It refers to a fixed sum that is paid in the name of interest at previously decided intervals, which is within the bond’s life and is usually expressed as a ratio to the bond’s face value.

Coupon Payments

The amount of payment made at fixed intervals based on the coupon rate of a bond is called a coupon payment. These are generally paid on a yearly or half-yearly basis.

Maturity Date

Bonds are financial assets that are always issued for a fixed and specified period of time. The date on which the issuer of the bond repays the holder of the bond the sum of money specified at the time of its issue the bond issued and the coupon rate is known as the maturity date.

Yield to Maturity (YTM)

YTM is a yield that an investor expects to gain through a bond held until it becomes due.

The Process of Bond Valuation

Understanding the Formula

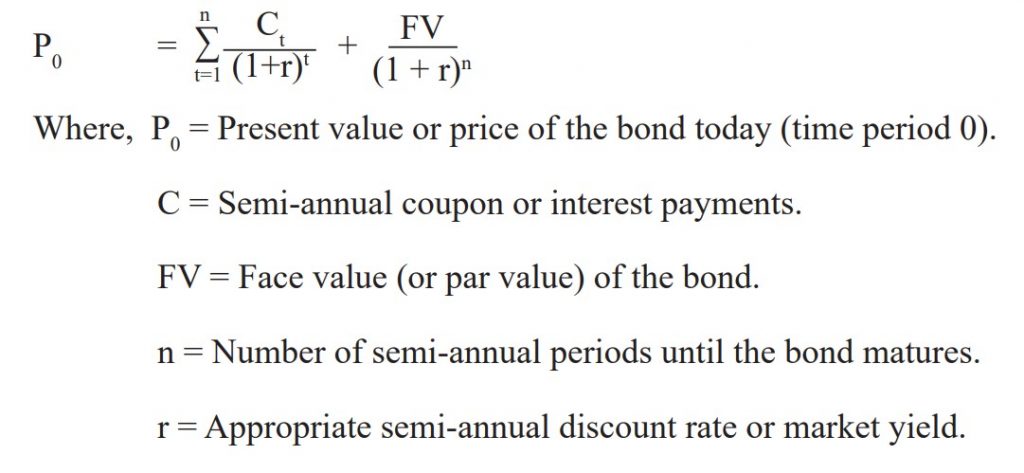

The valuation of a bond involves summing the present values of its future cash flows. The formula is:

OR

Example Calculation

Consider a corporate bond with:

- Face value = ₹1,000

- Coupon rate = 6% (₹60 annually)

- Maturity = 3 years

- YTM = 5%

The 3-step process of Bond Valuation

- Discount annual coupon payments (₹60) using the Yield To Maturity(YTM).

- Discount the face value (₹1,000) using the same rate(YTM).

- Sum these values to get the bond’s fair price/value.

Zero-Coupon Bond Valuation

As the name suggests, there are no periodic coupon payments when we value zero-coupon bonds. Thus, the valuation is relatively simple.

PV=FV/(1+r)^n

82.9%

of professionals don't believe their degree can help them get ahead at work.

Factors Affecting Bond Valuation

Interest Rates

As for interest rates, bond prices fluctuate in the opposite direction. When rates rise, the price of bonds declines because other new bonds are more attractive.

Credit Quality of the Issuer

Because bond issuers with lower credit ratings face high default risks, the price of the bond is low.

Time to Maturity

It can be concluded that long-term bonds are valued more than short-term bonds and fluctuate with changes in interest rates.

Inflation and Economic Conditions

A combination of costs and revenues moves higher when living costs increase, thereby lowering bond values. This process depends on various factors, including the economic conditions and monetary policies of the countries involved.

Types of Bond Valuation in India

Government Bonds

These are low-risk equipment and the prices of these equipment are affected by interests and money supply.

Corporate Bonds

Investors need to evaluate the financial situation of the company that issued the bond. They usually pay more on the term of yield than government bonds to make up for the extra risk.

Tax-Free and Municipal Bonds

It also provides a certain amount of tax incentives, so these bonds can be appealing. Their valuation takes into account the cash flows and the tax effect experienced by the investor.

Also Read: Financial Management – Meaning, Scope and Importance

Conclusion

Bond valuation is an essential component used in the evaluation of the fair value of bonds in order to facilitate investor decisions. Explaining calculations such as YTM, along with key elements of interest rates and maturity and thematic factors, including the overall economy and credit rating, permits the enhancement of the resources of investors. To achieve consistent results in a volatile Indian financial environment, it is crucial to locate and understand the principles of bond valuation. Learn everything about bond valuation through the Certificate Program in Financial Analysis, Valuation, & Risk Management offered by Hero Vired in collaboration with EdX and Columbia University.

Why are bond prices inversely related to interest rates?

What is the difference between YTM and coupon rates?

How does credit quality affect bond valuation?

What is the significance of zero-coupon bonds?

Are bond valuations the same as stock valuations?

What is Bond Valuation?

Updated on January 21, 2025