Ever wonder how the Indian financial system really works? Ever get confused by how banks, markets, and regulations fit together to keep the economy running smoothly?

We hear these questions all the time. Most people want to understand the structure of Indian financial system but are left in a haze of jargon or complicated explanations. In reality, though, when we break it down, the system’s structure is pretty straightforward.

Let’s delve into the structure of the Indian financial system and find out how each piece plays its part-from formal banks to lesser-discussed financial institutions. Let’s walk through the structure supporting everything from your savings account to large-scale national investments.

What is a Financial System?

A financial system is, in the literal sense, a network that makes money flow from the pockets of one individual to another pocket of a different person, be it an individual, business, or government.

This involves banks and other financial institutions and the market through which asset mobilisation takes place; these markets are divided into capital, money, and other markets. Then, there are services that provide credit, loans, and insurance.

Together, these components aid in mobilising savings, allocating credits, and managing risks. These factors help ensure that the economy runs smoothly.

Also Read: Top 10 Types of Financial Services

POSTGRADUATE PROGRAM IN

Financial Analysis, Valuation, & Risk Management

Learn financial modeling, valuation techniques, and risk management to drive strategic business decisions.

Organised and Unorganised Sectors in the Structure of Indian Financial System

The Indian financial system is characterised by the distinction between two major sectors: the organised and the unorganised. It is a kind of broad division, but this bears importance in understanding how money works its way through the economy.

Organised Sector: The Spine of Regulation

The organised sector comprises everything associated with the formal financial system, including banks, insurance companies, stock exchanges, and Non-Banking Financial Companies (NBFCs).

These institutions are regulated by various authorities, such as RBI, SEBI, and IRDAI, among others. They ensure smooth money and credit flows from savers to borrowers.

They also are necessary to establish trust in the system, whose activities are strictly governed by legislation and regulatory authorities.

Unorganised Sector: The Informal Side

As opposed to the organised sector, everything outside the governable government regulations falls into the unorganised sector. It includes money lenders, chit funds, and local money lenders working without regulation through formal procedures.

Most rural residents and people not being able to gain bank facilities view this shadow side to gain credit in the short run.

They serve an actual need, though they are not regulated.

A shop owner in a village needs urgent inventory, but he does not have the paperwork to go to the bank or otherwise find the time to wait. Such gaps are filled by the unorganised sector. In the absence of regulation, though, it follows the costlier interest and riskier lending.

Also Read: What is Financial Management

The Core Elements of the Structure of Indian Financial System and Their Functions

The Indian financial system has four basic building blocks that work together, driving the engine of the economy.

1. Financial Institutions: The Key Players

Banks, normally, are the first place where most people experience anything related to money. They accept deposits, provide loans, and offer other financial services. State Bank of India, or HDFC Bank, the principal commercial bank, manages the system by converting savings into productive investments.

NBFCs such as Bajaj Finserv do not accept deposits but issue loans, leases, and investments. They typically respond to markets that are either smaller or more challenging to access in the traditional bank. For example, small business owners seeking to finance equipment here.

Cooperative Banks always focus on local communities. For example, Saraswat Bank helps members save and borrow in unique ways to meet their needs, often becoming less rigid than that of a traditional commercial bank.

2. Financial Markets- Where Buying and Selling is Done

Financial assets are traded in markets. There are primarily two types of markets in India. These are the money market and the capital market:

- The capital market is a place where companies raise long-term funds by issuing either shares or bonds. That’s where you get to buy your stocks on BSE or NSE.

- Money markets are about short-term loans, generally less than a year. This is where the banks and governments get cash to raise short-term funds to cover their expenses. Instruments traded in this place include treasury bills and commercial papers.

3. Financial Assets: Investment Tools

Other assets that are monetary in nature include financial assets which include stocks, bonds, and mutual funds. Think of them as tools we use to invest or borrow. Equity refers to ownership of a company. A bond is basically a loan we provide to the government or companies so the government or companies can repay the amount with extra interest.

Think of an example: treasury bills are short-term securities of the government. They are very good for short-term safe investments since they carry the security of the government.

4. Financial Services: The Binding Glue Holding It All Together

Financial services are banking and all other forms of insurance, investment advice, etc. If you require a loan, protection for your car or advice on how to grow your wealth, these services will help.

Also Read: Financial Instruments: Types and Functions Explained

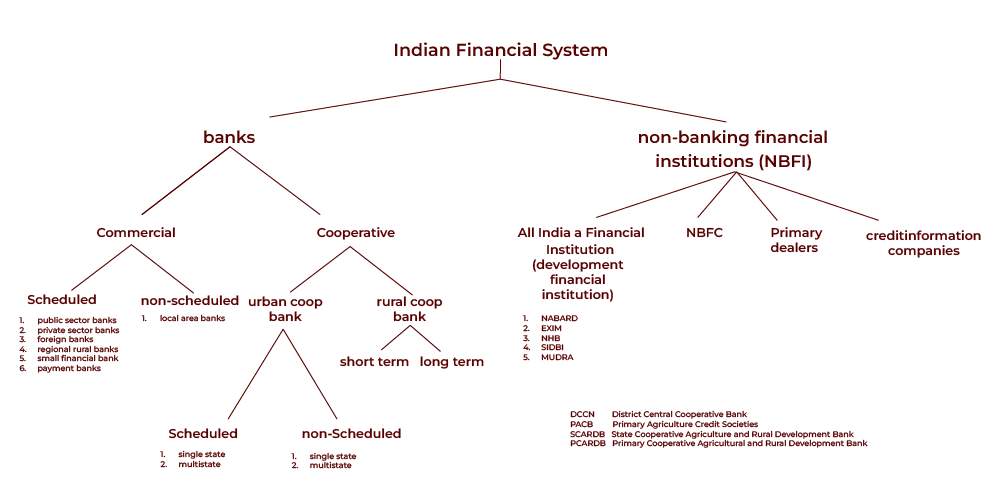

Structure of Financial Institutions in India

Now that we have a view of the basic components let us see what the structure of financial institutions looks like. These are the pillars holding up the system.

Central Banks and Their Regulatory Function

The apex of the pyramid is the Reserve Bank of India or RBI. It performs:

- Control over inflation

- Regulating banks

- Managing the currency of the country and foreign exchange reserve

RBI ensures that banks do not lend brazenly and that the financial system is in balance. It may be thought of as the watchdog that ensures no roadblocks come our way financially.

Commercial Banks: Public, Private, and Foreign Banks

It is here that all our money is regulated.

These banks are further categorised into public sector banks, private sector banks, and foreign banks.

- Public sector banks – Banks like Punjab National Bank and State Bank of India are owned by the Government. As a rule, these banks are usually focused on being a tool for national development goals such as financing an agriculture project or an infrastructure project.

- Private Sector Banks – The private sector banks, such as Axis Bank, run on the profit motive and pay more importance to customer services, innovation, and business growth.

- Foreign Banks – International banks, for instance, HSBC India, bring in international expertise that helps companies in cross-border trade and investments.

Cooperative Banks: Serving Communities in Rural and Urban Areas

Cooperative banks have been structured, like Cosmos Bank, to cater to specific distinct communities, such as rural farmers or city-dwelling populations.

These banks are owned by their members and offer flexible loan options mainly to those who fail to qualify for normal bank credits.

Non-Banking Financial Companies (NBFCs): Major Financial Giants

NBFCs, such as Mahindra Finance, fill gaps left by the commercial banks.

They offer loans for cars or microunit enterprises. They do not have a bank licence; however, their operations are gaining as people seek special financial support other than traditional banking.

Regional Rural Banks (RRBs): Inclusion of Financial Development in the Rural Areas

Regional Rural Banks have focused on rural regional financial inclusion.

Banks, including Vidarbha Konkan Gramin Bank, focus on the rural economy by providing cheap loans to farmers, artisans, and small-time entrepreneurs.

Development Financial Institutions (DFIs): Long-term Financing

Development Financial Institutions like NABARD and SIDBI focus on long-term financing in agriculture, infrastructure, etc, and other small-scale industries.

They are necessary for financing projects that generate returns over several years, though such projects are of high priority to national development.

82.9%

of professionals don't believe their degree can help them get ahead at work.

Indian Financial Market Structure: How and When Does the Money Flow

Ever ask yourself where the companies get their money to expand? Or where do governments borrow when they require funds for some infrastructure projects?

This is where financial markets come in.

They constitute a critical part of the structure of Indian financial system through which money can flow from those who have it to those who need it.

1. Capital Market: Centre of Long-term Investment

The capital market is where companies source long-term funds.

It can be regarded as a place where big ideas, such as the opening of a new factory or launching of a new product, find the needed money.

- Stock Market: The market where companies sell shares of ownership in their business to investors.

- Debt Market: Here, companies and governments sell bonds.

For example, when the Indian government needs money to build highways and other infrastructure, it issues bonds.

Those bonds are purchased by investors, who give the government the money. The investors get a fixed return on that money.

2. Money Market: Fast, Short-Term Liquidity

Now, the money market is about quick cash and short-term liquidity, all within less than one year.

It is the source from which corporations and governments quickly get liquid funds to keep the organisation running. The instruments traded here are quite secure but with lower yields, of course.

This money market serves almost like some sort of financial lifeline between businesses and governments in the form of keeping their everyday workings running without any hiccups.

Key participants in the money market

- Banks

- Corporates

- Government Bodies

There are some commonly used instruments to raise short-term funds:

| Treasury Bills or T-bills | Commercial Paper (CP) | Certificates of Deposit (CDs) |

| The government sells these to raise money for short periods, often just a few months. Since they are issued by the government, they are a pretty safe form of investment. | Industrial corporations issue commercial paper to meet short-term expenses, like payroll or inventory. Investors prefer CPs since they provide more returns than T-bills but entail slightly more risk. | CDs are certificates provided by banks as a source of raising money from investors. They pay a fixed interest rate and thus represent a low-risk investment for short-term capital. |

3. Foreign Exchange Market: Where Rupees Meet Dollars

It is the place where the trade of currency takes place. Businesses and governments come here when they want to convert rupees into dollars or any other currency.

- Spot Market: It refers to the market where currency trades are carried out for immediate payment and delivery. Payment and delivery are made immediately when the deal is made.

- Forward Market: Businesses hedge or lock in a currency exchange rate for some date moving forward. This would hedge against the possibility of the exchange rate moving in an unfavourable direction before they have to make their payment.

4. Credit Market: Borrowing for the Long and Short-Term

The credit market is where households and businesses borrow on short and long-term, including short-term loans for businesses through credit lines and long-term loans via mortgages.

- Banks and NBFCs provide personal loans, vehicle loans, and home loans.

- Business Loans are taken by a company to expand further or pay for short-term expenses.

- Government Loans are constructed schools or hospitals.

The borrower gets the loans needed, and the lender earns the interest.

It is an essential part of how the Indian financial system supports growth, whether it is for small entrepreneurial ventures or large infrastructure development initiatives.

Role of Financial Assets in the Indian Economy: Tools for Growth

Financial assets are actually the backbone of the Indian economy. They include equities, bonds, and other investment products through which entities as well as individuals can invest, save, increase wealth, and create more capital.

- Treasury Bills and Government Bonds: Perhaps the safest investments.

- Corporate Bonds: Corporate bonds have a higher level of risk than government bonds but provide higher returns.

- Commercial Papers and Certificates of Deposit: When a company or bank requires short-term funds, it sells commercial papers or certificates of deposit.

- Equity Shares: It is a more volatile investment than bonds but can actually be rewarded with huge returns if you can wait long enough.

Also Read: Top 9 Functions of Financial Management

Role of Financial Services in Indian Economy: The Importance of Everyday Essentials

What is the structure of the Indian financial system in our mind? Is it huge institutions like banks and stock markets?

But have you ever thought about the services these institutions provide?

After all, we interact with them every day – for opening a savings account or securing a car loan, or health insurance.

Banking Services: The Heart of Financial Transactions

Banks provide an entry point for many.

It is how we access basic financial products such as savings and current accounts. Banks give credit, which businesses and people require to grow and make big purchases.

And here’s how banking services power the economy daily:

- Deposits: We keep our money in the bank, hence offering the banks the much-needed cash to lend to others. Here, the banks offer interest to us, and that, in turn, increases our savings.

- Loans: Whether it is a personal loan, a home loan, or a business loan, banks lend credit for funding houses, cars, education, and even business ventures.

Insurance Services: The Guard Against What Doesn’t Go Right

Nobody likes contemplating things going wrong, but life is very unpredictable.

That is where insurance services come in.

They protect us and our riches from unplanned threats like accidents, diseases, or losing our belongings.

Some of the most significant insurance services are:

- Health Insurance: It covers all expenditures in relation to medical treatment, something that would otherwise have to be borne out of pocket for severe health problems.

- Life Insurance: Life insurance ensures the family is financially protected if a member dies.

- House and/or Car Insurance: You may have property insurance for your house or for your car to avoid losing or damaging them.

Insurance doesn’t just give you peace of mind. It also keeps the economy stable by spreading out the risk of loss.

Investment Services: Growing Wealth for the Future

One of the greatest powers of the Indian financial system is how it enables ordinary people to grow their wealth.

Here’s how investment services work:

- Mutual Funds: We pool our money with that of other investors and experts at companies like HDFC Mutual Fund and invest this together prudently in either stocks or bonds.

- Fixed Deposits (FDs): The banks offer FDs as an extremely risk-free way for money to grow over time.

- Investments in the Stock Market: We can purchase stocks on the BSE or NSE through brokers.

Investment services give people opportunities to ensure a secure future and enhance and build wealth beyond their regular source of income.

Examples of Key Institutions in the Indian Financial System

Let’s get a little more specific about the specific institutions providing these financial services and look at what each has in store for the makeup of the Indian financial system:

- Indian Bank: A general bank which provides loans to products of investment. Focuses more on personal banking solutions.

- Kotak Mahindra Bank: A private bank majoring in custom financial services like saving accounts, loans, and wealth management with individuals and corporates.

- Shriram Transport Finance: This is an NBFC which specialises only in providing finance for commercial vehicles hence enabling small enterprises and transport operators to continue operating.

- Saraswat Bank: a cooperative bank that offers facilities to the local community with deposit schemes, loans, and other banking services, thereby making financial inclusion available to even smaller populations.

- NABARD: a development financial institution that supports rural development through credit for agriculture and small-scale industries.

Each of these institutions contributes to ensuring that everyone has access to the services they require.

Major Regulatory Authorities That Regulate the Structure of Indian Financial System

The idea of the entire system operating peacefully in India is not possible without a number of regulatory bodies dealing with different aspects of the financial system.

- Reserve Bank of India (RBI): RBI is the central banking authority that regulates the banking system, tackles inflation, and provides financial stability.

- Securities and Exchange Board of India (SEBI): SEBI regulates the working of the stock market, guards investors’ rights, and brings all companies under its regulatory fold.

- IRDAI: It regulates the insurance sector; thus, the insurance companies are set to operate fairly.

- PFRDA: It runs the pension sector by putting forth the pension schemes such as NPS.

Conclusion

The structure of Indian financial system is based on the two sectors, organised and unorganised, as well as numerous institutions, including banks and NBFCs, and key services such as insurance, investments, and loans. This system interlinks all functions of the economy, from a person saving in a bank to a company seeking investments for growth.

Financial markets, regulatory bodies, and financial assets lend stability and enhance participation to make the economy work.

Whether it is personal finance or national development, the financial system plays an extremely active role in supporting economic activities. This way, all of us, right from small and micro enterprises to large corporations, can access the required resources for strengthening our success.

Mastering financial markets, the role of regulatory bodies, and the best in fintech, Hero Vired’s Finance and Financial Technologies course delivers hands-on knowledge with extensive breadth.

This course will give you the skills to prosper and be better equipped in today’s financial world.

What is the function of banks in the Indian financial system?

Why are insurance services important in India?

How do mutual funds work in India?

What is the impact of NBFCs on the Indian economy?

Updated on October 25, 2024