Fintech is an abbreviation for “financial technology,” which refers to the use of new technologies to improve the effectiveness of financial services.

In recent years, there has been a significant increase in the number of firms that have begun developing new technologies to assist with financial services, which has led to the rapid growth of the fintech sector.

The value of the fintech business has increased to billions of dollars due to the successful fundraising efforts of various fintech startups. These might include mobile applications that let you perform banking operations on your phone or innovative methods of assisting individuals in saving money or obtaining loans.

It has also assisted in creating new employment opportunities in the fintech sector, as an increased number of businesses are searching for individuals skilled in developing new technologies. This demand has given rise to a totally new sector of education that fast-tracks skill development to meet the ever-expanding fintech sector.

In the injunction to meet this demand, there are many finance certification courses and professional courses in finance to aid the increasing appetite for skilled fintech workers.

The development of new technologies, changes in consumer behavior, and a greater acceptance of regulations are some of the primary causes that have led to the expansion of the fintech industry.

How customers get access to and make use of financial services is undergoing continuous change as a result of advances in technology. Mobile banking and payment technology developments have made it simpler for consumers to do online and offline financial transactions. This is true for both situations.

Moreover, a surge in the legislative approval of digital currencies and the technology behind blockchains has contributed to the expansion of this sector.

What direction is fintech Ttking?

Looking at the fintech industry in terms of pre-COVID, COVID, and post-COVID gives us a clearer understanding of where we are heading.

In the pre-COVID days, fintech was all about innovation. fintech companies were creating new ways for people to access financial services and products. This was when mobile banking and payments, peer-to-peer lending, and other fintech innovations were just taking off. Digital finance adoption was growing at a steady slow pace.

The COVID pandemic has changed all of that. The lockdowns required people to spend their days confined at home. Restrictions from stepping out meant many people had to conduct commerce remotely.

This gave rise to the rapid adoption of digital financial services. All of the offline incumbent banks had to reimagine their service offerings for the new digital services demand.

The financial institutions that switched to a complete digital ecosystem thrived along with the services that went digital first, like online delivery, ecommerce, social media, etc.

This is where fintech companies also stepped up to provide solutions that helped people with their finances, whether assisting them in managing their money better, providing them with access to credit, etc.

In the post-COVID world, we expect the fintech industry to continue to grow. The pandemic has shown us how important financial technology is and how it can help us in our everyday lives.

Various countries are embracing digitizing their financial system due to the benefits such as transparency, accountability, etc. The demand for skilled workers will also be higher.

With the rapid digitization of education systems, even the edutech sector is catering to the demands of the fintech sector by providing online certifications for finance. Companies offering professional courses in finance directly impact the generational shift due to the digitization of the financial industry.

We believe that the fintech industry will continue to innovate and provide new ways to manage finances and access financial services.

POSTGRADUATE PROGRAM IN

Multi Cloud Architecture & DevOps

Master cloud architecture, DevOps practices, and automation to build scalable, resilient systems.

Exciting new developments in fintech

Short term

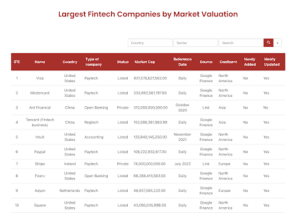

According to CFTE, the largest fintech companies by valuation are Visa, Mastercard, and Ant Financial (China’s largest online payment company). These are all paytech companies, which means they provide services such as processing payments and issuing cards to customers.

Paypal is the fourth largest paytech company in the world, with a market cap of $108 billion. Further, Stripe is the fifth largest paytech company with a market cap of $74 billion. Finally, Square is the sixth largest paytech company with a market cap of $43 billion.

This data suggests that paytech companies are on the rise in the short term. The innovations due to the widespread adoption of AI and machine learning in fintech will continue to push the industry forward.

By providing digital payment access to the unbanked populace, newer markets will come to life.

Countries like India are developing and adopting newer fintech products at an unprecedented pace. India’s unified payments interface (UPI) is an amazing example of fintech achieving economies of scale.

UPI has transitioned the primarily cash-based economy to a cashless economy, digitizing the entire payments grid to integrate and incorporate newer advancements easily.

According to Business Standard, digital payment transactions in India have grown by 7422 crores during 2021-22. The preferred payment mode of citizens has been BHIM-UPI, and it achieved a value of Rs 8.27 lakh crore by February 28, 2022.

The COVID pandemic has thus also established that digital payments enable access to healthcare through contactless payment modes like the BHIM-UPI QR code.

Medium term

In the medium term, there will be an uptick in the number of fintech courses and programs offered by the edtech sector and the adoption of decentralized technologies such as blockchain, which will be increasingly deployed in banks.

The fear of total centralization with its ugly head of corruption does loom over the fintech sector. Blockchain as a technology would be powering the backend of various financial institutions as the research on the integration process is being carried out by various financial institutions worldwide.

Blockchain, artificial intelligence, and machine learning could help banks and other financial institutions automate various tasks, such as fraud detection and risk management.

Other possible developments include using blockchain technology to create a more efficient and secure banking system and the rise of mobile payments.

As fintech has continued to transform the financial terrain, so will the education system by supporting the increased need for more brain power to make new developments possible.

Without an infrastructure to impart skills, there won’t be a workforce that can make the most of the increased demands of the fintech sector.

Countries that offer certificate courses on finance to their young workforce will definitely reap its benefits in the long run in the form of flourishing digital economies being established.

Long term

In the long term, we may see a completely new banking system based on mobile payments and peer-to-peer lending. This would enable customers to make mobile payments and transfer funds between each other without the need for a central bank or financial institution.

Crowdfunding and marketplace lending platforms could provide an alternative source of financing for businesses and individuals.

Credit scoring would be based on data from social media and other online sources, and mobile wallets would be used to store funds and make payments.

Robo advisors would provide automated investment advice, and tax filling and processing could be done via the internet of things.

Blockchain technology could be used to create a decentralized ledger of all financial transactions, while big data could be used to identify trends and predict future behavior.

Factors driving the growth of fintech

Some of the factors that could drive different developments in fintech include changes in regulation, advances in technology, and shifts in consumer behavior.

For example, if there is a change in regulation that allows for more innovation in banking, then this could lead to more development of mobile payment systems.

Alternatively, if consumers become increasingly comfortable using mobile devices for their financial needs, this could also lead to more growth in this area.

The financial technology landscape is constantly evolving, with new players and new products emerging all the time. This can make it hard to keep up with the latest developments, but some key factors are driving different types of fintech innovation.

One of the biggest areas of growth in fintech is mobile payments. This is being driven by the increasing popularity of smartphones and other mobile devices, as well as the growing number of people who are comfortable making transactions online.

Peer-to-peer lending and crowdfunding are also becoming more popular as they offer an alternative to traditional banking products and services.

Another key factor that is driving fintech innovation is the increasing amount of data that is available. This includes data from social media, sensors, and other sources that can be used to create new insights into customer behavior. Big data analytics is being used by firms in a variety of ways, from credit scoring to fraud detection.

Finally, blockchain technology is also starting to have an impact on the fintech landscape. This distributed ledger technology has the potential to revolutionize how financial transactions are processed and could have a major impact on a wide range of industries.

82.9%

of professionals don't believe their degree can help them get ahead at work.

Top 10 key technologies fintech will integrate with

- Machine learning: Machine learning algorithms can be used to automatically identify patterns in data and make predictions about future events. This can improve financial decision-making, for example, by identifying fraudulent activity or predicting customer behavior.

- Artificial intelligence (AI): AI can be used to carry out complex financial tasks such as risk assessment and fraud detection. AI-powered chatbots can also provide customer support or advice on financial products.

- Robotic process automation (RPA): RPA can be used to automate repetitive tasks such as data entry or claims processing. This can help reduce costs and improve efficiency in financial institutions.

- Self-service channels: Online and mobile applications can provide customers with a self-service experience for managing their finances and carrying out transactions such as payments or money transfers.

- Big data analysis: Big data analytics can be used to gain insights into customer behavior or identify trends in the markets. This information can improve decision-making in areas such as product development or marketing campaigns.

- Insights from behavioral analysis: Behavioral analytics can be used to understand why customers make certain financial decisions. This information can be used to develop products or services that meet customer needs and improve the overall customer experience.

- Data visualization: Data visualization tools can be used to present data in a way that is easy to understand and interpret. This can be helpful for decision-makers in financial institutions who need to make sense of large amounts of data.

- Cloud computing: Cloud computing can provide a scalable and cost-effective way for financial institutions to store and access data. It can also allow for the delivery of new services and applications through the cloud.

- Regulatory tech: Regulatory technology (RegTech) refers to technologies that are used to help organizations comply with regulations, such as know-your-customer (KYC) rules or anti-money laundering (AML) laws. RegTech solutions can help financial institutions save time and money by automating compliance processes.

- Insurance tech: Insurance technology (InsurTech) refers to technologies used to help insurance companies manage risk and provide new insurance products and services. InsurTech solutions can help insurers save money and improve customer satisfaction by automating claims processing or providing new digital insurance products.

A number of factors are driving the growth of fintech, including the increasing adoption of digital technologies by financial institutions, the need for financial institutions to reduce costs and improve efficiency, and the rising demand from consumers for new and innovative financial products and services.

Overall, we are seeing a surge in the edtech sector geared towards supporting the needs of the fintech industry, which is looking for skilled candidates with a professional certificate in finance.

The Integrated Program in Finance and Financial Technologies is a professional certificate in finance developed by Hero Vired in collaboration with the Massachusetts Institute of Technology (MIT).

It is one of the most comprehensive and in-depth fintech courses currently available. It begins with the fundamentals and then moves on to the most important skills related to fintech.

Key concepts covered include financial accounting, behavioral finance, technical analysis, financial regulation and analytics, machine learning, Artificial Intelligence, and Python programming, among others.

This is one of the only fintech programs offering access to international exposure due to its partnership with MIT. A finance certification course with content & teaching that is highly interactive to ensure that students do not get bored, the program is also gamified to ensure students stick with it until the end.

Some of the most notable aspects of this course include:

- 10+ industry projects and case studies developed in alliance with fintech industry leaders

- The only certificate program in finance that offers access to international exposure

- Placement assurance

The future outlook for fintech is very positive. The industry is seeing rapid, healthy, and sustainable growth and is expected to continue to do so in the coming years.

What this means is that there is going to be a strong demand for highly-skilled professionals who are knowledgeable in the core principles of finance and can augment it with the growing technology trends in the industry.