If you are wondering what is fintech it simply means all Software, mobile applications, and other technologies designed to enhance and automate conventional forms of finance for both corporations and consumers collectively and are referred to as “financial technology”. Simple mobile payment apps and complex blockchain networks that store secured transactions are examples of fintech. This widely growing sector with ample job opportunities can be in your grasp with a simple financial analysis certification. Here are some of the benefits of taking a fintech course from Hero Vired.

How Does Fintech Work?

Now that you know what is fintech, here is how it works. Fintech uses novel techniques that weren’t available before to give consumers and businesses access to conventional financial services. Fintech definition, at its most basic, uses sophisticated algorithms on devices to help customers, business owners, and organisations better manage many parts of their lives. Here is a beginners guide to fintech in 2022 to keep up.

POSTGRADUATE PROGRAM IN

Multi Cloud Architecture & DevOps

Master cloud architecture, DevOps practices, and automation to build scalable, resilient systems.

The Evolution of Financial Technology

Although many people think that fintech is a recent technological advancement, it has actually been around for a while. So, what is financial technology? Its beginning dates all the way back to the 1950s, when credit cards were first introduced. After their introduction, people no longer need to carry hard currency. From there, the industry developed to encompass mainframes for banks and online stock trading services. PayPal entered the market in 1998, making it one of the first businesses to focus primarily on the internet. It’s a development that has been further transformed by social media, mobile technology, and data encryption. Here is a guide to the rise growth of fintech transitioning from traditional finance.

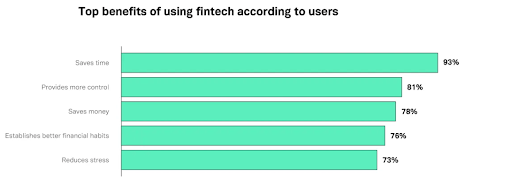

Benefits of Using Fintech : (Add infographic mentioning the Benefits)

- Saves Time: One of the most positive benefits of the Fintech is the cost Saving. Fintech provides lower fees compared to other types of conventional financial services. This is also seen as a positive benefit of fintech for consumers.

- Providing Ease of Financial Service: Fintech has made the various process of financial services a lot faster and easier.

- Helping Business People Get Business Capital: Fintech help people get business capital and making the process of getting the needed funding more effectively and efficiently.

- Increasing Financial Inclusion in the Country: The biggest benefit of fintech is that it can help increase financial inclusion in India. By making the financial process much easy the Fintech indirectly becomes a financial accelerator in the country.

Types of Fintech Companies

Fintech companies are functional in a wide range of domains, such as peer-to-peer (P2P), business-to-business (B2B), and business-to-consumer (B2C). Listed below are some of the types of fintech companies:

Banking & Neobanks

Banking services are one of the core elements of the fintech business sector. Thanks to technology, processes like account opening, funding, and a decline in fraudulent sign-ups are now quick and simple without the usual costs that can prevent people from reaching their financial objectives. Some examples of fintech banks or neobanks are Chime, Current, Aspiration and Varo.

Cryptocurrency Fintech

Fintech is intersected with Cryptocurrency and blockchain in multiple ways. A lot fintech companies now use blockchain technology for payment processing, money transfer and secure digital identity management. Some examples of cryptocurrency fintech companies include Coinbase, Blockfi and SALT.

Fintech Investment and Savings

Fintech investment is a system of investing money or capital by utilizing financial technology. Financial technology (fintech) has become the choice for investing money nowadays. Numerous number of saving apps has launched recently because of the evolution of Fintech.

Payments Fintech

Cashless transactions have increased since the start of the pandemic. Payment services and apps have proliferated concurrently. That’s because getting customers signed up and authenticated has been quicker and simpler, and collecting payments via direct bank transfer is substantially less expensive than getting them using credit cards due to the positive impact of fintech.

Personal Financial Management

Personal Financial Management, or PFM, apps make it simpler for customers to stay on top of their money by combining financial data from numerous accounts into a single dashboard. Those who use these services can better budget, manage, and understand their finances.

82.9%

of professionals don't believe their degree can help them get ahead at work.

The Technologies That Power FinTech

Blockchain technology, artificial intelligence (AI), machine learning, and other big data functions like robotic processing automation (RPA) are the technologies that essentially power the financial industry. Since the introduction of the first automated teller machine (ATM) in the 1960s, financial institutions have used technology to streamline service delivery and reduce costs. Even in comparison to cash and checks, credit cards—which existed before ATMs—were a revolutionary technological development in the payments industry. One can always keep an eye on where is fintech heading next breakthroughs powering the next decade.

How Safe is FinTech?

Fintech is frequently the target of cyberattacks because of an overreliance on cutting-edge technology and the processing of private financial information. The encryption algorithms RSA (a highly secure algorithm with private and public encryption keys), Twofish (a freeware algorithm encrypting data into 128-bit blocks), 3DES (the encryption method preferred for credit card PIN encryption), P2PE, and EMV are just a few examples of the sophisticated technologies and encryption algorithms that FinTech companies can use to protect data. AI and machine learning can also be incorporated to create a secure connection. Here are the top 10 uses of AI and machine learning in fintech.

Reasons Why Consumers Use Fintech

Fintech companies provide customers with specialised financial products and services that are tailored to their needs. They can provide real-time, round-the-clock services every day of the year, providing convenience, speed, and easy access to quick, fast, and paperless operations without requiring users to leave their homes.

How Fintech Impacts Business?

The impact of Fintech on business has enhanced the PoS (point of sale) system, reduced costs for businesses, and given them access to sophisticated analytics data to better engage their customers by enabling access to financial services on smartphones.

Making Career in Financial Technology

With cutting-edge solutions, a number of Fintech companies and other new market participants are entering the market and upending the financial services sector. As a result, job seekers interested in the fintech industry will have a tonne of options. One can expect a volatile career for roles such as financial or business analysts, cybersecurity analysts, product managers, and compliance experts.

Key FinTech Skills you Need to Know

Listed below are some of the key skills one needs to acquire for a successful career in the fintech industry:

Programming:

Programmers are primarily responsible for building and maintaining the fintech sites and applications, designing them to be secure, efficient, and navigable. Some of the popular fintech programming languages include Java, C++, Python, and Ruby.

Software Development

Software engineers may expect to be involved in a wide variety of Fintech projects, from building a platform for a digital bank to setting up an online market for a game-changing insurtech firm.

Data Specialist

In addition to disrupting and redefining financial services, technology also produces enormous volumes of valuable data that must be carefully examined, analysed, and understood. Understanding of technologies like Deep Learning, Big Data, Artificial Intelligence (AI), and Machine Learning is crucial which is a high in demand skill for fintech companies.

AI/ML & Data Science:

AI/ML & data science in fintech is the use of artificial intelligence for financial data analytics, customer service, supply chain management, trading advice, and much more.

Soft Skills for Fintech You Need to know

For long-term success in this field, fintech workers must also amass a strong portfolio of soft skills. The fintech industry is expected to hire the most high profile employers. These executives will now need to have a solid understanding of information technology at all levels, as well as the critical soft skills needed to manage teams with different personalities and make wise decisions.

Scope of Fintech in Future

Since fintech is a rising sector driven by a young and well-trained group of people, it is expected to grow tremendously throughout the upcoming years. This could be one of the leading job sectors, providing high-profile opportunities with high pay and benefits.

Recent Trends in Fintech

- Open Banking: Controlled financial information exchange is the main goal of open banking. Account holders are able to consent to protocols for securely sharing their financial information with unconventional financial institutions.

- Embedded Solutions: Embedded finance has grown over the past year and is poised to develop even more as many banks aim to provide customer experience or service proposition involving financial services as a component of a bigger offering.

- Digital Wallets: Digital wallets, like Google Pay, Phone pay, allows people to store their payment information in a mobile app, and then use that app when it comes time to pay for something.

- Blockchain in Fintech: Blockchain is a core technology in FinTech. Blockchain helps Fintech with its distributed, decentralized, transparent and immutable digital ledger technology and more.

Conclusion

The financial technology sector is poised to transform how we use, manage, save, and invest our money. For the foreseeable future, innovation will continue to change this industry. Those who want to redefine conventional procedures using developing technologies are eager to find employment in this expanding field. Fintech STEM careers provide countless chances.

FAQs

How does Fintech improve financial services for consumers?

Fintech enables customers to make online purchases of goods and services without using a credit card or debit card.What role do Fintech companies play in the financial industry?

Fast credit approvals and funding are made possible by fintech companies for both consumers and enterprises.How does Fintech help with financial inclusion for those without access to traditional banking services?

Fintech businesses make it possible for people living in rural areas or low-income, unbanked individuals to save money, develop it, and take advantage of government aid and programmes.How does Fintech contribute to the growth of the economy?

Fintech companies help the economy expand by fostering digital industrialization and industrial digitization.How does Fintech use technology to enhance financial services?

A range of quick and highly automated underwriting systems that use algorithms powered by AI and RPA to facilitate quick credit judgements and fundings for both consumers and companiesWhat are the risks and challenges associated with Fintech?

Data security and lack of awareness are some of the major risks and challenges associated with Fintech.How does Fintech impact traditional banks and financial institutions?

Fintech companies provide various advantages, such as accessibility and financial inclusion. This translates to helping those who may not have had access to financial services in the past gain access to them.