What does a financial manager really do? Just dealing with numbers in some spreadsheet? Or is there something more to that?

Those are questions business managers often wonder about.

From balancing budgets to analysing market trends and ensuring conformity, just so much goes into the duties of a financial manager.

The thing is, financial management is not just a number game. It ensures that the whole ship floats- the cash should be adequate to pay employees so that the company is firmly on the ground to grow.

The job role of financial manager touches nearly every aspect of the business, and the stakes are high. Get it wrong, and the business struggles to survive. Get it right, and it can thrive and grow in ways most people only dream about.

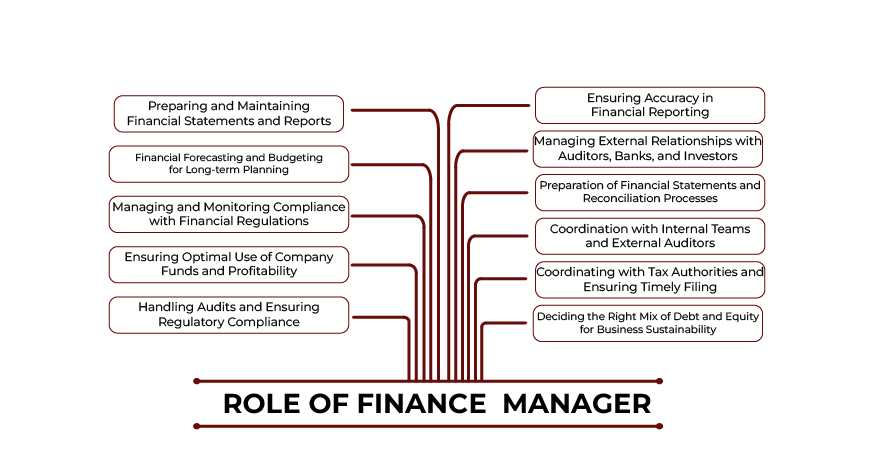

Key Roles of a Financial Manager in Business Operations

You are probably asking: What are the actual responsibilities of a financial manager?

Preparing and Maintaining Financial Statements and Reports

The most important role of a financial manager is to keep the books straight.

This involves much more than just recording transactions or keeping an everyday tally. It is about producing clear financial reports that accurately reflect the comprehensive narrative of a business’s health.

Think of these reports as the medical records of your company; they can be income statements, balance sheets, and cash flow reports. Each of these documents gives you a snapshot of where you stand.

For instance, a balance sheet will depict what your business has against what it owes. A cash flow report depicts the incoming versus outgoing cash. Both are must-haves for decision-making.

Without these reports, you’re essentially flying blind. And no business wants that.

Financial Forecasting and Budgeting for Long-term Planning

Planning for the future? That’s where financial forecasting comes in.

Forecasting is a little similar to map reading. Since it shows the direction in which the business is heading by showing how much distance it has covered, financial managers monitor previous trends, market conditions, and the current position of the company to foretell future revenues and expenses.

A financial manager will also make a budget that will serve as guidelines for spending. That way, the company won’t incur unnecessary costs and will keep its finances within bounds.

Suppose you want to grow. Do you know the best time to do so? Financial forecasting can tell whether this is the right time. It is not guessing. It calculates a guess based on sound data.

Managing and Monitoring Compliance with Financial Regulations

Navigating regulations can feel like trying to stay afloat in rough waters.

Financial managers play a huge role in ensuring that a business adheres to all financial rules. This ranges from tax laws to accounting standards.

Unless all those rules and regulations are complied with, a company risks paying fines and, in more serious cases, facing the courts. Hence, it is the responsibility of the financial manager to ensure that most of the paperwork is completed and filed on time. This includes a letter addressed to the tax authorities or some other external auditor.

To put it simply, compliance is the corporate lifeblood: without it, everything crashes.

Ensuring Optimal Use of Company Funds and Profitability

No company can flourish if it is wasting money.

The role of financial manager is to ensure that every pound counts. There is an analysis of where all the money goes and whether or not the money is used most effectively.

Supposing they wish to build some new gear. The financial manager will thus calculate the returns generated by that investment. Is it good enough to warrant the expense of investment?

That’s not “cheap.” It is smart.

Financial managers ensure that all the available resources at the company are used in such a way as to maximise the resultant profit generation with minimal wastage. That’s what keeps business on the green.

Overseeing Financial Reporting and Stakeholder Communication

So, the reports are ready. What’s next?

Financial reporting is not only an internal exercise. It also deals with stakeholder communication.

Ensuring Accuracy in Financial Reporting

Financial managers oversee the preparation of financial reports on which the decisions of top management, investors, or stakeholders are based. A small error may misconstrue an investor or trigger wrong decisions at the top-most level.

For example, the statements might show more profits than exist. The stakeholders may thus deem the business to undertake and accept more risk when, in fact, this is not the case. That is why accuracy is necessary.

Financial managers not only make the reports accurate but also make them easy to understand for people who are not equipped with any type of bookkeeping skills. In other words, they make things look easy instead of complicated.

Managing External Relationships with Auditors, Banks, and Investors

Financial managers are also at the front of the external relationship.

Auditing, getting a loan from the bank, or explaining the financial position to potential investors put the financial managers in the spotlight.

It is important in an audit or when the company needs new investors. Everything needs to appear transparent so that other stakeholders will become comfortable with the fiscal health of the company.

For example, negotiating to secure funds expansion with the bank. He will present his reports and indicate risks, showing how the company is in a position to pay back the loan.

It’s all about trust-building and keeping relationships.

Also Read: Risk Analysis in Financial Management

POSTGRADUATE PROGRAM IN

Financial Analysis, Valuation, & Risk Management

Learn financial modeling, valuation techniques, and risk management to drive strategic business decisions.

Financial Manager’s Role in Month-End and Year-End Closing Activities

Things tend to grow serious around the end of the month. These are times when a financial manager must ensure that everything adds up and is accurate and efficient.

Month-end and year-end closings are not routine exercises. Rather, they are milestones in keeping the business on the right track without down the road encountering bigger issues.

But what does a financial manager do in the closing times?

Preparation of Financial Statements and Reconciliation Processes

The primary activity around any closing period is to prepare the financial statements. In fact, these reports reflect the performance of the business during the month of the year.

A financial manager works on completing documents such as profit and loss statements, balance sheets, and cash flow statements. Each of these is crucial to understanding the health of the finances of the company.

And yet, it doesn’t end here. The financial manager also reconciles accounts. That means checking every transaction entered by making sure that each has been accounted for properly. Is an entry missing or misplaced? That’s what a financial manager looks for when doing this.

Let’s assume that a purchase wasn’t reported. Without reconciliation, that is an expense that could mess up your entire report.

Coordination with Internal Teams and External Auditors

It is not only the finance team that closes the books.

Financial managers ensure everyone- from sales to inventory- is on the same page. All data must be in before they can finalise the statements.

Then, obviously, are the external auditors. They visit the company to audit their books and check whether each item is done appropriately as per the law and whether every figure is correct.

The head of contact here would be the financial manager. They have to ensure that every piece of information in line with the audit is presented before the auditors so that nothing is missing and nothing is incorrect, thereby delaying the audit and causing further problems.

In a nutshell, a financial manager makes month-end and year-end processes smooth sailing. No surprises, no mistakes—only clean, accurate numbers everyone can rely on.

The Role of Financial Manager in Taxation, Compliance, and Legal Frameworks

Nobody likes dealing with taxes. But if you don’t, things can quickly go in the wrong direction.

To a financial manager, taxation is not at all about simply filing on time. It is about complying with the regulations so that your firm does not suffer penalties and has an unblemished record.

Coordinating with Tax Authorities and Ensuring Timely Filing

Let’s say the company operates in multiple locations, like Maharashtra and Delhi. Each region could have different tax rules. It’s up to the financial manager to keep track of those regulations and file accordingly.

The company operates from several regions, so different tax rules apply to every region. The task falls upon the financial manager to keep track of the regulations that are followed in that region and file accordingly.

This is not just about tick-boxing. Financial managers must analyse tax reports and ensure that the company is deriving every possible deduction without crossing legal lines. It’s a balancing act that requires a solid understanding of both the law and the company’s finances.

Handling Audits and Ensuring Regulatory Compliance

Audits are part of the daily routine of a financial manager.

Whether it is a regular internal audit or a kind of external one, financial managers ensure that everything is alright. They deal with the relevant paperwork, assist the auditors with all data required, and ensure the entire operation is in accordance with the financial laws.

It is not easy to keep up with changes, but one needs to catch up with them. A financial manager has to be aware of the updates to new rules and apply these to the company’s practices. True, avoiding penal charges is important; however, it goes beyond that because a financial manager has to create a sense of confidence in people and ensure strength for the long haul.

The Role of Financial Managers in Managing Corporate Debt and Equity

One of the most significant jobs that financial managers perform is to strike a balance between debt and equity.

It’s not bookkeeping. It’s just balancing the fuel in the tank to allow more breathing room for expansion without risking too much capital.

Deciding the Right Mix of Debt and Equity for Business Sustainability

Every enterprise needs capital. Some raise it by borrowing, others by selling equity, and most by a combination of both. But the real magic is knowing exactly how much debt to take on and how much equity to give up.

A financial manager weighs the pros and cons of each option.

For example, raising too much debt makes it hard for the firm to face a return settlement. However, raising too much in equity calls for them to give control of the business.

For example, if a company needs to expand its activities. The financial manager will calculate how much capital will be needed and whether it is better to borrow the loan or by issuance of new shares.

Factors they consider include:

- The loan interest rates.

- Market conditions for selling the shares.

- The current debt-equity ratio of the company.

For example, Tata Motors in India may decide to issue bonds or sell equity by leveraging market conditions and long-term goals.

It’s not just for today; a financial manager looks ahead: will this decision make sense five or ten years from now?

One key area where the company should take time in assessing debt versus equity is so that it grows sustainably and without unnecessary risk.

Also Read: Difference Between Financial Accounting and Management Accounting

82.9%

of professionals don't believe their degree can help them get ahead at work.

Skills Required for a Financial Manager to Succeed in a Competitive Environment

So, what does a good financial manager possess? More than just knowing numbers.

To stay ahead, financial managers need a mix of technical know-how, leadership abilities, and the kind of communication skills that can make even complex reports sound simple.

Technical Skills Like Financial Modelling, Data Analysis, and Forecasting

If you’re a financial manager, you need to know how to forecast the future.

This means building models that help predict what the business will look like in the next year or even five years down the road.

Take tools like Excel or financial software—these are not just for crunching numbers. They help break down the data and give you a glimpse into where the company is headed.

Imagine you’re managing finances for a mid-sized company in Bangalore. You’ll need to know how to create financial forecasts that take into account market trends, competition, and customer demand.

It’s not just about keeping things running smoothly today—it’s about making sure the company’s future is on the right track.

Leadership and Communication Skills for Team and Stakeholder Management

Handling finances is only one piece of the puzzle.

As a financial manager, you’re also leading teams and working closely with department heads, CEOs, and investors.

This is where leadership comes into play.

Let’s say your company is expanding into new markets, like the automotive sector in Pune. It’s up to you to communicate the risks, benefits, and financial outlook to key decision-makers.

And it’s not just numbers—they need to understand what those numbers mean for the business.

Can you explain complex financials in simple terms? Can you lead a team of analysts while making sure upper management knows exactly where the company stands? That’s what separates great financial managers from the rest.

Conclusion

The financial manager serves an important function in keeping and making the financial health of an enterprise more healthy.

The role of financial manager includes preparing the most accurate financial reports and managing debt and equity, and the list is far from just crunching numbers. Their jobs include ensuring compliance with regulations, stakeholder relationships, and insights that allow companies to make informed decisions.

They play a crucial role in the business by budgeting effectively and projecting likely future trends for the right investment decisions.

In today’s fast pace of competition in the business environment, a well-experienced financial manager can be the difference between survival and success in bringing stability and long-term growth. If you’re interested in studying finance in detail, consider pursuing the Certificate Program in Financial Analysis, Valuation, & Risk Management with EdX by Hero Vired.

How does a financial manager contribute to a company’s growth?

What qualifications do I need to become a financial manager?

How do financial managers handle corporate debt?

What is the role of a financial manager in auditing?

Updated on February 22, 2025