If you’re running a small business or even a large company, at the end of the year, you are supposed to know exactly where the money went, what you earned, and even if you actually have cash on hand.

The truth is, it’s not always easy figuring out how healthy your business’s finances are.

Do you know ASSET and LIABILITY in detail? Are you up to growing, or are you just barely getting by? And that’s exactly why financial statements exist and are the questions every business needs to answer.

They feel like a map, showing us the way through the terrain of our finances so we can make decisions grounded in real numbers rather than just our gut. The financial statements tell you the complete story of a company’s financial position and performance. These reports are essential whether you’re a startup founder or a seasoned executive.

They let us know if we’re profitable, financially solid, and monetarily stable enough to stay afloat. What’s more beyond the numbers they tell the story of how well the business is being managed and how well are we tracking for hitting our goals.

Financial statements are not only for compliance purposes; they are also tactical tools.

They’re a peek into the company’s future for investors.

They indicate whether a business can pay its debts as they come due to creditors.

To management, they indicate how well the company is actually doing and how much potential it has for expansion.

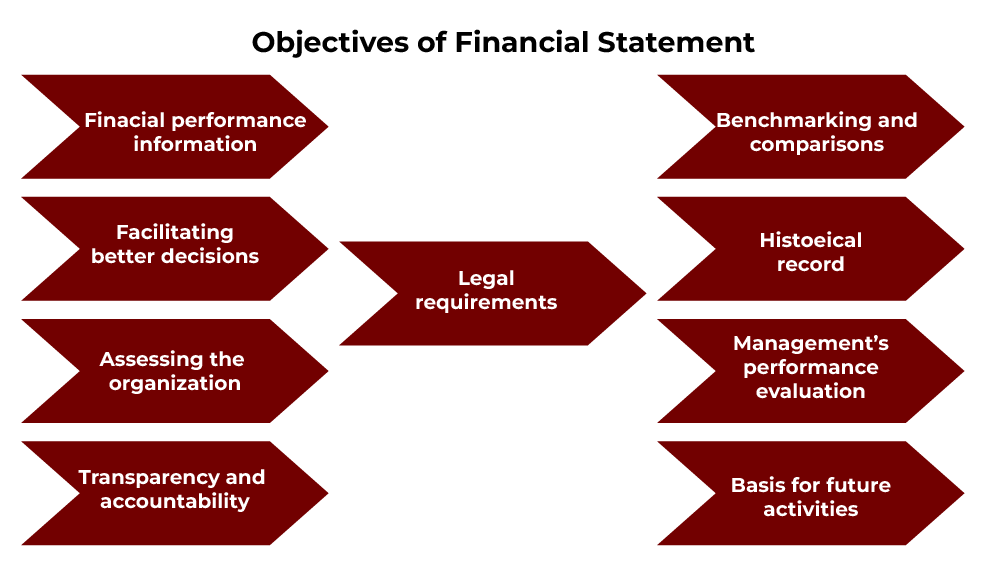

Let’s analyse the main objectives of financial statements, what they really show, and why each category is such a big deal to us, the stakeholders.

What is a Financial Statement?

A financial statement is a formal document of a company’s financial activity.

It collects crucial information on assets, liabilities, revenue, spending, and cash flows to provide a comprehensive view of the company’s financial situation. The financial statements play a specific role in helping business owners, investors, and creditors understand the numbers behind the business.

Also Read: Types of Financial Statements

POSTGRADUATE PROGRAM IN

Financial Analysis, Valuation, & Risk Management

Learn financial modeling, valuation techniques, and risk management to drive strategic business decisions.

The Basics of Financial Statements and How They Play a Part in Financial Reporting

Understanding financial statements starts with knowing their different types.

Each one is used for different reasons, and they each supply specific data that helps us understand the complete fiscal status of the company.

The four primary financial statements are:

Balance Sheet

What a company owns and owes at a given point in time is what the balance sheet tells us. The company’s net worth is shown as it’s split into assets, liabilities, and shareholders’ equity.

Income Statement

This report is often referred to as the profit and loss statement because it tracks the revenue and expenses over a given period. It basically tells you whether or not a business is operating at a profit or a loss.

Cash Flow Statement

The movement of cash into and out of the business is what this statement is about. It’s a critical day to day expense control mechanism that guarantees the business has sufficient liquidity to facilitate expenses.

Also Read: A Beginner’s Guide to Cash Flow

Shareholder Equity Statement

This statement records the changes in the equity part of the balance sheet over a fixed period of time. It tells us what equity has been after disposition (investment, retained earnings, and dividend payouts).

Additionally, this statement will be useful to shareholders who want to know how much of the company’s earnings are being fed back into the company for future growth and then distributed through dividends.

Key Objectives of Financial Statements and Their Benefits for Stakeholders

Why are financial statements so important to businesses, investors and even to government bodies?

These reports are full of information that will help you make decisions, hold people accountable and maintain transparency.

We can examine the key objectives of financial statements through the value they bring.

Also Read: Financial Analysis: Meaning, Importance & Functions

Offering Accurate Insights into Financial Position and Health

Financial statements are, above all, required to show a company’s assets, liabilities and equity in an accurate manner. This can help us determine if it’s financially standing or if something is troubling the horizon.

Quite like a bank account, we want to know not just how much we have but also how much we owe.

Seeing their business from a financial position can show a business owner if they are able to invest in new inventory, how much stock they can order and hold or expand while not overstretching.

Supporting Decision-Making for Investors and Creditors

Financial statements are used very heavily by investors and creditors when making decisions. For investors, it is about potential returns; for creditors, it is about repayment ability.

The income statement and the cash flow statement are especially important if you’re a small restaurant, searching for investors.

Important as an investor is a report that shows the restaurant how profitable it is and whether it has a steady cash flow.

Financial statements are used by creditors such as banks to decide whether to do a loan for loan eligibility and repayment schedules.

Before a bank gives a loan for a new project, if a construction company wants that loan, the bank is going to look at the construction company’s balance sheet and make sure the construction company has enough assets and manageable debt levels.

These critical decisions are based on financial statements.

Ensuring Management Transparency and Accountability

Financial statements provide an objective measure of company performance for internal stakeholders like the management team. It is actions as a report card for management financial stewardship.

For example, a decreasing net income in a company signals a time to revisit expenses or examine revenue approaches again.

For example, imagine a family owned food company is noticing profits have been dropping each of the last two quarters. It is shown in the financial statements that raw material cost increases have had an effect on the overall profitability.

This transparency allows managers to fix problems even before they become real problems.

Meeting Regulatory and Compliance Requirements

The objectives of financial statements don’t just end at helping business owners or investors – they’re also a regulatory necessity.

It is required of businesses to create accurate financial statements in order to comply with local tax laws and industry regulations. If you fail to meet these requirements you could be fined, have penalties issued or even subject to legal action.

Think of a pharmaceutical company that has to publish its financials to regulatory authorities to adhere to (industry) standards. The legal requirements are that the company’s balance sheet and income statement must be transparent; that is to say, the company’s financial dealings and revenue source must be clearly shown.

These reports are necessary to keep businesses accountable to external standards.

Facilitating Effective Planning, Budgeting, and Forecasting

Planning for the future is one of the most strategic objectives of the financial statements. They enable us to have the data to determine budgetary amounts and predict net revenue growth and needs for funding.

For example, an IT services firm might be looking at its cash flow statement to predict what funds are available for the next quarter in order to add new hires or equipment. The firm will choose to slow down, go for external financing, or keep up if cash inflows are strong. Otherwise, it may decide to be efficient and expand.

Companies can use historical data to set practical targets and line up their goals with what the resources are.

Assessing Cash Flow and Liquidity Through Financial Statements

One of the biggest questions business owners face is, “Will I have enough cash on hand to cover my expenses?”

For any business, cash flow is critical. Cash flow shows us the actual money coming in and going out of the company. It’s like tracking how well water flows in a tank — too little, and we’re in trouble.

The cash flow statement breaks down cash movements into three sections:

- Operating Activities: Cash generated from daily business activities like sales and payments to suppliers.

- Investing Activities: Cash spent on assets like equipment or money earned from investments.

- Financing Activities: Cash flow from borrowing, repaying loans, or issuing stock.

Why does this matter?

Let’s say that a logistics company has just taken on a very large contract. On paper, it may seem profitable, but they risk running out of cash when payments are delayed.

The cash flow statement helps us identify such risks early. We know exactly where cash is coming from, where it is going, and whether or not we will have the cash to pay upcoming expenses.

Survival isn’t the only thing here.

If we can understand cash flow, we can expand when and how much, we can invest in new projects, and we can ensure we don’t take on any debt we don’t need.

Cash flow isn’t a guess. The cash flow statement is useful to know if the business is financially healthy or not and getting a cash crunch.

82.9%

of professionals don't believe their degree can help them get ahead at work.

Measure Profitability and Growth Potential Through Use of Financial Statements

It is every business’s lifeblood: profits.

How can we really know when we’re profitable? Or if we’re positioned to be the next big growth company?

Financial statements, in particular the income statement, come into play in that spot.

The income statement depicts revenue and expenses and shows profit. It’s a scorecard for profitability, telling us whether our products or services are profitable or not.

Suppose you have a small furniture shop. The income statement shows, ‘Even though we’ve kept up with sales in the past, profit is down. Could it be that the cost of wood is increasing?’ When you catch this early, you can decide to modify prices or locate new suppliers.

However, growth potential can tell you whether or not there’s room to grow.

Using the income statement along with other statements like the balance sheet, we get insights into whether we can afford growth. If assets are strong and liabilities are manageable, expanding might be a viable option.

To get an even clearer picture, businesses often use financial ratios derived from statements:

- Gross Profit Margin: It is an amount of the profit earned after the cost of goods sold.

- Net Profit Margin: Recovered profits after deducting all expenses.

- Return on Assets: This measures the efficiency of assets with which you generate profit.

Ratios like these are powerful tools. They allow us to assess profitability and growth potential in specific, measurable terms.

Also Read: Difference Between Cash Flow and Fund Flow

Real-World Examples of Financial Statement Use in Business Scenarios

Understanding financial statements isn’t just for finance experts. Real businesses use these reports to make everyday decisions.

Here are a few practical examples to see how they come into play:

Retail Clothing Store

- A boutique uses its income statement to track seasonal sales patterns.

- If winter coats sell best in November, the shop owner knows to invest in more inventory around that time.

- The balance sheet also shows if there’s enough cash on hand to stock up on seasonal items without taking on extra debt.

Manufacturing Firm

- A factory producing electronics needs to manage high production costs.

- By examining the cash flow statement, management can plan better for raw material purchases and avoid liquidity problems.

- If cash flow from operating activities is strong, the firm might reinvest in faster machinery to boost production.

Café Chain

- A local café chain uses the cash flow statement to assess its ability to open new locations.

- If cash inflow is high, the owner knows there’s financial room for expansion.

- With this data, they can approach investors confidently, showing solid cash flow to support their growth plans.

Conclusion

The objectives of financial statements go far beyond simple record-keeping. They provide a comprehensive view of a company’s financial health, guiding essential decisions on cash flow, profitability, and growth.

This is important information to make better decisions. They help us determine when best to invest, expand or manage resources carefully. For lenders and investors, they provide a sound basis on which to judge whether a company is stable and capable of remaining so in the future.

Financial statements reveal clear, accurate data about assets, liabilities, income, and cash flow and become invaluable to everyone across the board, making it transparent and accountable and facilitating great strategic planning.

The Integrated Program in Finance and Financial Technologies by Hero Vired is a great way to deepen your knowledge of financial statements and more! The course will take you through finance fundamentals and the cutting edge of financial technologies, helping you gain the power to use financial insights in the right ways.

For investors and creditors, why are financial statements valuable?

What limitations should users be aware of in financial statements?

What insights can financial ratios offer from financial statements?

Updated on November 8, 2024