When running a business, keeping a close eye on your expenses can feel like trying to catch water in a sieve. Where exactly is your money going? Are your costs under control, or are they silently eating away at your profits?

This is where cost accounting comes in. Cost accounting helps us follow, quantify, and control costs in an orderly way. It’s not only the numbers but every detail that goes into running a business.

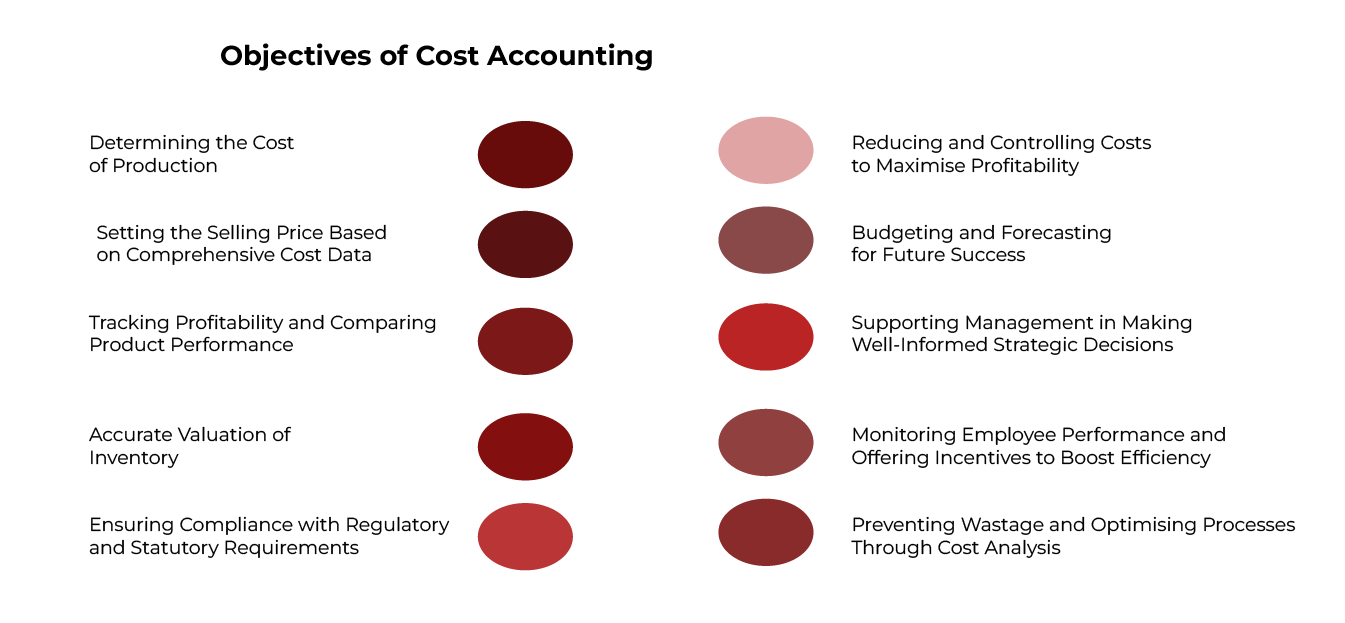

Why does it matter? Well, if the objectives of cost accounting are not known, then smart decisions cannot be made in terms of boosting profits, reducing waste, or ensuring long-term growth.

Determining the Cost of Production: Analysing and Classifying Business Expenses

This is one of the fundamental aims of cost accounting: to determine the real cost of manufacturing a product or delivering a service. It is like peeling layers of an onion – we keep digging until we are absolutely sure about where each and every penny goes.

Cost accounting systematically breaks up costs into two broad categories:

- Direct costs: These are easily attributed to the production, such as raw materials or labour. So, if you are creating textiles, it would be the cost of the cotton and the pay of the workers working the machines.

- Indirect costs: These ones are a bit trickier. They can include electricity, equipment maintenance, or rent- all these costs which are necessary but not tied to one product. These are called overheads.

This, therefore, is what cost accounting does: it helps us put these costs in broad categories.

Example: Suppose we operate a furniture factory. The direct costs are wood, fabric, and wages of the carpenters. What about rent for the factory or electricity consumed by the machines? These indirect costs must be spread over all the furniture we make so we have a real cost of the chairs and tables.

POSTGRADUATE PROGRAM IN

Multi Cloud Architecture & DevOps

Master cloud architecture, DevOps practices, and automation to build scalable, resilient systems.

Setting the Selling Price Based on Comprehensive Cost Data

Now that we have determined the cost, we need to know how much to sell our product for. That’s a delicate balance indeed; after all, the selling price must pay off the costs and, at the same time, produce enough profit without driving the customer away.

That’s when cost accounting comes in.

Understanding both fixed costs, such as rent, and variable costs, like materials, we are able to determine what we should charge for every product that will keep us in the profit.

In other words:

- Sum up all your costs, be it fixed and variable.

- Determine how much profit margin you want.

- Price the product accordingly.

The costs vary, and so does market demand. It is for such reasons that the cost data needs to be updated every now and then to avoid either under or over-charging.

Example: Suppose we own a bakery. The price of flour and sugar will depend on the market. However, the rent on our bakery does not change. If we incorporate the material price variance in our cake sales, we will go on to set prices too low and make a loss on every sale. Cost accounting can help incorporate those variables and adjust our prices so we remain profitable.

Also Read: What is Financial Accounting

Reducing and Controlling Costs to Maximise Profitability

Cutting costs is no longer just a reduction in the budget; this shows being smart in the use of our resources. It means using what is needed and cutting what is not.

The objectives of cost accounting are to help us identify what can be cut without further compromising the quality of our product or service. It tracks the gap between budgeted costs and actual costs and how expenses are spiralling out of control.

Here are some proven ways to reduce and control costs through cost accounting:

- Overhead monitoring: Utilities, maintenance, and rent are all tracked closely. Small changes can make a big difference.

- Process improvement: Are there steps in the production process that can simply be cut out or streamlined for greater efficiency? Reducing waste – material and time- reduces costs largely.

- Deal with suppliers: At regular intervals, review the existing agreements with suppliers to see if there still is room for savings on raw materials.

Example: Suppose we are running a small-sized café. Through the benefit-cost accounting, we determine that electricity costs are too high compared to what we expected. Careful scrutiny identifies the fact that all the machines used for coffee are switched on throughout the day, even during off-peak hours. Adjusting the usage of such machines to better times reduces our electricity cost without affecting service delivery quality.

Knowing where our money is going will enable us to make the right decisions and, therefore, reap bigger profits.

Tracking Profitability and Comparing Product Performance

We assume that all products or services are equally profitable. But, in reality, the truth is more of the fact that some products and services yield much higher profitability than others.

Cost accounting provides one with the inside view as to how each of the products is going to make its profit, on which exact costs would get incorporated, and how much revenue each product will generate.

Here’s how we do it:

- Break down costs for every single product or service.

- Compare the cost with revenue to determine the profitable products.

- Make adjustments according to the strategy.

By tracking what is profitable, we can avoid falling into the trap of allowing high-cost and low-profit products to infringe on overall earnings.

Example: Suppose we run a printing business and have a few services, such as poster printing, brochure designing, and customising t-shirts. Using cost accounting, we would find out that custom t-shirts are highly profitable but take way more resources than a simple piece of printing or brochure designing. Understanding this reality, we would sell more brochure designs and eat less from those resource-consuming custom t-shirts.

Practical Tips:

- Use a profitability report that provides the cost incurred, the revenue generated, and the profit margin for each product.

- Examine the products’ performance from time to time in terms of trends. This enables an enterprise to see what changes are happening in terms of the performance of the products and, hence, adjust its price or production accordingly.

82.9%

of professionals don't believe their degree can help them get ahead at work.

Accurate Valuation of Inventory: Ensuring Transparency in Financial Reporting

Inventory very quickly becomes a financial black hole if we do not measure its value.

Cost accounting ensures we know exactly what our inventory is worth at any given time. That not only helps in financial transparency but also helps us avoid overstocking or understocking the right goods.

Actually, we can value our inventory using several different methods:

- First-In, First-Out (FIFO): This principle assumes that the oldest stock is sold first. It works best for short shelf lives or perishable products like food.

- Last-In, First-Out (LIFO): This method assumes that the fresh stock is sold first. It is mainly used in trades when the prices of the products keep on fluctuating often.

- Weighted Average Cost: In this method, cost is averaged for every inventory; therefore, it is a middle ground for companies whose price variation on their inventory is not so significant.

Example: Assume we run a retail business selling cell phones. In case we remain bound to the FIFO, then we sell the first of the older models so that they do not become less popular. In this way, we keep our stock as fresh as possible and do not allow ourselves to hold stock that may become obsolete, thereby lowering the profits for us.

Practical Tips:

- Choose an inventory valuation method suitable for your industry and the product life cycle.

- Review the inventory regularly to avoid excess stock and create a space for moving products.

Role of Cost Accounting in Budgeting and Forecasting for Future Success

A successful business does not do things by chance. We need a roadmap, and that is where budgeting and forecasting come into the picture.

Cost accounting helps us establish a cost history and knowledge of predicting future costs and revenues. Cost accounting is like building a forecast based on facts and not on guesses.

This is how it works:

- Past data: Cost accounting will give a clear cut of what things costed in the past along with any unexpected cost.

- Current conditions adjustments: Market trends, supplier prices, and demand shifts are all considered to project future costs.

- Set a budget: We will prepare a feasible budget based on all this information. In such a budget, spending limits and revenue targets would be established.

Example: Suppose we are running a clothing business; cost accounting may indicate it costs more to manufacture clothes for winter than for summer. Then, we can adjust our budget to better prepare for the higher material cost of making winter clothes by curtailing unnecessary expenses.

Budgeting is not just about cutting costs. It is about ensuring that every rupee goes into the right place.

Practical Principles:

- Use historical data when estimating so that the budget can be set as close to reality as possible.

- Continually compare actual performance with budgeted performance and make changes as necessary.

Supporting Management in Making Well-Informed Strategic Decisions

Cost accounting is more than just arithmetic; it provides us with the information we must have to make decisions.

Whether we are considering launching a new product, discontinuation of an existing one, or even entering into new markets, cost accounting informs us of the financial implications of everything we decide on before we act on that thing.

It basically questions us:

- Would it be worthwhile to keep this line of products?

- Should we spend more on advertising for this service?

- Is it worth entering that market and so on?

Cost accounting has the answers to all those questions.

Example: Suppose we are looking at opening up a new café. We could use cost accounting to calculate startup costs, revenues, and margin of profit based on comparable projects. Then, we could let that help us make an informed decision as to whether the expansion makes economic sense.

Practical Tips:

- Apply cost-benefit analysis when deciding on new projects or products.

- Keep track of your break-even points so you will know when your investments will be profitable.

Ensuring Compliance with Regulatory and Statutory Requirements in Cost Accounting

Cost accounting in some industries is a bit more than keeping accounts of expenditures: it has become a matter of law.

Regulatory agencies require businesses to keep records of their costs transparent and detailed. These are frequently audited to ascertain whether companies are not only following the regulations on charges and taxation but also the surcharge limits they are permitted to accept as profit on particular products.

Example: In the pharmaceutical industry, for instance, the government caps the prices of essential medicines. If you manufacture these drugs, you’ll need cost records to prove you are not overcharging the clients.

The reason cost accounting is important is that it will ensure that you have all the necessary data in case of an audit and keep you away from sanctions or penalties from regulatory authorities.

Now, how do we use cost accounting to meet compliance requirements?

- Maintain cost records: This ranges from materials and labour to overheads.

- Audits: Ensure cost records are updated and comply with government regulations.

- Preparing a report: Some businesses are required to send cost records of their products to certain regulatory departments regularly.

If your business falls in a regulated industry, then cost accounting is no longer just a choice but rather a must-do.

Monitoring Employee Performance and Offering Incentives to Boost Efficiency

Keeping employees motivated is tricky, especially when trying to balance productivity and costs.

The objectives of cost accounting are to provide clear pictures of how your people work. It identifies and rewards top performers as well as tracks areas needing improvement through the data provided.

The following are monitored through tracking of costs:

- Labour costs: How much of wages are you paying on output?

- Performance metrics: Are your employees meeting production targets within budget?

That way, you incentivise employees to work smarter and not harder.

Example: Let’s say we are running a textile factory. Here again, if one team produces more garments within the time budgeted on each occasion, it would be a practical incentive to reward them with bonuses. Cost accounting tracks all such performances and would assist in creating incentive programs that raise productivity.

Tips for improving efficiency:

- Use cost data to find areas of inefficiency in the production process.

- Reward or bonus plan for employees who achieve or exceed the targeted goal.

- Account for overtime costs to ensure they don’t eat into your profits.

Cost accounting keeps you up-to-date on labour efficiency so you can manage your workforce better.

Preventing Wastage and Optimising Processes Through Cost Analysis

Are you losing money in business because your operations are not efficient?

Wastage of material and time can quietly gobble away your profit.

The objectives of cost accounting are to find such inefficiencies. It determines specifically where money is being lost. Analysing the costs will further enlighten areas of resource wastage and make adjustments for greater efficiency.

Here is how cost accounting optimises processes:

- Material wastage: Are you consuming more materials than what you require?

- Time inefficiencies: Are there bottlenecks in the production process resulting in a slower one?

- Overproduction: Is there more production than you could sell, causing unsold stock?

Example: Suppose we are running a restaurant, and through a cost accounting analysis, we can identify that our restaurant is wasting lots of ingredients. We could save money not only by reducing waste in foodstuffs but also by possibly changing our order sizes and menu items.

To stop wastage, businesses can:

- Monitor Material Usage – Track the materials used and the amount wasted while using them.

- Streamline the Process – Identify production bottlenecks and eliminate unnecessary steps that have no added value.

- Check inventory periodically – This helps avoid over-ordering or carrying excess stock.

Optimisation does not mean taking shortcuts but optimising resources for getting the work done.

Conclusion

Cost accounting is the very driving force behind business efficiency and growth.

It enables businesses to make the right decisions with constant, accurate insight into costs, profitability, and compliance. Whether cost tracking, appropriate pricing, or optimised processes, cost accounting is something to work on in terms of profitability.

It also ensures compliance with regulations and helps identify opportunities for improvement across various operations. With these objectives in mind, cost accounting becomes an essential tool not just for managing expenses but also for ensuring long-term business success and growth.

Effective cost accounting practices may be the difference between staying competitive and falling behind.

So, if you’re looking to optimise costs, boost efficiency, and stay compliant, understand the objectives of cost accounting and use it as a tool that makes it all possible.

How does cost accounting help with compliance?

Does cost accounting increase employee productivity?

In what ways can cost accounting help in reducing wastage?

Updated on September 26, 2024