Financial Planning and Analysis (FP&A) is a basic necessity for any company since it assists in adequately utilizing resources, making sound financial decisions, and ensuring solvency. In the case of FP&A, it helps you have a structured approach to budgeting to identify the financial forecasts and data to aid the decisions you will make in the future.

FP&A is not mechanical: It allows companies to plan for expansion, manage risk, and stay on top of their financial picture. FP&A, FandP&A, FASS, FIMP, FPIS, FPNS, FP&V … these are all acronyms used by FP&A (Finance and Planning & Analysis) to describe the various functions of an FP&A process. This article will explain what FP&A is and its functions and hopefully introduce FP&A software to streamline FP&A processes, foster collaboration, and improve overall FP&A performance.

What is Financial Planning and Analysis?

Financial Planning and Analysis (FP&A) involves how a business arranges its processes to guarantee that it plans precisely, forecasts properly, and budgets correctly for the business to make big business decisions and remain sustainable. They include planning, budgeting, forecasting, scenario modeling, and performance reporting. Accounting is not what FP&A is but an essential part of what FP&A considers. Specialized FP&A software is one of the many things CFOs purchase to help them complete the most critical tasks.

In most large enterprises, the CFO typically has a person directly responsible for the Director of FP&A. The most important FP & A teamwork is to use existing and past financial data to predict future revenues, expenses, profits, and cash flows to an accurate degree. From there, CFOs use these assumptions to make long-term decisions about the future of their business.

POSTGRADUATE PROGRAM IN

Financial Analysis, Valuation, & Risk Management

Learn financial modeling, valuation techniques, and risk management to drive strategic business decisions.

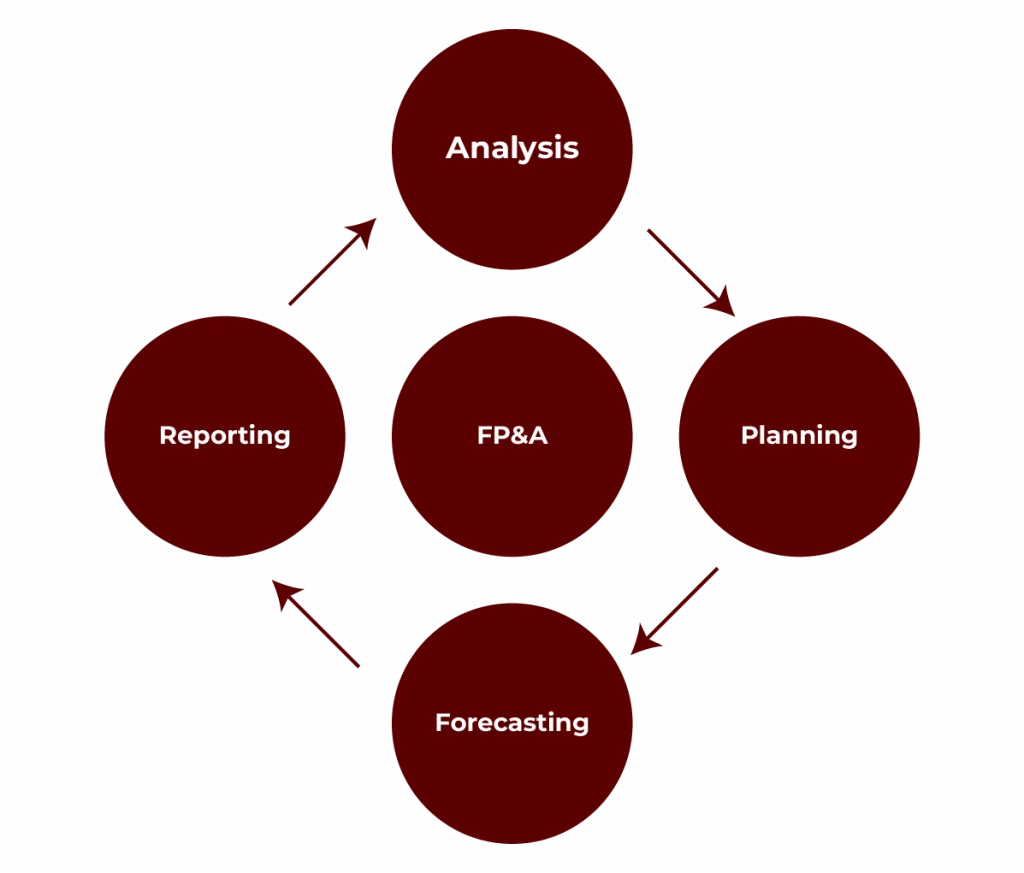

Functioning of FP&A Process

Financial planning and analysis (FP&A) is an endless data collection and analysis flow. As the business size increases, or as we expand into more markets or the market itself changes, the complexity of this process also starts increasing. For larger and midsize companies, this complexity is often handled by companies creating dedicated FP&E teams in their finance departments. Despite the challenges, the FP&A process includes four basic steps:

1. Data Collection, Consolidation, and Verification

Financial and operational data from such systems as ERP (Enterprise Resource Planning) and data warehouses are aggregated first. External data may include demographic and market trends, as we are random outside. Data after collection must be standardised and verified for accuracy. More importantly, it allows for developing a reliable plan, forecast, and budget. Plus, it’s also time-consuming, so most businesses use AI-driven tools to execute these tasks.

2. Planning and Forecasting

In this stage, FP&A analysts use the verified data to come up with a financial forecast of what will happen in the future regarding business performance. Sales forecasts, cash flow projections and more are included in these forecasts. Analysts also use models to test various scenarios and decide what to do next. Common planning methods include:

- Predictive Planning: Using historical data to predict a project’s future performance through time series forecasting models.

- Driver-Based Planning: Key business drivers are identified, and plans to show how they would be affected by varying variables are developed.

- Multi-Scenario Planning: Assume what might happen and devise plans to react to any possible events.

3. Budgeting

In the budgeting step, FP&A professionals estimate the cost that must be spent in implementing the corporate plan based on forecasted revenue. They budget for each business unit or function and then operate as an integrated corporate budget by working collaboratively with all departments. This budget is normally created annually and updated quarterly, but as many businesses adapt to better market volatility, they are now moving towards using continuous budgeting cycles with rolling forecasts. Also, some organisations have tried zero-based budgeting to overly prove spending needs and avoid unnecessary expenses.

4. Performance Monitoring and Analytics

Finances are constantly compared with the same standards: sales, expenses, profits, working capital and cash flow by FP&A teams, and these are analysed, among other things. They answer ad hoc queries and convert data into a narrative that helps decision-makers understand the situation and take informed actions.

Importance of Financial Planning and Analysis

Everything has some kind of finance in it. But while the entire Finance branch is responsible for tasks like record keeping, accounting, payroll, compliance and control, risk management, investor relations, and more, FP&A also focuses on the future: It determines a company’s financial performance.

However, the FP&A team’s value lies in helping executives, and the broader company get insights by analysing financial and operation data.

FP&A greatly impacts how a company’s culture, growth, trajectory, and, ultimately, its fate will be made. The FP&A team must thoroughly understand the company’s immediate — and ever-long — financial needs.

Benefits of Financial Planning and Analysis Software

Financial Planning and Analysis would be easy and reliable if a business used FP&A software. Here are some of the main benefits:

- Better Financial Analysis: FP&A software greatly enhances the quality of financial analysis, enabling companies to better understand their financial health. Over half of FP & A professionals say these tools have resulted in better analysis.

- Predicting Outcomes of Decisions: FP&A software allows companies to use forecast scenarios to predict how business decisions impact finances. For example, suppose a company wants to acquire new equipment. In that case, the software can help calculate its effect on profits by examining related costs and the period over which the new equipment will be used.

- Easier Financial Modeling: Building financial models is essential for planning, and FP&A software makes it simple. Teams often build models monthly; however, some create models weekly. This software includes templates that are easy to adjust and can help track progress and update information as needed.

- Smoother Collaboration Across Departments: Unlike Excel, FP&A software offers a space where financial teams can share information. This smart tool eases the work for team members and helps them leave comments, share ideas, and always know what’s going on with everyone on each development team’s financial goals.

- Managing Risks with Scenario Planning: FP&A software allows teams to try something out, like how much change in price or economic slowdown, to plan accordingly. Real-time data helps teams change plans rapidly to reduce risks and make well-informed decisions.

Also Read: The Main Objectives of Financial Planning

82.9%

of professionals don't believe their degree can help them get ahead at work.

Modern FP&A Solutions and Technologies

CFOs and finance leaders invested heavily in FP&A in 2020, and you can easily understand why. Automation, artificial intelligence, and the cloud are redefining the game – letting you plan, budget, and forecast more accurately, and financial analytics offer more power. Firms that employ these technologies within their FP&A activities have far better crystal balls than their competitors, which gives them an incredible advantage. Some of these tools are mentioned below:

- Cloud: Traditionally, FP&A software was on-premise based, but the cloud presents many opportunities. More Big Data sources can be connected with than their on-premise counterparts. They are accessible anywhere, collaboration is easy, and they’re scalable and cost-effective. Data is more secure in certain cases than if stored on-premise because of recent advancements in cloud security.

- AI and machine learning: A huge benefit of AI and machine learning is the use of financial planning and analysis tools that aid FP&A analysts. They can also make it so users can analyse a greater range of types of ad Data from more sources to find trends, patterns, correlations, and insights that would otherwise fly under the radar. Artificial intelligence and machine learning vastly improve financial forecasts’ accuracy, supercharge predictive analytics, self and service reporting, and multi-scenario planning. For instance, Gelsenwasser already has agile, real-time sales planning, but the intention is to develop planning and associated benefits for further AI and predictive maintenance levels.

- Robotic process automation: FP&A analysts spend a great deal of time sourcing, aggregating, and formatting data. Many of these manual tasks are automatable, and RPA powered by AI and ML increases processing times and decreases errors in the process. It can also automate the analysis, forecasting, predictive modelling, and report generation, allowing the team to concentrate on the more valuable work of interpreting results and advising the business.

Financial Planning and Analysis Skills

Math is very important, and crunching numbers is something we can get used to — never more so than when you are an FP&A analyst or director. Consequently, many of these people in this position have been accountants beforehand. The other side is that professionals in this field must also be comfortable spending time and diving deep into complex, often quite diverse data sets from marketing, sales, human resources, and operations.

A must-have software tool for analysing that data is spreadsheets (FP&A need to be good at Microsoft Excel or equivalent), so choosing the right type of data storage medium, be it on-premises or in the cloud, isn’t just a decision to consider, it’s a decision that affects the ability of FP&A to perform its work. They must know the formulas and hoops necessary to compile and work with raw data, producing key reports. Basic ERP systems should be what they know, know how this software can operate the reporting, and help more sophisticated reporting and analysis.

FP&A team members, therefore, need strong skills in business partnering (having to work with colleagues from across the organisation, communicating and collaborating with them). While there are a variety of business partnering skills, most businesses seek individuals who can work well with others, have an understanding of what is important to the business and its priorities and goals, can build a deep knowledge of the company and the processes within the company, and can turn droves of information to easily digestible reports. Finally, every business looks for exemplary problem-solving skills in someone like FP & A, as these people have to tackle the inherent problems of consolidating and reconciling financial data.

Also Read: The Role of Financial Planners

Recommended FP&A Software and Tools

Here’s a selection of top FP&A software to streamline and enhance the FP&A team’s processes, addressing common challenges they encounter:

- Cube: Cube is a spreadsheet-native FP&A platform that extends our team’s Excel or Google Sheets to become our single source of truth, with easy integration and automation of manual tasks to make analysis and forecasting more efficient.

- Microsoft Excel: Despite attempts to replace Excel, it is widely used and versatile, and FP&A uses it as its go-to for things that need to be done quickly.

- Google Sheets: While finance professionals are huge fans of Excel, Google Sheets has become popular due to its ability to make data transparent, clear, and easy to understand, as well as its interface.

- Workday Adaptive Planning: This software is for big enterprises focusing not on FP&A but on end-to-end company solutions. It’s long because it is meant to replace spreadsheets.

- Anaplan: Anaplan is a large enterprise cloud of tools centralising data sources on a single platform. Strong IT support is needed for a large-scale transformation.

- Planful: Planful is the perfect vertical solution for larger companies aiming to automate data processes and increase their strategic influence beyond finance. And was created specifically to address the specific needs of larger companies.

- Vena Solutions: Vena offers pre-built FP&A solutions with customisable options, which makes this a game for organisations that need structured planning and guidance.

It’s common for FP&A teams to struggle with data collection and data processing as it ends up taking too many resources — planning and not analysing. Behind the scenes, data integration is happening in real-time and integrated into the reporting tools, freeing FP&A teams to focus on the strategic planning and modelling that leads to long-term success and business growth.

Also Read: Financial Analyst Interview Questions And Answers

Conclusion

Businesses today operate at such insane speeds that financial planning and analysis are crucial to ensuring that your organisation stays competitive and remains resilient. FP&A processes and software aid in realising a company’s current status and its capacity to react to challenges ahead by creating accurate forecasts and assisting in better decision-making and team collaboration between departments. The use of advanced FP&A tools enables organisations to simplify data management, make better predictions, and devote more time to strategies that will support growth and the company’s long-term success. To Know more about this in detail, refer to the Certificate Program in Financial Analysis, Valuation, & Risk Management With EdX powered by Hero Vired.

What does finance planning and analysis mean?

What is the role of the financial planning and analyst holders?

How much is FP&A paid in India?

How do I get an FP&A role?

Updated on November 12, 2024