Whenever any institution or private investor puts money in any organisation, he or she has to come to the same question: ‘Is this company worth my money?’ The reason is that it’s not just about numbers; it is also about understanding the potential of the company to grow and fight the upcoming adversities and how the company will be facing its competitors.

This is where one comes across the necessity to know what equity research is.

Equity research is not something limited to just a few experts who have access to some expensive tools. It does not matter if you are a retail investor working with annual reports or a large institution with an array of tools like Bloomberg. The basic principles are the same for all: Use sound judgment to analyse and evaluate a company so as to make an informed decision.

In this article, we will delve deeper into equity research and try for a comprehensive understanding.

What Is Equity Research? Explain Its Critical Role in Financial Markets

At its core, equity research is all about the art and science of analysing the complete health of a company.

It answers some very vital questions, like:

- Is this stock undervalued or overvalued?

- What are the risks involved in investing in this company?

- Should we buy, hold, or sell?

Therefore, we can say that:- equity research fills a gap between a company and investors. An equity research analyst is able, through these various inquiries of available data, to develop precious insights which notify investors about better options among the myriad stock choices.

Without equity research, investment is like traversing the market blindfolded.

- For retail investors, it saves time and reduces guesswork.

- For institutions, it ensures investments align with long-term strategies.

POSTGRADUATE PROGRAM IN

Multi Cloud Architecture & DevOps

Master cloud architecture, DevOps practices, and automation to build scalable, resilient systems.

Different Types of Equity Research and Their Applications in Different Settings

There are four main types of equity research, determined mainly by the entity that conducts the analysis and the respective audience. Each one plays a distinctive part in the financial ecosystem, serving divergent stakeholders.

1. Sell-Side Equity Research

- Conducted by brokerage firms and investment banks.

- Reports are distributed widely to attract investors and drive transactions.

- These analysts cover numerous sectors but focus on high-profile companies with trading volume.

2. Buy-Side Equity Research

- Conducted within mutual funds, hedge funds, or pension funds.

- The goal is to assist portfolio managers in making decisions for their clients.

- Buy-side research is often confidential and never published publicly.

3. Independent Equity Research

- Performed by firms not involved in brokerage or banking activities.

- Offers unbiased insights to clients who pay for the service.

- Gaining popularity due to its neutrality.

4. Internal Equity Research

- Conducted by corporations for internal decision-making.

- Focuses on suppliers, competitors, and market opportunities.

Deep Dive into Equity Research Reports: Types, Structure, and Importance for Investors

Equity research reports are the final product of an analyst’s work. They translate hours of analysis into a concise document that guides investors.

Key Types of Reports

Initiation of Coverage

- A deep dive into a company’s financials and prospects when it’s added to an analyst’s portfolio.

Flash Reports

- Quick updates on breaking news, such as earnings announcements or market developments.

Earnings Reports

- Detailed analysis of quarterly or annual earnings, comparing results against expectations.

Industry Reports

- Sector-wide analysis covering trends, opportunities, and challenges.

Structure of a Report

While the exact format may vary, most reports include:

Executive Summary

- A snapshot of the key findings and recommendations.

Company Overview

- Background, products, and recent developments.

Industry Analysis

- Market size, competitors, and regulatory landscape.

Financial Analysis

- Revenue, profits, cash flow, and key ratios.

Valuation Models

- Methods like discounted cash flow (DCF) or P/E multiples.

Investment Recommendation

- Clear guidance to buy, hold, or sell.

Why Are These Reports Important?

For investors, reports simplify decision-making.

For instance, a report recommending “Buy” for a technology company would explain its recommendation, perhaps because of an innovative product pipeline or growing demand for its products in its market.

Even in the absence of expensive tools and hefty research teams, reports help retail investors get insider information.

Step-by-Step Breakdown of the Equity Research Process

Equity research is an organised process that demands an elaborate analytical framework and a clear-cut methodological approach. It is beyond numerical exercise, given that it seeks to demystify the story behind the numbers. Here’s how it works in a step-by-step fashion.

Step 1: Selecting Companies to Research

The first step is deciding which companies to analyse.

This selection often depends on:

- Sector focus: Analysts specialise in industries like technology, healthcare, or energy.

- Market potential: Companies with a large market share or strong growth prospects get priority.

- Recent events: An upcoming product launch, merger, or regulatory change may draw attention.

For example, an analyst focusing on consumer goods might pick a company launching a new product in India, where demand is high for FMCG items.

Step 2: Conducting Industry Analysis

Every company operates within an industry. Understanding the bigger picture is critical.

Industry analysis includes:

- Market trends and growth rate.

- Key competitors and their strengths.

- Challenges like regulatory changes or raw material shortages.

For example, an analyst analysing a solar energy company would review factors such as government subsidies and demand for renewable energy in emerging markets.

Step 3: Diving Into Company Analysis

Once the industry is clear, it’s time to dig deeper into the company itself.

This involves reviewing:

- Financial statements: Income statement, balance sheet, and cash flow.

- Management performance: Leadership decisions and governance practices.

- Competitive position: How the company compares to its peers.

One common method is using a checklist:

- Are profits consistent?

- Is the company managing debt well?

- Are operations generating enough cash flow?

Step 4: Building Financial Models and Projections

Next comes forecasting the company’s future performance. This is where financial models come into play.

Analysts use two main approaches:

- Top-down: Start with the industry’s potential and estimate the company’s market share.

- Bottom-up: Use specific drivers like sales growth or production capacity to build projections.

For example, if a tech company wants to expand into cloud computing, it can reflect significant growth in the demand for data storage now.

Step 5: Valuation and Investment Recommendation

The final step is determining the company’s intrinsic value.

Analysts compare this value to the current stock price to decide if it’s undervalued or overvalued.

Common valuation methods include:

- Discounted Cash Flow (DCF): Estimates future cash flows and discounts them to present value.

- Comparable Company Analysis (CCA): Compares the company to similar businesses in the same industry.

After completing this, the analyst issues a clear recommendation:

- Buy: If the stock is undervalued.

- Hold: If it’s fairly valued.

- Sell: If it’s overvalued.

For investors, this recommendation simplifies decision-making.

82.9%

of professionals don't believe their degree can help them get ahead at work.

Tools and Techniques Used in Equity Research to Boost Productivity

Essential Tools for Equity Research

- Bloomberg Terminal: Real-time market data, financial analysis, and research tools.

- FactSet: A comprehensive platform for data integration and analytics.

- Thomson Reuters Eikon: Market trends, news, and financial insights.

- Excel: The cornerstone of financial modeling.

Role of AI and Alternative Data

Modern equity research goes beyond traditional methods.

AI-powered tools:

These automate repetitive tasks like data collection. They also provide insights by analysing patterns in large datasets.

Alternative data sources:

Social media sentiment, website traffic, and even satellite imagery are becoming essential.

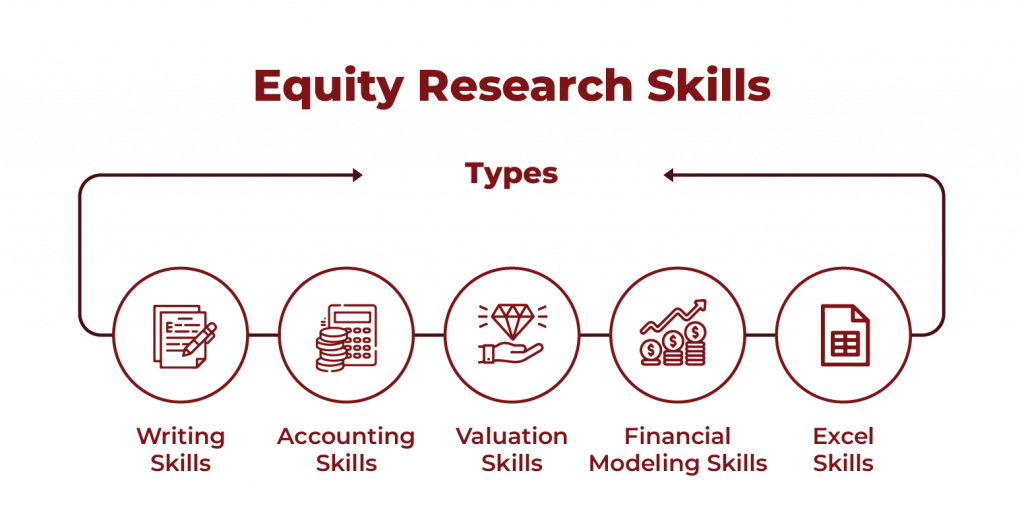

The Recruitment Process for Breaking into Equity Research Roles

Breaking into equity research can feel like a challenge. The competition is intense, and firms hire selectively.

Who Can Enter Equity Research?

Finance graduates and professionals with domain expertise (like engineers or doctors) can work in equity research by learning financial modelling. Firms value deep industry knowledge as much as technical skills.

How Recruitment Works

Most firms follow structured hiring processes, which include:

Resume screening

- Highlight financial modelling skills and research experience.

Technical interviews

- Test knowledge of valuation methods and analytical abilities.

Case studies

- Evaluate the ability to analyse data and make recommendations.

How to Stand Out

Publish research

- Writing about publicly traded companies can make you visible to recruiters.

Build financial models

- Hands-on experience with Excel and tools like DCF is highly valued.

Network effectively

- Attend industry events or connect with professionals on LinkedIn.

What Are the Key Responsibilities and Day-to-Day Tasks of Equity Research Analysts?

Do you know what equity research analysts actually do? Their workday involves much more than staring at spreadsheets.

Here’s what keeps them busy:

Building financial models

Analysts forecast a company’s future performance by projecting revenue, expenses, and profits.

Tracking industry trends

From regulatory changes to competitor moves, nothing escapes their radar.

Writing research reports

These reports break down complex data into actionable insights.

Engaging with clients

Analysts explain their findings to fund managers, investors, and even media outlets.

Analysing earnings reports

Every quarter, analysts take a look at company updates, comparing actual performance to projections.

So if an automotive manufacturer talks about launching an electric car, the equity analyst finds out how this could affect sales, production cost, and market share.

Salary Benchmarks in India in Equity Research

| Role | Average Salary in India (INR) | Top Employers |

| Equity Research Analyst | 7–10 Lakhs | JP Morgan, Goldman Sachs, Morgan Stanley, Credit Suisse, Kotak Securities |

| Associate Analyst | 4–6 Lakhs | Ernst & Young, KPMG, Deloitte, PwC |

| Senior Analyst/Research Director | 12–20 Lakhs | Citigroup, Barclays, ICICI Securities |

| Portfolio Manager | 15–25 Lakhs | HDFC Asset Management, ICICI Prudential, Reliance Nippon Life Asset Management |

| Equity Strategist | 10–18 Lakhs | Deutsche Bank, HSBC, UBS |

| Investor Relations Role | 9–15 Lakhs | Tata Group, Reliance Industries, Infosys, Wipro |

| Sales & Trading | 8–16 Lakhs | Axis Bank, HDFC Bank, Edelweiss |

Key Differences Between Equity Research, Investment Banking, and Hedge Funds

A major area of interest for investment professionals is how equity research stands compared with investment banking and hedge funds. Though there does exist some overlap between these roles, they serve different purposes and need different skill sets.

Equity Research

- Writing an analysis of a company, creating some forecast, giving buy, sell, or hold recommendations.

- To assist investors in better decision-making.

- Work on public data and interact with company management to gain insight into operations and market issues.

Investment Banking

- Related to raising capital, M&A, or advising companies on strategic choices.

- They build highly technical financial models that value companies for deals, such as IPOs or acquisitions.

- Banking teams often undertake transactions of huge magnitude under highly stringent time frames.

Hedge Funds

- Portfolio management to maximise returns for investors.

- Hedge fund analysts often become specialists in certain strategies, including long-short equity and global macro.

- This would be a mix of research and high-stakes decision-making on investment.

| Comparison Table | Equity Research | Investment Banking | Hedge Funds |

| Objective | Stock analysis | Transactions/M&A | Portfolio returns |

| Skills Needed | Analysis, reporting | Modelling, pitching | Strategy, risk |

| Main Output | Reports/forecasts | Deal execution | Investment returns |

Trends Shaping the Future of Equity Research: ESG, AI, and Alternative Data

Environmental, Social, and Governance (ESG) Metrics

Investors are paying more attention to ESG factors. These metrics evaluate a company’s impact on the environment, social practices, and corporate governance.

For example:

- A renewable energy company with a strong ESG score may attract socially responsible investors.

- Analysts now assess carbon emissions, employee policies, and board diversity alongside financial metrics.

Artificial Intelligence (AI)

AI is automating repetitive tasks like data gathering and improving the speed of analysis. Analysts use AI-powered platforms to:

- Identify trends from unstructured data like news articles.

- Automate valuation calculations and create dynamic models.

Alternative Data Sources

Traditional data like financial statements is no longer enough. Alternative data provides deeper insights.

Examples include:

- Analysing satellite imagery to track production at a manufacturing plant.

- Measuring consumer sentiment from social media mentions.

By embracing these trends, analysts deliver more precise recommendations and stay competitive in an evolving market.

Conclusion

Equity research is considered the foundation for an informed investment. It entails a close examination of companies, industries, and markets to furnish actionable insights for investors. Understanding the kinds of research, what step-by-step involves, and the reports that analysts write makes it clear how relevant their work is to both retail and institutional investors.

This field opens up many interesting career choices, from analyzing stocks to roles in hedge funds and corporate strategy. With growing trends such as ESG metrics, AI, and alternative data shaping its future, equity research is more relevant than ever. Whether at the beginning of your career or looking to advance, it remains a vibrant and impactful career choice.

For effective career enhancement in this ever-changing world, get excellent training and refine skills in the equity investigation field through the Certificate Program in Equity Research offered by Hero Vired. The program focuses extensively on hands-on training in financial analysis, valuation, and modelling to help you kick-start your career in equity research.

What is the main goal of equity research?

How does equity research differ from investment banking?

What tools do equity research analysts commonly use?

Updated on January 30, 2025