When it comes to operating a business, of necessity, financing is an ever-present and, at times, a multifaceted issue.

If we need more money, should we borrow it, or should we go out for an IPO to issue shares? Which is more appropriate: having a greater percentage of debt on the balance sheet than equity in terms of funding the company for growth without taking too much risk? These questions constitute what we refer to as capital structure in financial management.

Capital structure, in fact, represents a way in which a company finances its operations and investments, combining the use of borrowed money (debt: loans, bonds) and ownership sharing (equity: shareholders’ stakes). It is a key component of personal financial planning since decisions made here have implications on virtually all aspects of an organisation.

Do it right, and flexibility to capture new opportunities, manage operating expenses prudently, and reassure investors will be at our disposal. Screw it up, and we may load it with unmanageable debt or spread ownership to the point where it becomes self-destructive for long-term health.

The management of capital structure, therefore, involves searching for the right type of capital which fits the business in terms of development and stability.

Perhaps it helps to maintain the optimal budget to yield the necessary amount of money, respond to fluctuations in the market, and contribute to the effective satisfaction of shareholders and creditors. Whether it is for growth or simply to make sure that our operations are seamless, capital structure is the centre-piece of how that process is funded.

What is Capital Structure?

The term “capital structure” describes how a company balances its two primary funding sources—debt financing, which refers to borrowed resources, and equity financing, which entails owning your resources—in order to finance its operations and expansion. This combination establishes the company’s financial structure and all of its various facets, from the cost of capital to the ability of the business to adjust to shifts in the market.

In simple terms, capital structure is the blend of loans, bonds, or other forms of debt with money raised from shareholders.

Formulating a good capital structure assists a business in sustaining its financial stability, fostering more expansion, and increasing its overall financial profitability. Regardless of the selection of debt or equity funding, each decision impacts the ways that a company competes and develops in the business environment.

Also read:

POSTGRADUATE PROGRAM IN

Financial Analysis, Valuation, & Risk Management

Learn financial modeling, valuation techniques, and risk management to drive strategic business decisions.

Key Components of Capital Structure: Breaking Down Equity and Debt

To understand capital structure in financial management, we need to get clear on its two main components: equity and debt.

However, each of these plays its part in funding our business, each with its own perks and downsides. Let’s break it down.

Equity Capital: Own Without Repayment Responsibilities

Money raised by selling shares from the company is called equity capital.

When investors buy these shares, they are really buying part of the business. That means equity holders have a right to the company’s profits and assets. Unlike debt holders, however, they don’t get a guaranteed return or even the right to make interest payments.

Key benefits of equity capital:

- Flexibility: Since there is no mandatory repayment term associated with equity, we don’t have to worry about paying back shareholders on a set schedule.

- No Interest Payments: Secondly, it reduces our operating expenses because there is no interest they leave us for us to pay.

- Increased Credibility: Investors and partners often look for high equity levels because that usually means a stable financial footing.

But there’s a trade-off. Helping out by selling equity means we’re losing a piece of ownership — that dilutes our control. It also means shareholders want returns through dividends or as a value for the shares owned.

We may struggle to meet investor relations if profits are low.

Debt Capital: Fixed Cost Borrowed Funds

The money we borrow through loans, bonds, or other financial instruments is called debt capital.

If you have stable cash flows, then this is a common choice for companies which like to have debt financing to fund operations without sacrificing ownership. Borrowing with money is an agreement that is supposed to pay back the borrowing of the borrowed amount with interest with a fixed financial obligation over time.

Key benefits of debt capital:

- Tax Deductibility: Some of our interest payments on debt are often tax deductible and help reduce our overall tax burden.

- No Ownership Dilution: One option debt gives us to raise capital is without giving up the ownership or control.

- Potentially Lower Cost of Capital: In periods of low interest rates, debt can be cheaper than equity.

But with debt does also come risk, especially if your cash flow isn’t consistent.

Debt is fixed, we have to pay no matter what occurs in a downturn. Financial stress can also be created by high levels of debt, and it can affect the company’s creditworthiness.

Debt and Equity and Their Roles in Financial Flexibility

Flexibility in financing can be a matter of life and death for a business’s ability to react, thrive or survive hard times.

This flexibility occurs by debt and equity, but in very different ways.

When you’re in debt, you’re making fixed repayments. It is predictable, which is great for planning but painful when cash flow drops.

In contrast, with equity, there is no obligation to make a fixed payment. Instead, you share ownership, which means you’re also sharing control and profits.

In this case, equity can be less stressful, especially in unpredictable times, as there’s no loan to repay if sales fall short. Giving up a slice of ownership comes with a price, and sometimes, for a stock, it’s as high as any interest rate.

In most cases, a combination of debt and equity provides a nice balance between stability and growth and the freedom to make different choices without excessively burdening cash flow.

Also Read: Types of Financial Services

Industry-Specific Trends in Capital Structure Decisions

Different industries often have different preferences when it comes to capital structure.

Why?

Because each industry’s cash flow, growth cycles, and risks vary.

Manufacturing and Infrastructure

- Favour debt due to stable cash flows and significant asset investments.

Technology and Start-Ups

- Prefer equity financing; cash flows are unpredictable, with earnings often reinvested.

Utilities and Energy

- Leverage high debt ratios due to stable demand and consistent revenue streams.

Retail and Consumer Goods

- Use a hybrid structure to balance seasonal cash flow needs and expansion.

Financial Institutions

- Rely heavily on leverage; debt is integral to operations, as deposits fund lending activities.

82.9%

of professionals don't believe their degree can help them get ahead at work.

Types of Capital Structures and When to Use Each Approach

There is no one-size-fits-all choice of capital structure. The type of capital structure that works best in any given situation varies by industry, business stage, and financial goal.

Here are the main types of capital structures we can choose from:

Equity-Based Capital Structure: Maximising Flexibility

If such a company has a capital structure based on equity, it is dependent on, for the most part, funds raised through the issuance of shares rather than by borrowing.

This approach is common among start-ups or businesses that are about to grow over time because that involves flexibility.

Best suited for:

- New or high-growth companies: Start-ups often need funds without the burden of fixed repayment terms.

- Unpredictable cash flows: For companies where cash flow varies significantly, equity offers more breathing room since there are no regular debt payments.

- Riskier industries: Companies in volatile sectors, like tech, might favour equity over debt to minimise financial risk.

Debt-Based Capital Structure: Reducing Costs Through Leverage

Capital structure based on debt relies most on borrowed funds.

This is the structure that the majority of companies in stable, asset-heavy industries use because they can afford to make regular debt payments with steady cash flows. Tax benefits and the attractiveness of the cost of capital are often a big reason financing is debt.

Best suited for:

- Stable cash flows: Companies with reliable income, such as utilities, can manage fixed debt payments more comfortably.

- Tax advantages: Firms looking to optimise tax efficiency benefit from interest deductions on debt.

- Asset-intensive industries: Businesses that require a significant upfront investment, like manufacturing, may prefer debt to fund equipment and facilities.

Also Read: What is the Scope of a Career in Financial Management in 2024?

Hybrid Capital Structure: Flexibility and Financial Efficiency

Finally, a hybrid capital structure blends debt and equity elements but is meant to get the best of both worlds.

Established companies like this appreciate the advantages of maintaining flexibility with equity and paying with debt to lower the overall cost of capital.

Best suited for:

- Mid- to large-sized businesses: Companies with established revenue streams and growth plans often benefit from a balanced approach.

- Growth with stability: Businesses that aim to expand without excessive risk or ownership dilution.

- Adaptability to market conditions: A hybrid structure allows companies to adjust their financing mix over time, adapting to changing market dynamics.

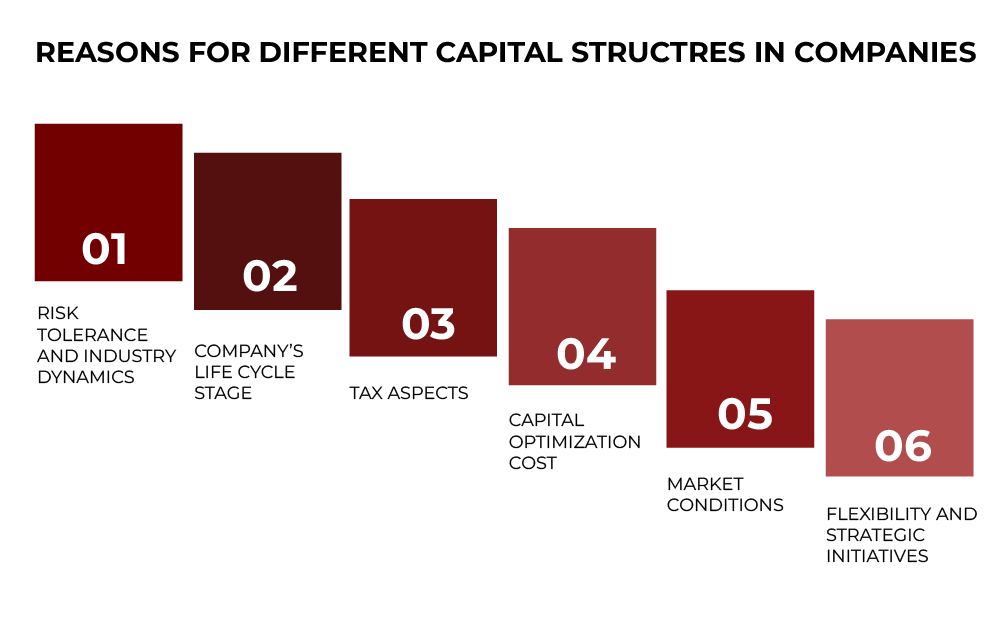

Critical Factors Influencing Capital Structure Choices in Various Markets

When choosing a capital structure in financial management, businesses don’t make decisions in a vacuum. Several factors shape these choices, especially when markets shift, or economic conditions change.

Let’s walk through the main factors that companies consider when deciding their capital structure.

Market Conditions & Economic Cycles

- Economic shifts affect financing costs and options.

- Lower interest rates in a growing economy make debt cheaper; downturns make equity financing appealing to manage risk.

Corporate Strategy & Business Stage

- Start-ups often opt for equity for flexibility, while established companies with stable revenue lean toward debt for their manageable obligations.

Tax Implications

- Debt offers tax advantages due to interest deductions, reducing financing costs and making it attractive for minimising taxes.

Control & Ownership Preferences

- Issuing equity dilutes ownership; companies valuing control often prefer debt.

- Family-owned businesses typically lean toward debt to maintain ownership within the family.

Industry Norms & Peer Benchmarks

- Industry norms influence capital structure; asset-heavy sectors (e.g., utilities) favour debt, while tech companies often prefer equity for flexibility.

Flexibility & Future Plans

- Companies focused on growth choose flexible structures, using debt for predictable needs and reserving equity for significant projects.

What is an Optimal Capital Structure?

The most effective combination of debt and equity financing that your business may pursue to increase firm value and lower the cost of capital is known as an optimum structure. A rigorous balancing act is necessary to get the ideal structure. It considers the company’s financial objectives and risk tolerance.

Finding a balance between the benefits of debt and equity for your company while minimising their disadvantages is crucial. To lower the financing cost, your business might try to optimise its structure.

Importance of Optimising Capital Structure to Minimise Cost of Capital

Lowering costs is a constant goal, and capital structure plays a big role here.

The blend of debt and equity we choose directly impacts our “cost of capital,” or the average rate the company pays for its financing. This is where a term called the “Weighted Average Cost of Capital” (WACC) comes in.

Simply put, WACC is a formula that helps us find the best balance between debt and equity.

To get a bit technical, here’s the formula:

WACC = (E/V x Re) + ((D/V x Rd) x (1 – T))

- E = Market value of equity

- D = Market value of debt

- V = Total value of capital (equity + debt)

- Re = Cost of equity

- Rd = Cost of debt

- T = Tax rate

The goal?

Keep WACC as low as possible to reduce the company’s overall cost of funding.

Debt is often cheaper than equity because of tax deductions on interest payments. However, too much debt increases financial risk.

Equity costs more, but it doesn’t need repayment and keeps the balance sheet lighter on liabilities.

Steps to Build and Adjust Capital Structure Over Time for Financial Stability

Creating the right capital structure in financial management isn’t a one-time task. It’s a process of monitoring, adjusting, and realigning as the company grows and markets evolve.

Here’s a simple roadmap to keep capital structure on track.

Regular Assessment & Monitoring

- Consistently review financial health, cash flow, and market trends to preempt issues.

Analyse Risk & Debt Management

- High debt suits stable cash flows but brings risks with fluctuating earnings.

Adjust Capital Structure as Needed

- Modify debt-equity balance as goals evolve to keep structure aligned with strategy.

Use Scenario Planning

- Test different scenarios to understand the impact of factors like interest rate changes or revenue dips on debt coverage.

Engage Advisors & Stakeholders

- Seek insights from financial advisors or board members to ensure alignment with long-term objectives when making structural adjustments.

Conclusion

Capital structure in financial management is the optimal combination of liabilities and equities, which enables the growth of flexibility and stability of a particular commercial enterprise.

Each component plays a unique role: debt, on the one hand, reduces cost through tax benefits but has mandatory fixed charges, and equity, on the other hand, provides flexibility with no repayment pressure.

Legal requirements, patterns of economic business cycles and stages in the life cycle of a business also influence capital structure policies, determining how the organisation is funded and how it responds to change.

The task of strengthening the capital structure is to exercise constant control over the state of financial stability, assess the degree of risk, and, if necessary, make changes to the proportions of borrowed and own funds.

This way, companies are in a more advantageous setting when it comes to constant growth and improvement in risk, value, and usefulness.

If you are interested in learning more about these basics, then check out the Financial Analysis, Valuation, & Risk Management course by Hero Vired. This is a course that prepares the learners the ability to assess the financial performance, and make useful valuations that would improve performance and/or minimal risky prospects.

How does a company determine its ideal capital structure?

What are the main differences between debt and equity financing?

Why do some industries favour high debt or equity levels?

Updated on November 8, 2024