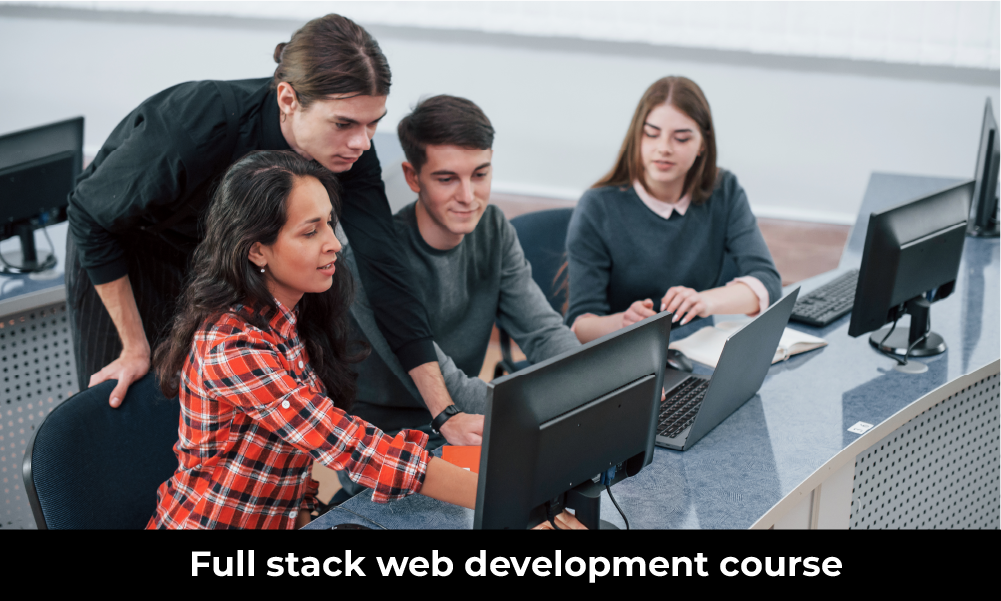

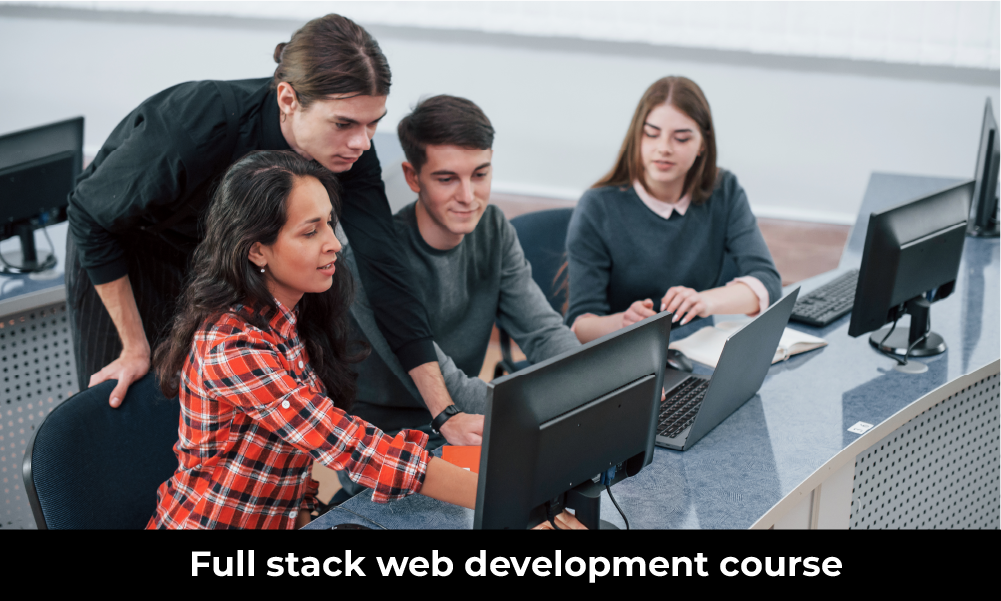

Top Online Full Stack Web Development Course Certification to Advance Your Career

Learn what a full stack development course is, its key features, benefits, career prospects, and more. Master web development skills to boost your career.

Are we making the best decisions concerning money management in our business, however big or small?

Most of us, no matter how big or small our businesses are, sometimes ask ourselves whether everything is correct. Money lies at the core of every business, and improper management can cause everything to crumble quickly. We have witnessed good businesses go bad just because of poor financial management.

Financial management is involved in every business step, from daily costs to long-term investment planning. It involves prudent financial decisions like raising funds, controlling costs, or assessing risk.

Unless controlled and managed financially, businesses cannot sustain themselves. Financial management keeps the company in the right position, enabling it to thrive rather than survive.

And so, dive into the core aspects that make financial management so vital.

Financial management refers to arranging, organizing, directing, and controlling financial resources so that the funds are properly used, and the organization steadily achieves its goals and stability over time.

Financial management is not mere record-keeping of income brought in or out. Prudent planning and the steps involved in making decisions will help us survive and, more importantly, grow.

Financial management helps us achieve our goals through proper planning, organization, control, and the direction of financial resources. The extent of responsibility is huge, but proper execution goes a long way toward keeping a business afloat.

POSTGRADUATE PROGRAM IN

Multi Cloud Architecture & DevOps

Master cloud architecture, DevOps practices, and automation to build scalable, resilient systems.

What happens when we don’t plan our finances?

It results in unbudgeted expenses, missed opportunities, and failure to achieve business goals. Financial planning is a roadmap.

It is an answer to deciding where to spend money and what to prioritize. We must consider both immediate needs and a business’s future vision.

For example, if a small business wants to expand, it does not just start throwing money at things. It has to plan out where the money goes. The owners would sit together and calculate budgeting for new equipment, rent on another location, and even marketing for more customers. Planning this way allows the owners not to overspend and have enough cash flow to cover day-to-day activities while implementing the expansion.

Here are some of the major things that we consider in terms of financial planning:

Without financial planning, we are driving in the dark. No business can afford that.

Managing finances is at the heart of every business. It involves careful planning, proper use of resources, following financial rules, and making informed decisions. The nature of financial management reflects how essential it is to ensure an organization’s stability, growth, and profitability. Let’s explore its key characteristics:

In finance, every risk has a potential return. Financial management is the relationship between these factors used to analyze well-made decisions.

Higher risks imply higher returns for an investment. These risks are evaluated by a financial manager, who determines how the decisions are in tune with company objectives. This balance fits the interests of the shareholders, investors, and founders with the least risks.

Financial management lets a business know how much money it needs to operate on a day-to-day and long-term basis.

Planning for capital requirements will ensure businesses raise enough funds instead of creating financial shortages and the subsequent effects of misallocating funds. This will establish the right debt-to-equity balance to reduce the overall cost of capital while meeting operational and strategic goals.

In financial management, cash inflow and outflow are controlled to avoid cash shortages.

The objective is to create and protect wealth in the organization and achieve its financial objectives. Cash flow management is proper cash flow management that helps a firm work smoothly without being caught off guard by an unexpected financial challenge.

The company’s value is one of the key aspects of financial management.

The value of this is that all financial decisions are made to maximize this value, whether investment profit sharing or fundraising. A company’s valuation tells you about its financial health and those decisions you’re asking, which helps the company stay sustainable.

Financial management also targets increasing the company’s stock value.

A company can grow its returns to shareholders by reducing costs and increasing profits. Finance managers are important because they know how a company’s earnings can be increased and how to make the company stay competitive.

Whether short-term or long-term, businesses must choose the best funding sources.

They offer one option, such as stocks, bonds, loans, etc., with varying risks and costs. Financial management involves evaluating these choices and choosing the best and least expensive method of raising funds.

The rule of investing has always been that risk and expected return must be thoroughly evaluated before investing.

Financial management ensures companies spend money wisely, trying to be safe while still profitable. It reduces losses and increases returns.

Monitoring and controlling expenses must be done, and the control should be highly effective.

They allow operating costs to match the company’s profit objectives. They can also show you what you are spending and what you are supposed to be spending, keeping you on top of your budget and spending to stay within and on target.

Risk and Return allow us to differentiate between good and bad investments.

One of the most difficult decisions we make as entrepreneurs or business managers is evaluating risk and return. The more risk we take, the more money we make; however, there is also a chance of losing money.

That’s where the evaluation of risk and return comes into place.

This is an element like financial management. We decide by weighing the risks with the rewards to serve our ends.

Consider a mid-sized company doing IT work and investing in AI technology. The front-end cost is too high, and there is no certainty of payback. Still, with the trend of the market and the scope for increases and hikes, the financial manager at the company may invest since the benefit will eventually come ahead of the risk.

This is what we call:

The bottom line is all about balance. We have to know when to take calculated risks and when to hold back.

82.9%

of professionals don't believe their degree can help them get ahead at work.

How much does a business need?

This is just one of the main questions that most business owners face. True enough, the right capital requirements must always go hand in hand with business development, but it must also explain how to keep the financial aspect stable.

It may be a simple daily operation or a long-term expansion, so we must determine how much money is needed to keep things running.

For example, let’s assume that a manufacturing company wishes to expand its production line. Capital would be required for new machinery, additional workers, and possibly inventory. However, if this capital requirement is not properly estimated, big trouble ensues, like running out of funds during an expansion.

So, when estimating capital requirements, we subdivide it like this:

By obtaining the appropriate capital requirements, we ensure the business has the money to pay current and future expenses. This avoids cash shortages and allows for proper resource allocation judgments.

Also Read: What are the 15 Key Objectives of Financial Management

How do we balance between debt and equity?

Getting that balance correct is tricky. To state the nature of financial management, we must highlight its focus on minimising the cost of capital while maintaining a balanced mix of debt and equity. We have too much debt and are likely to drown in interest payments. We may lose too much control over the business if there is too much equity. Getting a balance of capital structure right is the sweet spot. It helps us cut financing costs while maintaining flexibility in the business.

How it works out:

Do we have the cash to keep the wheels turning?

Cash flow management is the bread and butter of the company and breaks or makes its survival probability. We require the availability of cash for daily operations but do not want it to accumulate too much, such that it lies idle. Here come proper cash flow management steps.

And this is precisely what one needs to manage one’s cash flow effectively.

How do we boost the company’s value while keeping shareholders happy?

Our financial decisions impact the value of the company. Whether expanding our business into a new market, reducing unnecessary costs, or investing in technology, all our actions impact shareholder wealth. This is precisely why the nature of financial management is not just ensuring smooth-running businesses but increasing company value over time.

How do we grow company value?

Where do we find the money to raise?

The funding source will either make or break our growth strategy. Should we raise a loan, issue more shares, or apply for government grants? Every option has a profit and a drawback.

The funding options we usually consider are as follows:

How do we know that our business is performing as it should be?

This is where financial controls come in. Without them, we are flying blind. Financial management ensures constant monitoring and measurement of financial activities and then aligns them with the required adjustments, keeping everything on track to meet performance goals.

Think of them as the dashboard of the business—offering real-time insights into how the business is doing, financially speaking.

Financial controls help in the following ways:

Controls help measure what is happening and why, driving swift adjustments that move the company closer to, not further from, its financial goals. Without controls, we risk missing important financial goals or getting into trouble.

Also Read: 7 Key Scope of Financial Management to Know in 2025

Financial management is the core of any successful business. Its goal is to efficiently maximize all resources, thereby controlling costs, managing risks, and making decisions.

A well-managed capital strategy controls its financing cost, and careful cash flow management will help stabilize daily operations. Financial control acts as a defense, keeping the business on track regarding profitability and growth.

Effective financial management helps a business establish a solid footing, surmount challenges, and take advantage of opportunities in the long run. When those guidelines are commonly applied, businesses can expect to achieve durable success on their journey toward long-term financial health. To truly understand and explain the nature of financial management, it is essential to consider its approach to financial planning, risk control, and value maximisation in business.

Check out Hero Vired’s Financial Analysis, Valuation, and Risk Management course to learn more about financial management. It is designed by industry experts to provide hands-on experience and advanced knowledge, ensuring you can apply finance management essentials to propel your business forward.

Updated on January 23, 2025

Learn what a full stack development course is, its key features, benefits, career prospects, and more. Master web development skills to boost your career.

Explore app development course; key benefits, skills gained, and career opportunities in the booming tech industry, and course fees.

![How to Become an App Developer in 2025 [A Detailed Guide]](https://staging.herovired.com/wp-content/uploads/2024/01/app-development-scaled.jpg)

Discover the steps & resources about how to become an app developer. Know the must-have skills and get ready to kickstart your app development career.

It is Easy to Build an App when you have knowledge of Computer Science. Read the Blog All You Need to Know about Computer Science for Application Development

Discover why Flutter is revolutionizing cross-platform app development. Learn its benefits, features, and why it’s the go-to framework for developers worldwide.

Learn what Flutter is, its features, and how it simplifies cross-platform app development. Discover the benefits of Flutter and its popular use cases.

Hybrid apps are essentially web apps that have been put in a native app shell. Read here how hybrid apps are differ from Native and web apps.

Developing applications is a critical job role in today’s world. In this blog, we have listed top 5 things to consider before you design and build an application.