In financial management, working with and having a good feel for cash is crucial in the growth and running of any business. Although financial reports contain a rather essential aspect called profit, it is worth admitting that cash flow is important because it gives an understanding of the real situation, the opportunities to meet short-term commitments, and the ability to proceed with business operations effectively. The cash flow statement remains the primary document that sheds light on this aspect of business operating conditions.

What is Cash Flow Statement?

Cash flow statement is a statement that tallies up every sum that cash was received and every sum that was spent with cash during the period, say one month, three months or one year in the business. One of the three statements, along with an income statement and balance sheet, tells the user (investor, manager, analyst) how a firm is using and creating cash funds.

The cash flow statement is divided into three main sections:

- Operating Activities: This section gives information on the amount of cash received from or used by the company’s ordinary operations. It is composed of the measurement of cash generated from customers, cash used to pay suppliers, employees, operating expenses, and taxes, and cash received from generating interest.

Example: Purchase of equipment, sale of building, or buying /selling stocks.

- Investing Activities: This section displays how much cash has been received from investments in properties, equipment, or securities or has been utilized to purchase such investments. When used here, cash refers to cash in the process of obtaining assets and cash realized from the sale or disposal of the asset or investment.

Example: Purchase of equipment, sale of a building, or buying/selling stocks.

- Financing Activities: The cash flows from financing activity include the amounts borrowed, loans repaid, the issuance of new shares, purchase of share and payment of dividends. Simply put, is about how the firm financed its operations and how it pays the money back to the investors.

Example: Issuance of bonds, divided payment, borrowing or repaying debt.

Also Read: Financial Statement Analysis

POSTGRADUATE PROGRAM IN

Financial Analysis, Valuation, & Risk Management

Learn financial modeling, valuation techniques, and risk management to drive strategic business decisions.

Importance of Cash Flow Statement

A cash flow statement is an important financial statement in any business organization. A statement that helps people concerned view the amount of cash that flows and is out of a business for a particular period. Here’s why a cash flow statement is important:

- Liquidity Assessment: They employed cash flow statements to assess the efficiency of a business in generating cash for meeting bills, salaries, and loans within the first year. Though the income statement is capable of showing profits through the application of accountants’ accrual accounting technique, the cash flow statement distinguishes whether a business entity has sufficient working capital.

- Financial Health Insight: It is possible for a firm to be solvency but have sol fractionation discourage it substantially; this is because a firm can be profitable on paper yet meet great troubles in trying to get cash. The cash flow statement gives a view of the company’s liquidity position and whether the company is generating adequate amounts of cash from operations or whether it’s struggling for cash and has to borrow or seek funds in other ways.

- Predicting Future Cash Needs: Managing cash flows over time allows a business to predict when it is low on cash and make better financial choices. It assists in budgeting for future investments, paying off debts, and making operational adjustments; it cuts out problems of instability if there is an unexpected need for even a single dollar of cash.

- Operational Efficiency: Favorable cash flow from operations is a mark of good overall management of business activities. Lack of operational cash flows means that a business lacks efficiency and proper management or requires strategies to enhance the operations of the business.

- Dividends and Shareholder Returns: The cash flow statement also assists companies in identifying whether the organization possesses enough cash to make dividend payments to the shareholders. Sometimes, even if a company has been generating good profits for the period under analysis, it might be a lack of sufficient cash to be paid as dividends that would necessitate seriously depleting working capital.

- Investor and Creditor Confidence: Cash flow statements are important to investors, creditors, and analysts whenever they want to assess the sustainability of a business. There is usually an optimistic picture when there is good cash flow throughout the company and vice versa when cash flow is poor, even though the organization’s books show profits. Those involve the ratios that creditors find most interesting, namely, a company’s current ratio or its ability to repay its debts with cash.

Also Read: Cash Flow Analysis

Format of Cash Flow Statement

There are three sections in a cash flow statement. Operating activities, investments, and financial activities.

- Operating Activities: Trading activities refer to the day to day activities of a business in producing its revenues or incurring its costs directly associated with its principal business. These activities have a direct effect on the company’s business operations in the day-to-day running and may include such things as the purchase of stocks, taxes, wares, debts, interest and rent.

- Investing Activities: Investing activities include acquisitions or disposals related to long–term assets, such as property, plant, and equipment (PPE), investments in other organizations, or intangible assets. These activities suggest exactly how much a firm is capitalizing on its future activities or purchasing other assets.

- Financial activities: The third part of the statement of cash flow highlights the flow of cash between the firm and its owners and creditors. Financial activities include working with credit, stocks, and shares, as well as dividends. In these transactions, receipts of cash are recognized when cash is received through the issue of capital from investors or banks, and payments of cash are recorded when a company distributes its profits.

Also Read: Discounted Cash Flow (DCF)

Cash Flow Statement Example

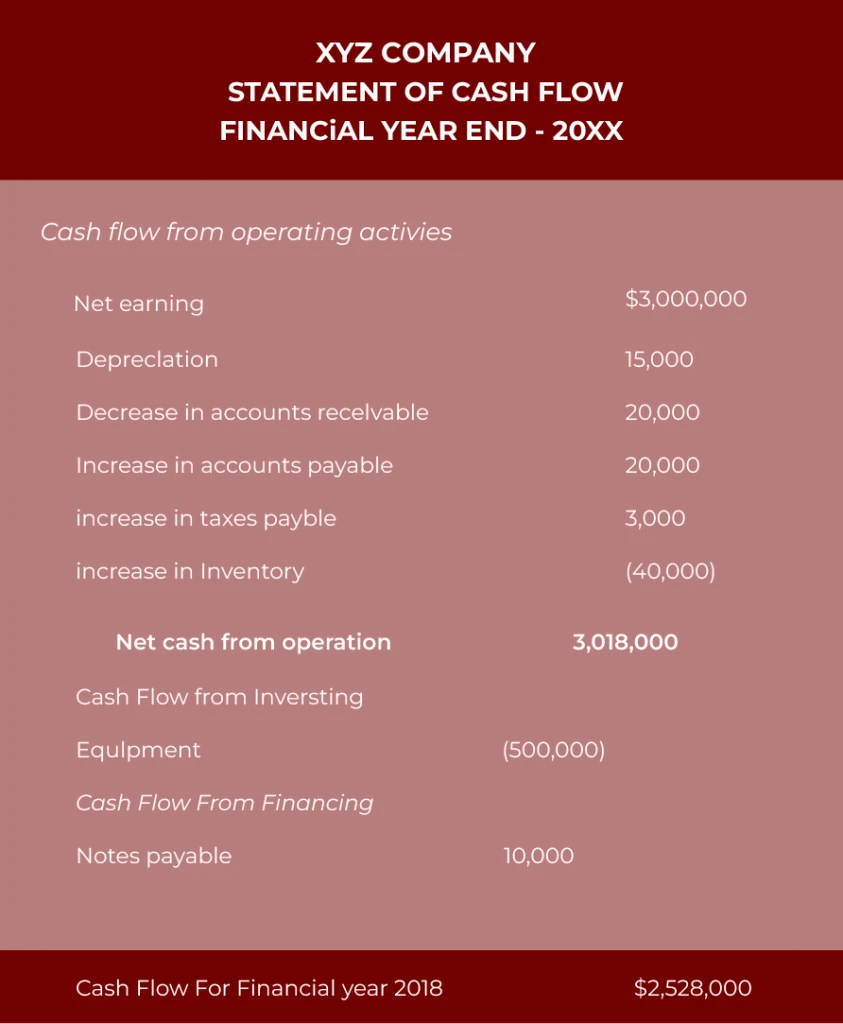

Here is an example of a cash flow statement: this is the cash flow statement for XYZ company at the end of the financial Year (FY) 2018.

Change data in the image according to the following table:

| XYZ Company Statement of Cash Flow Financial Year End 20 XX | |

| Cash Flow From Operating Activities | $3,00,000 |

| Net earnings | 15,000 |

| Depreciation | 15,000 |

| Decrease in accounts receivable | 20,000 |

| Increase in accounts payable | 20,000 |

| Increase in taxes payable | 3,000 |

| Increase in Inventory | 40,000 |

| Net cash from operations | 3,018,000 |

| Cash Flow From Financing | |

| Notes Payable 10,000 | |

| Cash Flow for financial year 2018 $2528,000 | |

Also Read: Types of Cash Flow

82.9%

of professionals don't believe their degree can help them get ahead at work.

What is Negative Cash Flow?

This means a situation where the cash the company brings in is less than the cash it spends, with outflows being costs, investments, repayments, and the like and inflows being cash proceeds, sales, loans, and the like. In essence, management decides to spend more than it takes or earns, thus reducing the cash balance.

Conclusion

The statement of cash flows is a relatively important statement in the company finances as its only function consists of supplying monetary information in regard to the situation of money the company is in. However, instead of the profitability issue, the income statement deals with the issue of profitability, while the cash flow statement provides an actual financial worth position of a business, along with how this cash was gained and used in the operations, investments and financing activities. And this is crucial because this means evaluating the company’s capacity to meet the outstanding and day to day operations funding needs and other strategic development projects. If you want to know more about cash flow statement, check out the Certificate Program in Financial Analysis, Valuation, & Risk Management offered by Hero Vired in collaboration with edX and Columbia University.

What is cash flow statement?

Is the cash flow statement the same as the statement of cash flows?

What is operating cash flow (OCF)?

Updated on January 13, 2025