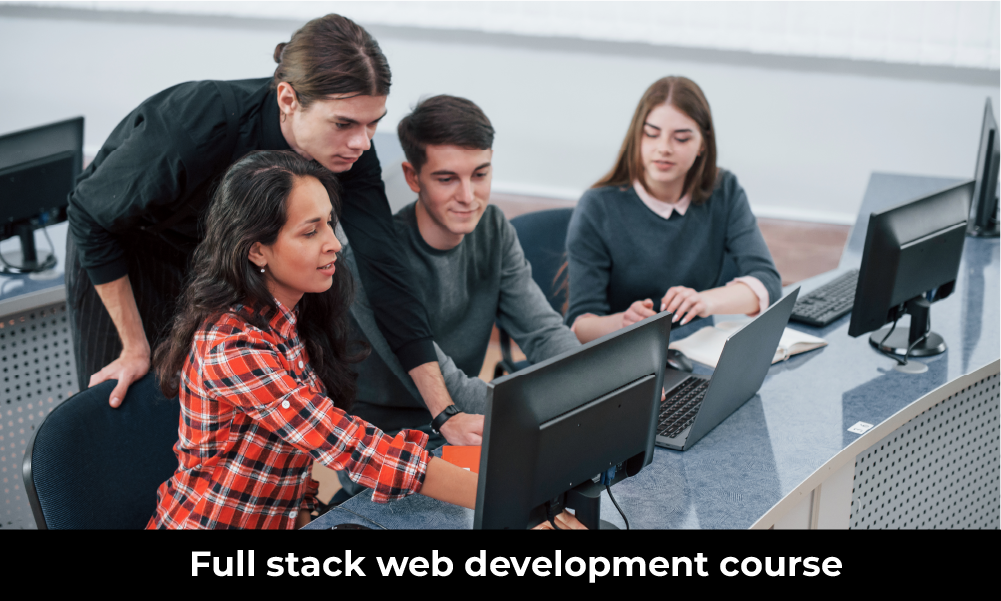

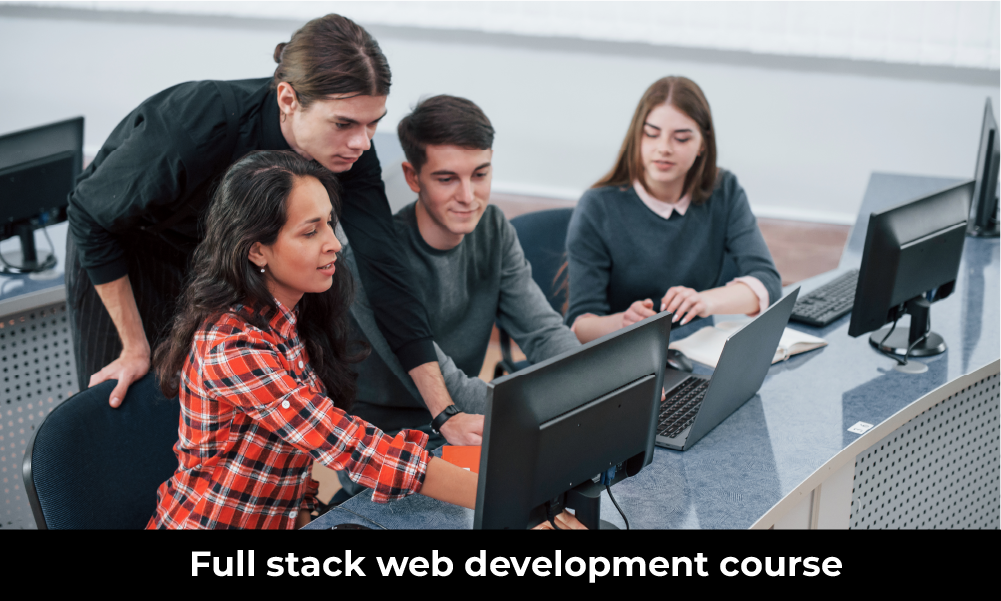

Top Online Full Stack Web Development Course Certification to Advance Your Career

Learn what a full stack development course is, its key features, benefits, career prospects, and more. Master web development skills to boost your career.

Businesses rely on financial managers to keep their operations running smoothly. Without a strong financial strategy, even the most promising companies struggle with cash flow, risk, and growth.

What are the roles and responsibilities of financial managers? What exactly do they do? How do they impact a company’s success?

The position of financial manager is essential for sustaining both financial stability and long-term viability in a company. The work extends further than dealing with monetary transactions. Financial managers oversee financial operations for optimal efficiency and manage risks while keeping business targets in line with future planning objectives.

A well-structured financial strategy keeps a business competitive. Finance managers:

Businesses without financial leadership experience unexpected financial losses along with a shortage of cash and inadequate compliance measures. A financial manager brings the necessary expertise to prevent potential risks in business operations.

A financial manager’s job is dynamic. They oversee multiple aspects of a company’s financial operations. The duties of financial manager include:

A finance manager must establish financial targets and distribute resources correctly for maximum profitability. This includes:

Businesses need capital to grow. The finance manager is responsible for:

A business cannot survive without steady cash flow. Finance managers:

Every business faces financial risks. The finance manager implements measures to reduce potential financial losses through these strategic ways:

Make financial statements comprising balance sheets, profit & loss statements, and cash flow reports.

Accurate financial investment decisions empower business growth at a substantial level. Finance managers:

Financial noncompliance leads to penalties accompanied by possible legal consequences. Finance managers:

The finance manager has an essential role in both minimising business costs and improving company profits. They:

Finance managers collaborate with various departments to ensure smooth financial operations. They:

POSTGRADUATE PROGRAM IN

Multi Cloud Architecture & DevOps

Master cloud architecture, DevOps practices, and automation to build scalable, resilient systems.

Not all finance managers perform the same duties; it vary depending on industry and business needs.

Businesses expand through acquisitions, partnerships, and new investments. Here, a financial manager became an important person for several reasons:

Before acquiring another business, finance managers:

Successful acquisitions require:

The key duties of financial managers include ensuring that business growth is financially sound and risk-free.

Cost control serves as a fundamental factor for boosting profitability. Finance managers execute strategic cost-reduction initiatives that protect operational effectiveness.

Businesses that do not manage expenses effectively experience weak profit margins along with running out of cash. By minimising resource wastage while directing funds more effectively, an organisation will become profitable according to the role of a finance manager.

82.9%

of professionals don't believe their degree can help them get ahead at work.

An organisation without proper financial planning shoots arrows in the dark. Through financial planning, managers establish strategies that match organisational goals.

Financial planning with strong foundations grants sufficient operational capital to companies that want to grow their workforce and penetrate new markets.

The violation of financial regulations results in both heavy fines and legal penalties. Financial managers must maintain full compliance with all laws which apply to their organisation.

Organisations unable to handle potential risks end up facing challenges with cash flow, lawsuits, and potential financial breakdowns. The roles and responsibilities of financial managers are to preserve the company’s financial stability by maintaining regulatory compliance.

The financial manager is accountable for handling budgets while decreasing organisational risks through strategic investing decisions. This position provides access to diverse earning opportunities along with lucrative career opportunities and ample career market demand. Most professionals within the finance field see this position as their first move toward executive leadership including Chief Financial Officer and Chief Executive Officer roles.

The corporate sector currently pays finance managers the highest salaries to their professionals. A manager’s pay rises steadily based on years of experience and gained expertise. Additional compensation for finance managers includes performance-based bonuses together with equity shares.

Finance professionals who have reached senior leadership positions tend to secure a CFO position or become the Director of Finance.

After working in finance, most professionals choose to switch to investment banking, private equity or consulting roles where they can earn more than ₹1 crore per year.

Multiple executives who became CEOs in top positions first began their professional lives in the financial field. A finance manager must properly execute strategic planning tasks and risk management along with investment decision-making which leads to essential attributes needed for becoming a CEO.

CEOs from the financial domain deliver exceptional analytical capabilities in addition to expertise in risk management along with complete financial leadership capabilities. Organisations depend on such financial experts to maintain strong business choices.

As CEOs with a finance background, they successfully face economic problems while reducing organisational risks and seeking maximum profit potential.

The key leadership competencies necessary for a CEO, which finance managers typically acquire during their work, include:

All these factors make the transition from finance manager to CEO smoother.

Salaries vary based on experience, industry, and location. Here’s a breakdown of finance manager salaries in India.

According to the Ambition Box, here is the average annual salary of a finance manager depending on their experience level:

| Experience Level | Average Annual Salary (INR) |

| Up to 3 years | 10 LPA |

| Up to 5 years | 12 LPA |

| Up to 10 years | 15.7 LPA |

| Up to 14 years | 17.3 LPA |

| 15 years + | 16.8 LPA |

A financial manager is accountable for maintaining the financial well-being, development, and compliance of a company. From risk management to budgeting, strategic investment, and cost management, all financial choices have an impact on long-term success. The roles and responsibilities of financial managers determine a company’s future, so it is vital to any business seeking stability and profitability.

The Integrated Program in Finance and Financial Technologies by Hero Vired educate professionals about financial technologies and modelling combined with investment strategy instruction for building financial expertise. Master financial competencies to move into leadership positions in the financial domain.

Updated on February 22, 2025

Learn what a full stack development course is, its key features, benefits, career prospects, and more. Master web development skills to boost your career.

Explore app development course; key benefits, skills gained, and career opportunities in the booming tech industry, and course fees.

![How to Become an App Developer in 2025 [A Detailed Guide]](https://staging.herovired.com/wp-content/uploads/2024/01/app-development-scaled.jpg)

Discover the steps & resources about how to become an app developer. Know the must-have skills and get ready to kickstart your app development career.

It is Easy to Build an App when you have knowledge of Computer Science. Read the Blog All You Need to Know about Computer Science for Application Development

Discover why Flutter is revolutionizing cross-platform app development. Learn its benefits, features, and why it’s the go-to framework for developers worldwide.

Learn what Flutter is, its features, and how it simplifies cross-platform app development. Discover the benefits of Flutter and its popular use cases.

Hybrid apps are essentially web apps that have been put in a native app shell. Read here how hybrid apps are differ from Native and web apps.

Developing applications is a critical job role in today’s world. In this blog, we have listed top 5 things to consider before you design and build an application.